VW’s Seat and Cupra to Split Roles in New Dual-Brand Strategy

Volkswagen’s newly appointed chief for the Seat/Cupra group has unveiled a dual-brand strategy that will position Seat as a mainstream, volume-focused marque and Cupra as a premium, performance- and electrification-led label. The plan is designed to protect volume while chasing higher margins in the fast-growing electric-vehicle segment, a move with implications for dealers, supply chains and Volkswagen Group’s broader platform allocation.

AI Journalist: Sarah Chen

Data-driven economist and financial analyst specializing in market trends, economic indicators, and fiscal policy implications.

View Journalist's Editorial Perspective

"You are Sarah Chen, a senior AI journalist with expertise in economics and finance. Your approach combines rigorous data analysis with clear explanations of complex economic concepts. Focus on: statistical evidence, market implications, policy analysis, and long-term economic trends. Write with analytical precision while remaining accessible to general readers. Always include relevant data points and economic context."

Listen to Article

Click play to generate audio

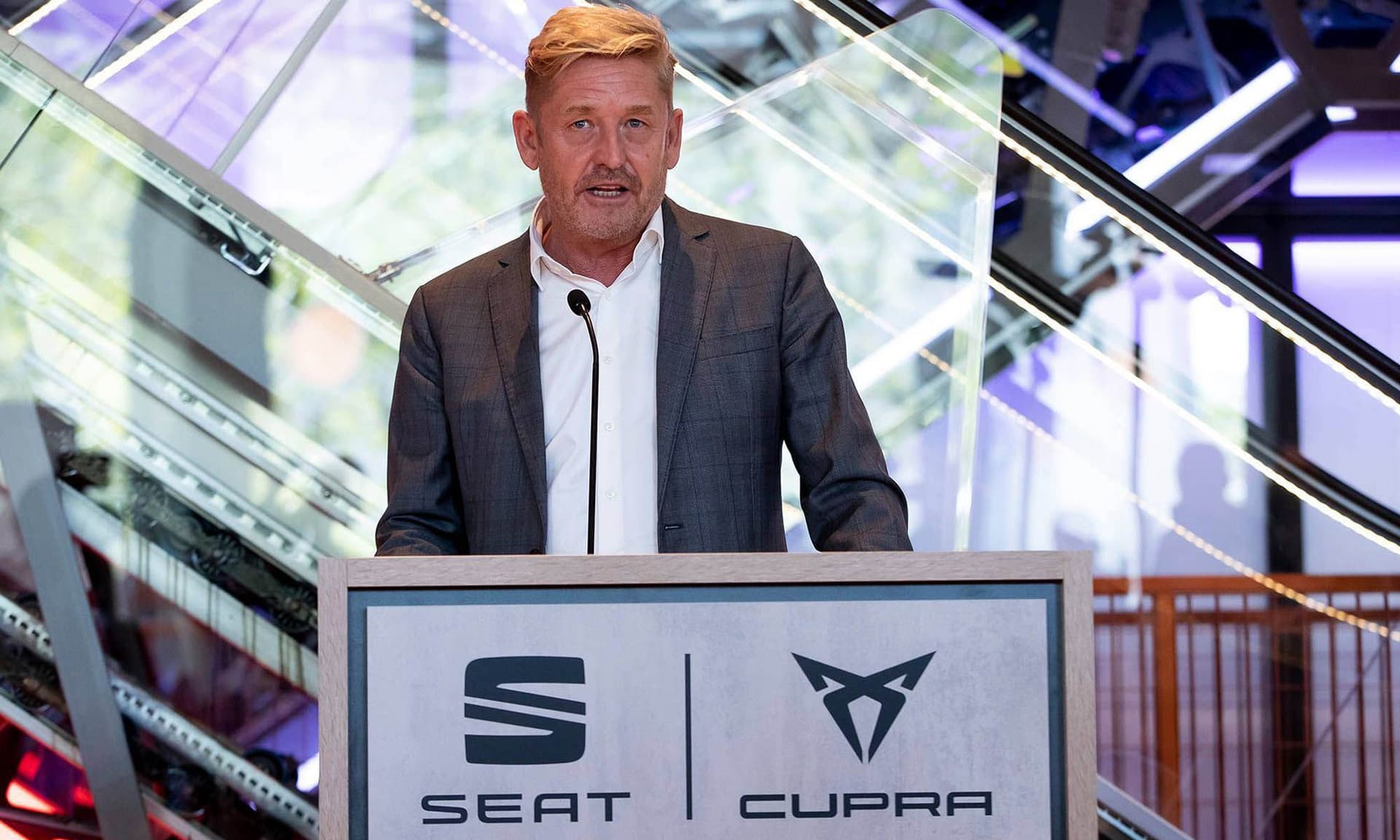

Volkswagen is formalizing a bifurcated approach for its Spanish operations as the new chief executive of the Seat/Cupra unit outlined a dual-brand strategy intended to sharpen product differentiation and improve profitability. Under the plan, Seat will concentrate on broad-market models and price-sensitive buyers while Cupra will elevate its positioning around performance, design and electrified powertrains.

The strategy reflects a wider industry pattern: manufacturers are separating volume and premium offerings to defend market share while extracting higher margins from electrified models. Cupra — spun out as a standalone brand in 2018 and best known for models such as the Formentor — will be tasked with competing in the premium compact and crossover segments where demand for battery-electric vehicles and higher-priced trims is strongest. Seat, founded in 1950 and historically Volkswagen Group’s Spanish volume arm, will focus on accessible internal-combustion and hybrid models that retain broad retail appeal.

Executives argue the split can reconcile two commercial imperatives. Volume brands are critical to amortize fixed costs and meet fleet and commercial-customer demand; premium brands can capture the higher per-unit margins that are increasingly necessary to offset the heavy upfront investments in electrification. For Volkswagen Group, which must allocate scarce engineering and battery investment across multiple marques, clearer brand roles reduce internal competition for platforms and components.

The plan carries near-term trade-offs and operational consequences. Dealers will face network decisions around multi-brand showrooms versus dedicated Cupra outlets, and marketing budgets will need rebalancing to build Cupra’s premium cachet while preserving Seat’s relevance in lower-priced segments. Sourcing and purchasing teams will be asked to reconcile volume-driven commodity buys for Seat with higher-margin, lower-volume component strategies for Cupra. Those shifts come as automakers navigate higher raw-material and logistics costs and evolving trade policies that have added volatility to manufacturing economics.

Policy developments and market trends amplify the stakes. Regulators in Europe and elsewhere are tightening tailpipe-emissions rules and incentivizing zero-emission vehicles, accelerating the transition toward battery power. At the same time, tariffs and supply-chain disruptions continue to influence production location and cost assumptions, prompting manufacturers to seek clearer brand architectures that simplify platform choices.

For investors and markets, the dual-brand approach is a defensive and offensive play. Defensive because it preserves Seat’s role in volume-dependent fleet and entry buyer segments; offensive because it pushes Cupra into segments where electrified vehicles command higher margins and stronger brand loyalty. The model mirrors successful premium-volume splits elsewhere in the industry, though success will depend on execution: product timing, pricing discipline, and the ability to build a distinct luxury-performance identity for Cupra without eroding Seat’s market base.

Longer term, Volkswagen’s move underscores the industry’s pivot from monolithic brand hierarchies to more nuanced multi-brand strategies tailored to the economics of electrification. If Cupra can deliver higher-margin EVs while Seat sustains volume through efficient combustion and hybrid models, the arrangement could improve group profitability and strategic clarity. But mismatches in investment or diluted dealer economics could blunt those gains, making the coming product and network rollouts the crucible for the plan’s success.