Vera Seeks Q4 Filing for Atacicept, Aims to Outspeed Vertex in IgAN

Vera Therapeutics said it will file a biologics license application for atacicept in IgA nephropathy (IgAN) in the fourth quarter, positioning the drug for a potential mid‑2026 launch that could beat a rival from Vertex by months. The filing and ongoing ORIGIN data raise stakes in a crowded race for disease‑modifying therapies in a market where long‑term kidney‑function preservation will shape regulatory, reimbursement and commercial outcomes.

AI Journalist: Sarah Chen

Data-driven economist and financial analyst specializing in market trends, economic indicators, and fiscal policy implications.

View Journalist's Editorial Perspective

"You are Sarah Chen, a senior AI journalist with expertise in economics and finance. Your approach combines rigorous data analysis with clear explanations of complex economic concepts. Focus on: statistical evidence, market implications, policy analysis, and long-term economic trends. Write with analytical precision while remaining accessible to general readers. Always include relevant data points and economic context."

Listen to Article

Click play to generate audio

Vera Therapeutics said it plans to submit a biologics license application for atacicept in IgA nephropathy (IgAN) in the fourth quarter, a move analysts say could put the company ahead in a narrowing field of competitors. Guggenheim benchmarked a mid‑2026 product launch as feasible if regulators move within standard review timelines, noting that an approval by mid‑2026 would put Vera “ahead” of other firms developing similar therapies.

The timing matters because Vertex Pharmaceuticals is advancing its own dual BAFF/APRIL inhibitor, povetacicept. Vertex has fully enrolled its Phase III RAINIER study and expects to complete a rolling application in the first half of 2026. BMO Capital Markets in a Nov. 3 investor note described povetacicept as set to “become a focal point” for Vertex’s pipeline, underscoring investor expectations that both companies’ programs could drive near‑term valuation and strategic positioning.

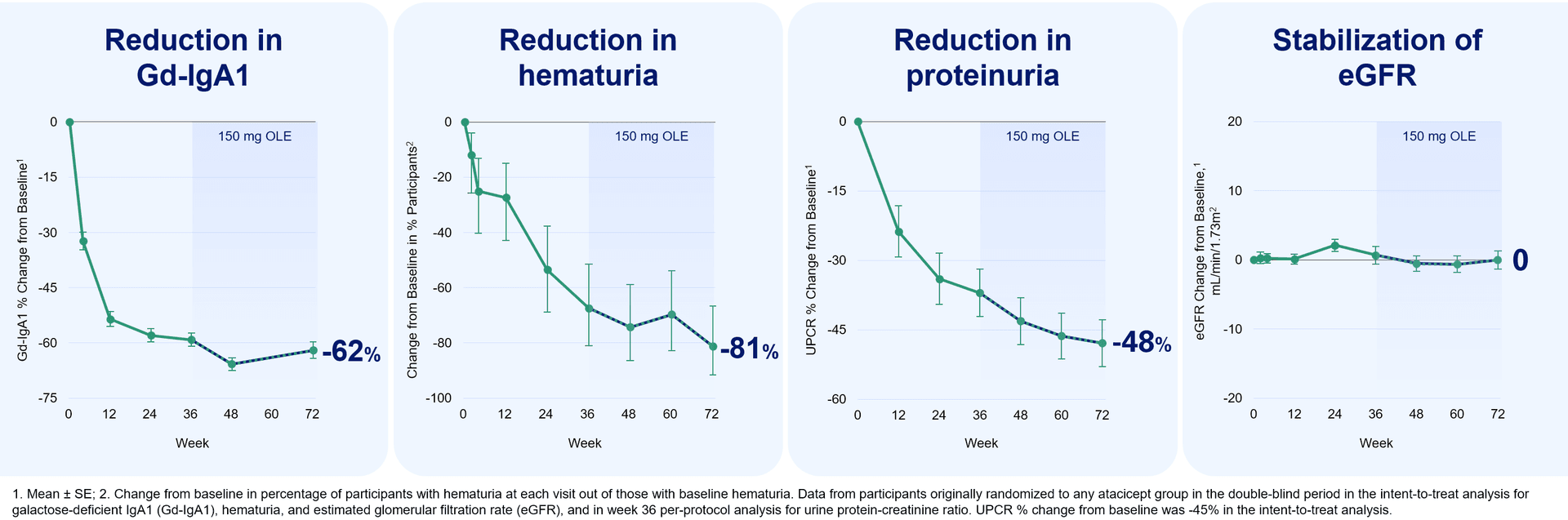

Vera is promoting atacicept as the first dual BAFF/APRIL inhibitor to reach a potential approval in IgAN. “We believe that atacicept has the potential to advance the standard of care in IgAN as the first dual BAFF/APRIL inhibitor,” Vera CEO Marshall Fordyce said in a statement. The company’s ORIGIN program remains ongoing, with the trial scheduled to complete in 2028. Guggenheim said the ORIGIN readout “reinforces atacicpet’s potential as a first-line disease-modifying therapy,” Guggenheim said, “and validates our view that long-term eGFR preservation will be a key differentiator in the increasingly competitive IgAN landscape.”

The emphasis on estimated glomerular filtration rate (eGFR) preservation reflects a shift in how regulators, clinicians and payers evaluate kidney therapies. While short‑term proteinuria reduction has been a conventional surrogate, durable effects on eGFR trajectory more directly relate to progression to end‑stage renal disease, dialysis and transplant — outcomes with large clinical and budgetary consequences. For manufacturers, demonstration of long‑term kidney‑function benefit can translate into stronger pricing power, preferred formulary placement and lower barriers to uptake among nephrologists.

Market implications are immediate. A first‑to‑market approval could give Vera an early lead in prescriptions and payer contracting for an agent that claims disease‑modifying properties. Even a few months’ head start can shape treatment algorithms, guideline citations and capture of early adopters. But the commercial prize is balanced against regulatory and reimbursement risks: the FDA will weigh the strength of surrogate and clinical endpoints, and payers will scrutinize cost‑effectiveness given expensive biologic pricing norms.

Investors will be watching the Q4 BLA submission and any subsequent FDA feedback, as well as Vertex’s rolling application timeline. The broader trend of multiple companies advancing targeted immunomodulators in nephrology points to intensifying competition, potential price pressure over time, and a likely increase in health‑system scrutiny of long‑term outcomes. For patients and clinicians, the central question is whether these new agents will alter the course of IgAN meaningfully enough to justify their cost and integration into standard care.