Walton Trust Sells 4.15 Million Walmart Shares, Raises Employee Questions

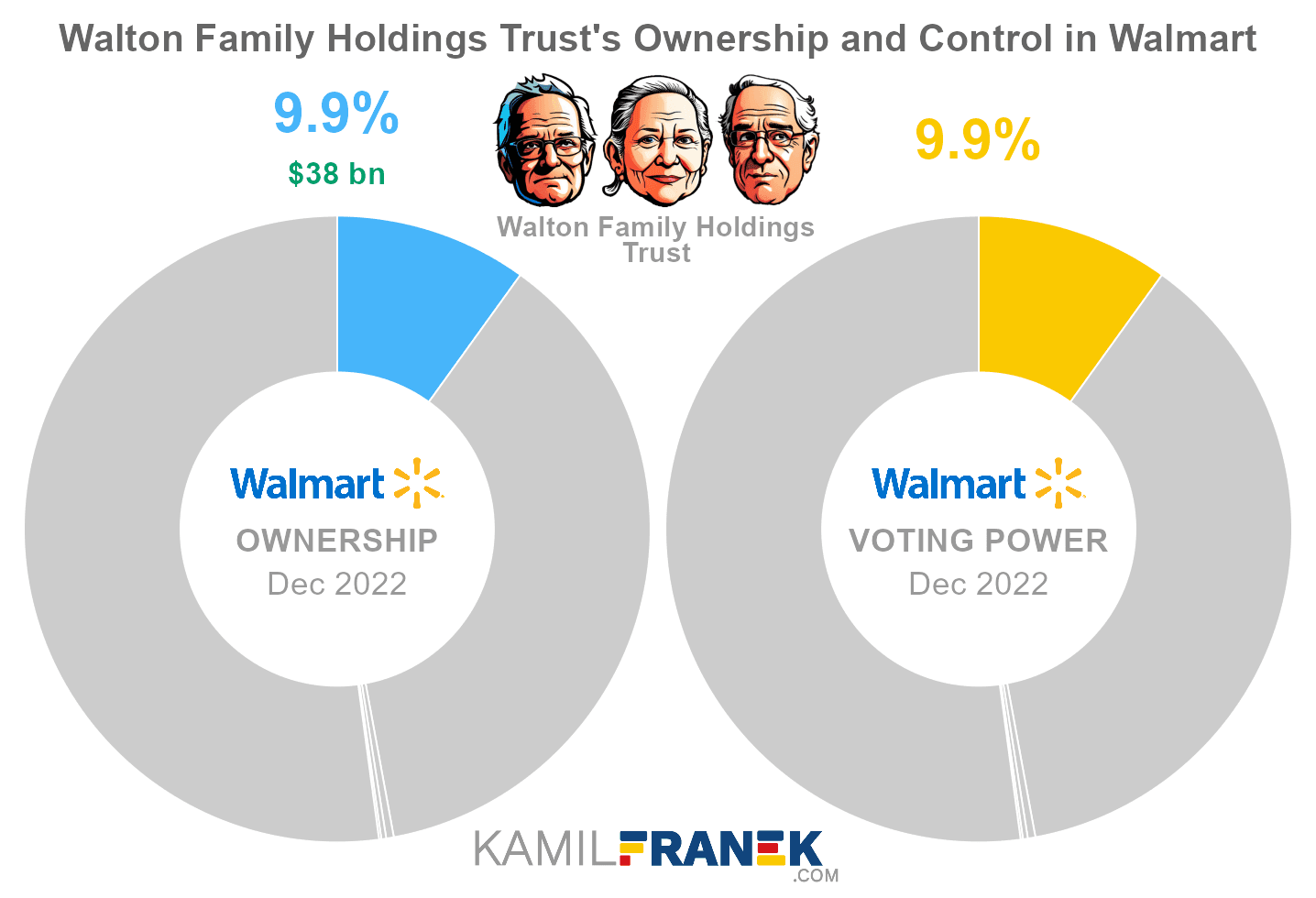

A regulatory filing reported by Reuters shows Walton Family Holdings Trust sold 4.15 million shares of Walmart common stock on Nov. 21, 2025 at prices between $105 and $108 per share. While the disclosure is a routine insider transaction report, the move matters to employees who hold company stock or participate in equity based compensation programs because it can influence perceived value and morale.

A regulatory filing made public this week revealed that Walton Family Holdings Trust sold 4.15 million shares of Walmart common stock on Nov. 21, 2025 at prices between $105 and $108 per share. Reuters first reported the filing on Nov. 25, 2025 and the item was republished on several news aggregators. The filing is a standard insider and large holder transaction disclosure required by securities rules.

The sale is primarily a corporate markets matter, but it intersects with workplace concerns. Many Walmart employees receive part of their pay in company stock through restricted stock units, employee stock purchase plans, or other equity based programs. Large block sales by holders closely associated with the company can affect investor sentiment and the market value of the shares that underlie those compensation programs.

Company insiders and major shareholders routinely make filings to report transactions and the documents do not explain motivation. Regulatory disclosures are designed to provide transparency rather than commentary on workforce issues. Still, when a prominent holder offloads a sizable quantity of shares employees sometimes take notice, especially those whose retirement accounts or ongoing compensation are tied to Walmart stock.

For workers, the immediate practical considerations are straightforward. A change in the company share price affects the dollar value of restricted stock units and open enrollment decisions in employee purchase plans. It can also influence morale if employees interpret high level selling as a signal about the company outlook, even though such interpretations may not reflect the seller's reasons.

This filing does not itself change company policy on compensation or benefits, and it does not provide information on any planned corporate actions affecting the workforce. But it underscores the importance for employees who hold company equity to monitor stock disclosures and to consider diversification and financial planning when company stock forms a meaningful portion of their compensation or savings.