U.S. Posts $284 Billion October Deficit, Shutdown Clouds Numbers

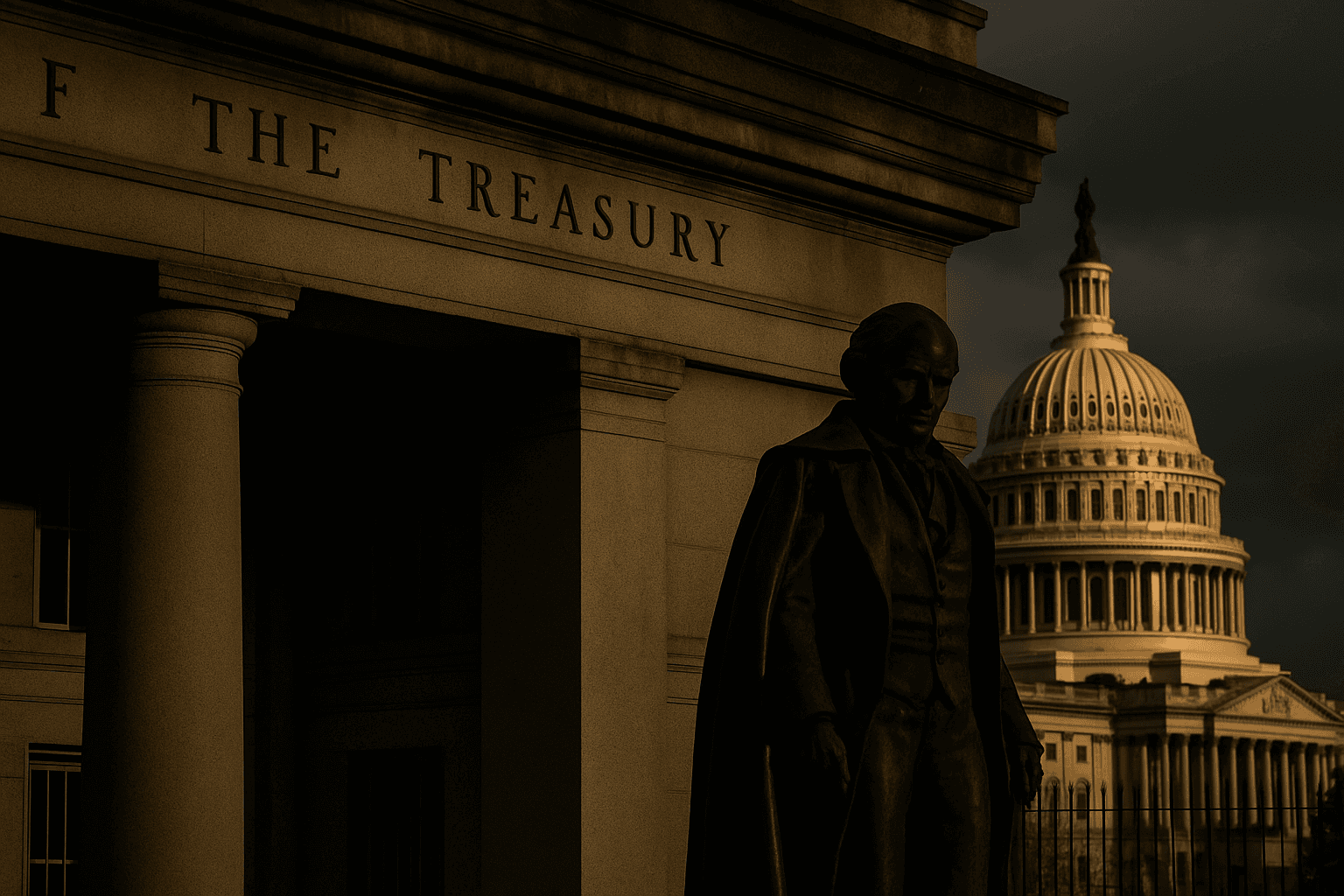

The U.S. Treasury reported a $284 billion budget deficit for October on November 25, a figure that Treasury officials say was skewed by last month’s federal government shutdown which delayed reporting and shifted some payments into October. The one month spike matters because it complicates comparisons across fiscal years, influences short term Treasury borrowing and will feed into contentious fiscal debates in Washington.

The Treasury Department reported a $284 billion budget deficit for October on November 25, a headline figure that Treasury officials and outside analysts say was distorted by the recent partial federal shutdown. The gap reflected an unusual combination of timing effects, including postponed benefit payments that were pushed into October when agencies resumed operations, and unusually large tariff receipts that partially offset the added outlays.

October marks the opening month of the federal fiscal year, and monthly results can be volatile when routine flows are rescheduled. In this instance the shutdown delayed budget reporting and many routine disbursements, pushing them into the month that normally serves as a financial starting point for fiscal year totals. Treasury officials cautioned that the number is not a clean indicator of underlying fiscal trends and that comparisons to prior single months can be misleading because of the disruptions.

Record tariff receipts provided a notable offset to the spike in payments. Those receipts, described by the Treasury as unusually large for the month, helped limit the headline deficit even as moved benefit payments and other pent up obligations elevated outlays. Analysts noted the combination of unusual receipts and shifted spending complicates early estimates for the fiscal year and will require careful adjustment in quarterly and annual accounting.

For markets, the immediate significance of the October deficit is muted relative to longer term fiscal fundamentals, but the timing shock has practical implications for Treasury cash management and short term borrowing. Investors and money managers watch Treasury issuance plans closely, and higher than expected near term deficits can increase demand for bills and notes, exerting upward pressure on short term yields. Market participants also remain sensitive to political risk, and the recent shutdown underscored how policy brinkmanship can affect financing needs.

In Washington the figure is already poised to become fodder in fiscal fights. The number gives fiscal hawks fresh ammunition to press for spending restraint, while opponents will point to the shutdown as the cause of the spike and argue that it does not reflect permanent policy choices. Lawmakers facing negotiations over spending levels and revenue measures will square the October data against projections from the Congressional Budget Office and Treasury over the coming weeks.

Longer term, analysts emphasize that a single monthly report does not alter the broader fiscal trajectory shaped by structural spending pressures, tax policy choices and rising interest costs. The October anomaly will be absorbed into broader fiscal accounting as more regular monthly flows resume, but it serves as a reminder that political disruptions can translate quickly into measurable financial consequences for the government and for markets that finance its borrowing.