USDA Keeps Soybean Export Forecast Unchanged as China Returns

The U.S. Department of Agriculture left its 2025/26 soybean export forecast unchanged at 1.635 billion bushels, a 13 year low, even as China resumed purchases after a late October U.S. China meeting. The decision signals that early sales to China have so far been too limited to alter the broader trade and supply outlook, a development that matters for farmers, grain traders and global oilseed markets.

The U.S. Department of Agriculture on Tuesday maintained its 2025/26 soybean export forecast at 1.635 billion bushels, keeping projections at a 13 year low despite a fresh round of purchases by China following a late October diplomatic meeting. USDA noted that confirmed sales to China since that meeting totaled millions of tonnes and that some shipments had already moved, but the agency left its month to month export and ending stocks estimates largely unchanged.

The unchanged forecast underscores the gap between headline diplomatic progress and the scale of commercial flows needed to shift the U.S. supply and demand balance. USDA analysts appear to have judged that the renewed Chinese buying is a nascent development, not yet substantial enough to reverse the multiyear slide in U.S. soybean exports. The agency's stable ending stocks projection reinforces that view, leaving key supply metrics intact for now.

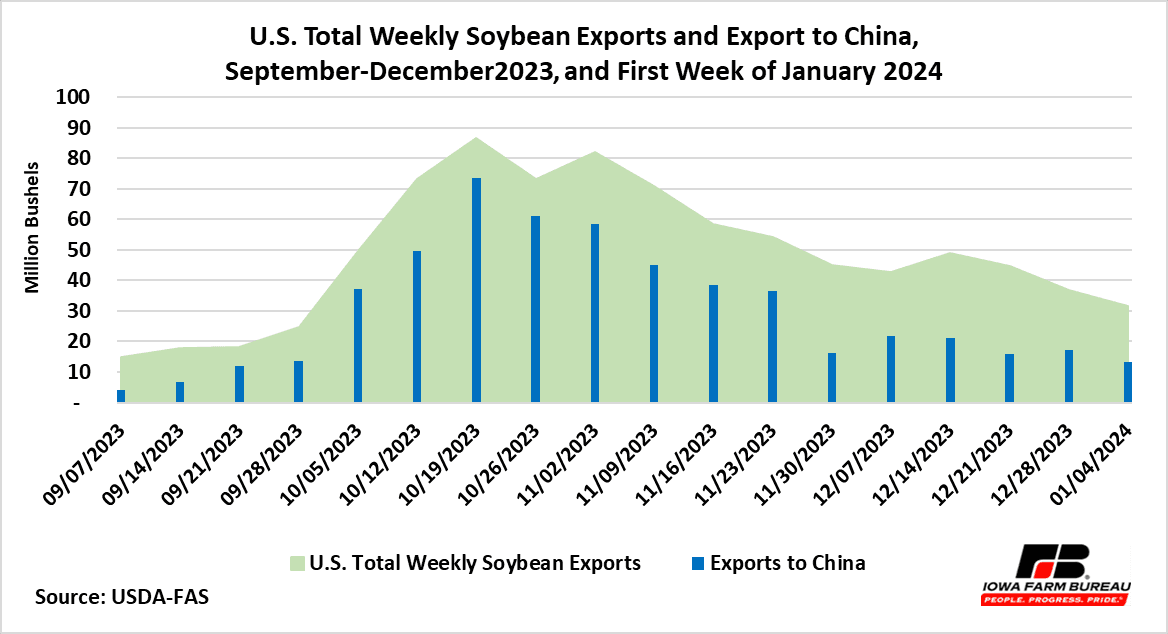

Market participants will be watching two metrics closely. The first is the pace of confirmed sales and actual shipments to China in the coming weeks, which will reveal whether the early round of trade represents a sustained trend or a temporary uptick. The second is the trajectory of South American exports, where large harvests in Brazil and Argentina have been pressuring U.S. competitiveness in recent seasons and contributing to the lower export baseline.

For U.S. farmers the immediate signal is one of limited near term upside from export demand. An export forecast at a 13 year low implies weaker external demand relative to past cycles, and that has consequences for producer marketing plans, basis levels in Gulf and Pacific Northwest terminals, and the flow of soybeans into domestic crush facilities. Grain traders will also be parsing the durability of Chinese demand, since China is the dominant marginal buyer in the global oilseed market and can swing prices if buying accelerates.

The policy dimension remains important. Resumed Chinese purchases illustrate how diplomatic engagement can open commercial channels, but they also show that a political thaw does not automatically translate into a full scale recovery of U.S. market share. Structural shifts, including expanded crushing capacity and procurement strategies in China, and the rise of South American exporters, have altered trade patterns. Those long term trends mean U.S. producers face a more competitive global environment even as bilateral ties improve.

Looking ahead, USDA's next monthly supply and demand update will be treated as a referendum on whether the resumed Chinese purchases are the start of a larger trend or a modest blip. Until confirmed sales and shipments grow materially, the agency's steady forecasts are likely to keep price signals muted, leaving the market sensitive to incremental procurement reports, weather developments in major producing regions, and any further diplomatic progress that could unlock larger volumes.