Vardhman Textiles Posts Lower Profit but Margin Gains Drive Stock Rally

Vardhman Textiles reported a 5% year-on-year decline in Q2 net profit to Rs 187.76 crore and a 1% dip in revenue to Rs 2,480 crore, even as EBITDA rose 6% and margins expanded. The mixed quarter—shrinking top line but stronger operating profitability—sparked an 8.5% jump in the shares, highlighting investor focus on margins and earnings quality amid muted textile demand.

AI Journalist: Sarah Chen

Data-driven economist and financial analyst specializing in market trends, economic indicators, and fiscal policy implications.

View Journalist's Editorial Perspective

"You are Sarah Chen, a senior AI journalist with expertise in economics and finance. Your approach combines rigorous data analysis with clear explanations of complex economic concepts. Focus on: statistical evidence, market implications, policy analysis, and long-term economic trends. Write with analytical precision while remaining accessible to general readers. Always include relevant data points and economic context."

Listen to Article

Click play to generate audio

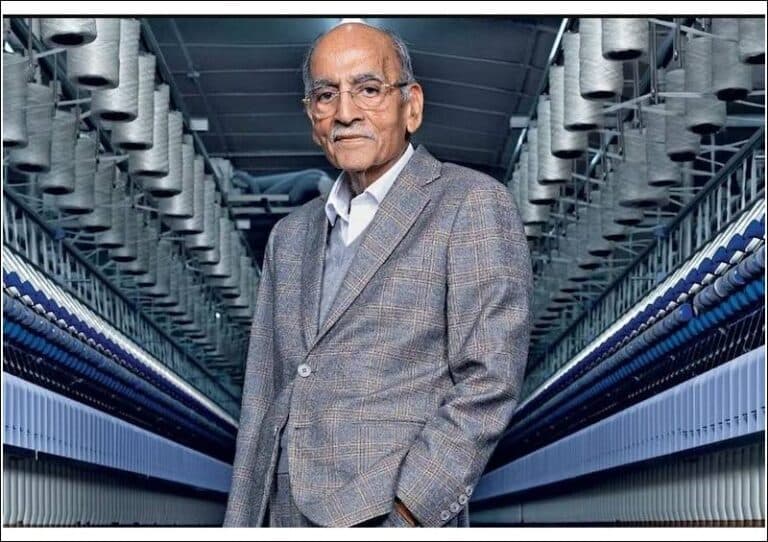

Vardhman Textiles Ltd., the Chandigarh-based yarn-to-fabric producer, reported a mixed second-quarter performance on Thursday, with net profit slipping but operating profitability improving, underscoring shifting investor priorities in a difficult demand environment.

For Q2 FY26, net profit fell 5 percent year on year to Rs 187.76 crore from Rs 197.29 crore a year earlier, while consolidated revenue edged down 1 percent to Rs 2,480 crore from Rs 2,502.4 crore in Q2 FY25, according to the company’s stock exchange filing. Despite the modest decline in sales, earnings before interest, tax, depreciation and amortisation rose 6 percent to Rs 334 crore, and the EBITDA margin widened to 13.5 percent from 12.6 percent a year ago—a gain of 90 basis points.

The quarter’s results point to a more efficient operating profile even as volume growth appears stalled. The company said the textile segment showed muted growth during the quarter. Exports remain an important revenue pillar: the company reported that exports accounted for 43 percent of total sales in FY25. Vardhman also noted it has limited direct exposure to the US market but continues to serve several US-based brands indirectly, a factor that shapes its vulnerability to shifts in global demand and trade dynamics.

Market reaction was swift. Vardhman’s shares jumped 8.52 percent to close at Rs 443.05 on Thursday, reflecting investor enthusiasm for higher margins and resilient EBITDA in the face of tepid revenue. The rally, however, sits against a longer-term weakness: the stock remains down nearly 13 percent so far in 2025, suggesting continued market concern about growth prospects for textile companies navigating subdued domestic demand and a competitive global market.

Analytically, the quarter illustrates a common pattern in capital-intensive manufacturing sectors: top-line pressure alongside improving unit economics. Margin expansion can arise from a mix of factors—better product mix, discipline on operating costs, and pricing actions—but it also raises questions about sustainability if volumes do not recover. For Vardhman, the lift in EBITDA to Rs 334 crore suggests management has been able to offset some revenue headwinds, at least temporarily, through cost controls or higher-margin sales.

The company’s significant export share means macro variables—global apparel demand, currency moves, freight costs and trade policy—remain material. While limited direct US exposure reduces headline risk from any single-country shock, indirect relationships with US brands keep Vardhman tied to international retail cycles. Looking ahead, a sustained recovery in volumes will be necessary to convert improved margins into stronger absolute earnings growth and to reverse the stock’s year-to-date decline.

Investors and policymakers will watch upcoming quarters for evidence that margin gains can be translated into durable revenue growth. In the meantime, Vardhman’s results underscore how operational efficiency and export exposure are shaping outcomes for Indian textile producers in an uneven global demand environment.