U.S. Spot Solana ETFs Draw Large Inflows, Institutions Rotate Into Altcoins

U.S. spot Solana ETFs logged strong net inflows on November 25 as investors moved into altcoin exchange traded funds, underscoring growing institutional appetite for token based exposure. The flows reinforce a broader trend of ETF led adoption of crypto assets, with implications for market liquidity, price dynamics, and regulatory oversight.

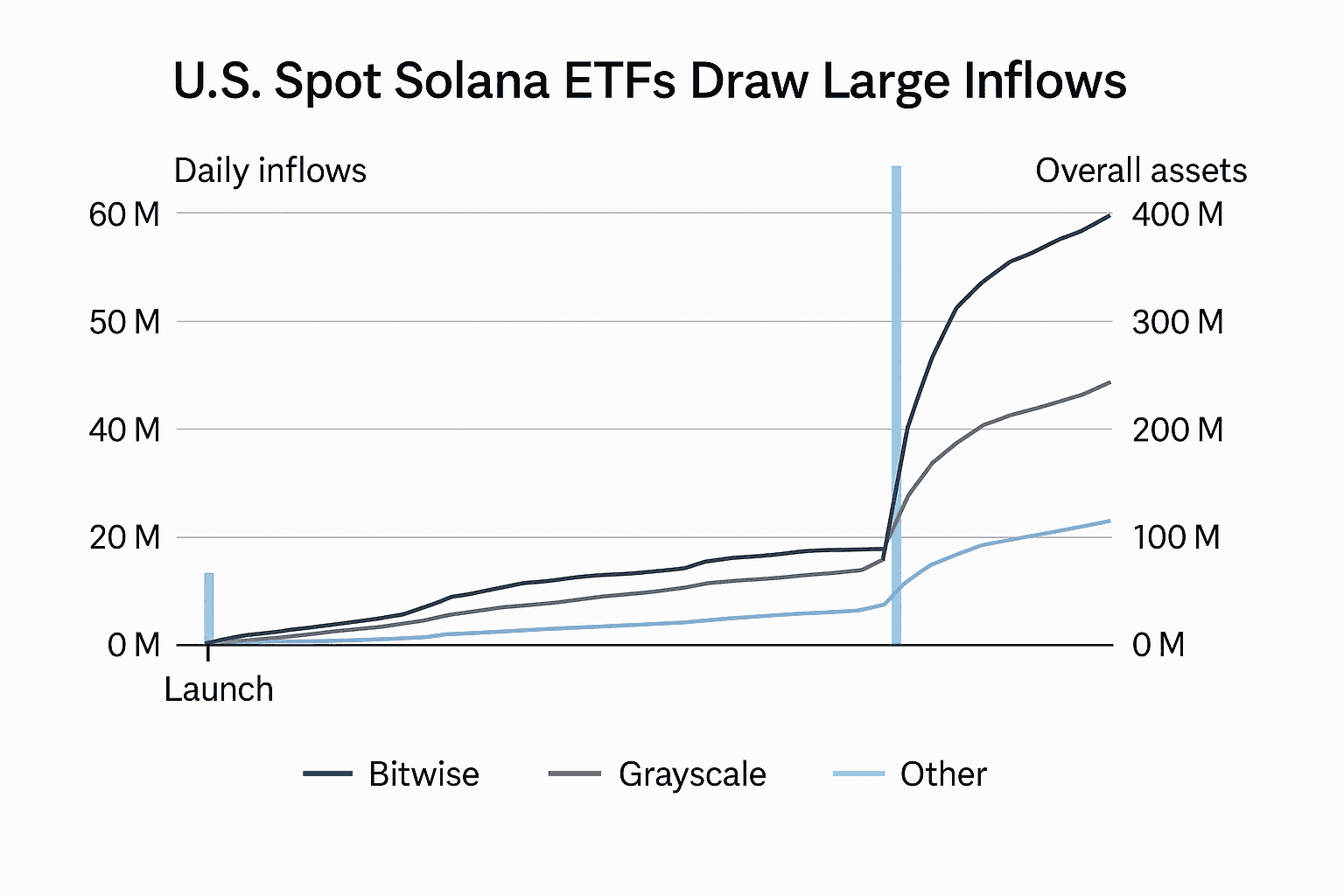

U.S. spot Solana exchange traded funds saw a surge of investor demand on November 25, with industry data aggregators reporting net inflows in the range of fifty million to sixty million dollars. SoSoValue data cited by market outlets showed the largest share of that single day of flows went to Bitwise's BSOL, which drew roughly thirty million to forty million dollars, while Grayscale's GSOL and other funds also added substantial amounts.

The inflows come amid a broader rotation by institutional investors into altcoin ETFs, according to trackers including The Block, RootData and SoSoValue. Aggregate net inflows into Solana spot ETFs since their launch have reached the hundreds of millions of dollars, and total assets across the suite of funds are reported as approaching the high hundreds of millions. That accumulation has taken place even as overall spot crypto funds continue to attract fresh capital, suggesting diversification beyond the largest protocols.

A single day of fifty million to sixty million dollars is meaningful relative to the reported aggregate assets under management. Industry trackers note that concentrated flows into a relatively small set of funds can amplify price moves and liquidity effects in the underlying market, because spot purchases to back ETF creation can add demand pressure on the traded token. For Solana, which has a smaller market capitalization and on chain liquidity than Bitcoin or Ethereum, ETF flows are likely to be a more prominent driver of short term price dynamics.

The pattern highlights how the ETF wrapper is reshaping institutional access to crypto. Exchange traded vehicles simplify custody, reporting and execution for large investors and can cement long term holdings through passive allocations. That institutionalization can deepen markets, reduce trading frictions and expand the investor base, yet it also concentrates monitoring and counterparty risks in fund structures and custodians. Policymakers and market participants will be watching how continued inflows interact with on chain liquidity and spot trading depth.

From a market structure perspective, the advance of altcoin ETFs represents a second phase of ETFization in crypto following earlier adoption of Bitcoin and Ethereum products. If flows into Solana and other token ETFs remain steady, portfolio managers may reweight allocations across digital assets, affecting correlations and the composition of crypto market cap. The trend also raises questions about how these funds will behave in stress episodes, including creation and redemption mechanics and the resilience of custody chains.

For investors and market observers, the near term implication is clear. The ETF conduit is channeling sizable institutional capital into Solana in concentrated bursts, amplifying the link between fund flows and token market outcomes. Over the longer term, sustained institutional demand through ETFs could support deeper trading markets and higher institutional ownership, while also drawing closer regulatory scrutiny of how spot crypto funds operate and how that oversight should evolve.