U.S. Officials Signal Delay in 100 Percent Semiconductor Tariff

Administration officials privately told industry leaders the planned 100 percent tariff on imported semiconductors may be postponed to avoid supply chain disruption and retaliation from China, raising fresh questions about the trade offs in U.S. industrial policy. The possible pause highlights tensions between accelerating domestic chip production and limiting near term inflationary and economic risks that could ripple across technology and manufacturing sectors.

U.S. officials privately informed semiconductor industry stakeholders on November 19 that the rollout of a planned 100 percent tariff on imported semiconductors, announced in August, may be delayed while the administration reassesses timing and scope. The proposal, put forward as a tool to accelerate reshoring and protect national security, has been under internal review amid concerns it could disrupt complex supply chains and invite retaliatory measures from China.

White House spokespeople and Commerce Department officials publicly denied that the policy had changed, reaffirming that boosting domestic chip production and safeguarding critical technology supply chains remain priorities. Nonetheless, private conversations with industry executives and trade groups signaled a retrenchment in the timetable for imposing the tariff, reflecting the administration's recognition of the immediate economic trade offs.

Economists and industry analysts say the stakes are high. The tariff would represent a dramatic increase in the effective tax on imported chips, and even a temporary implementation could raise costs for companies that rely on global suppliers. Semiconductors are embedded in a wide range of products from smartphones and personal computers to electric vehicles and cloud servers. A steep tariff could therefore translate into higher consumer prices, upward pressure on core inflation measures, and margin compression for downstream manufacturers.

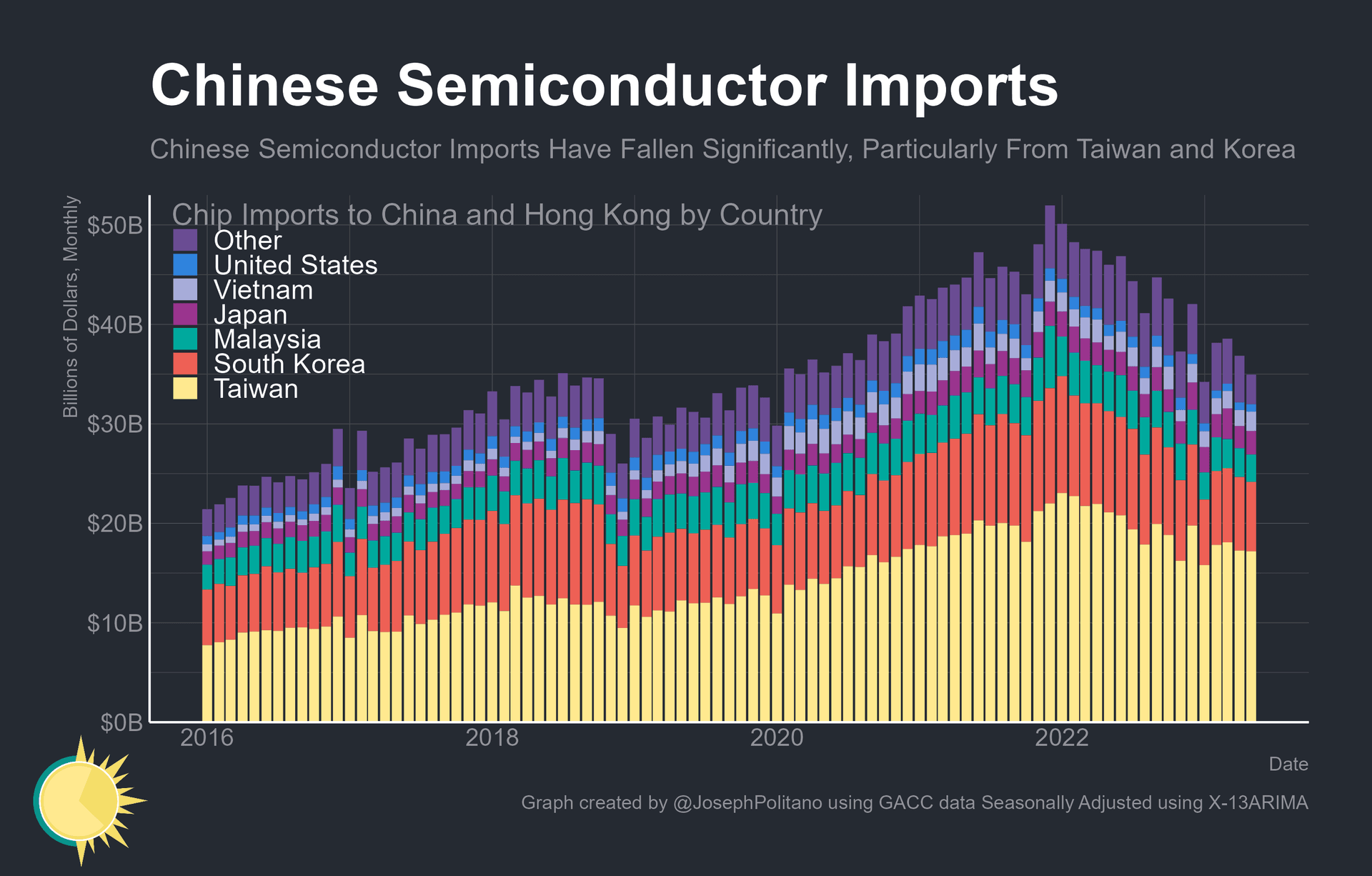

The move also intersects with longer term U.S. policy efforts. Since the passage of the CHIPS and Science Act in 2022, which directed roughly $52 billion in subsidies and support, Washington has sought to rebuild domestic manufacturing capacity that had dwindled over decades. Despite that funding, the United States remains reliant on foreign foundries for many advanced chips, with Taiwan and South Korea supplying the bulk of leading edge fabrication capacity. Reshoring that capacity requires years of investment and construction, not a single tariff decision.

Policymakers are weighing whether tariffs can be an effective lever to speed investment without imposing undue short term costs. Tariffs are blunt instruments that can raise prices and provoke retaliation. Officials expressed concern that a 100 percent tariff could trigger countermeasures from China that would target U.S. exporters, complicating diplomatic and economic relations at a moment of heightened geopolitical tension.

Markets and manufacturers are watching closely for clues about a more calibrated approach. Options under discussion reportedly include narrowing the tariff to specific product categories, phasing implementation over time, or coupling trade measures with expanded incentives for domestic fabrication. Any of those alternatives would aim to preserve the strategic objective of strengthening supply chain resilience while limiting shocks to prices and production.

The episode underscores a recurring policy dilemma in industrial economics. Ambitious goals to reclaim technological leadership clash with the immediate realities of integrated global supply chains and consumer price sensitivity. How the administration resolves that tension will shape the semiconductor landscape and broader industrial strategy for years to come.