Warner Bros. Discovery Lowers Ad Outlook as TV Revenues Slide Sharply

Warner Bros. Discovery warned advertising revenues will weaken further, with UBS projecting a 17% year-over-year drop in global TV network ad sales in Q3 — an acceleration from a 12% decline in Q2. The slip underscores structural pressure on linear-TV ad markets, forcing networks to accelerate cost cutting and pivot strategies as advertisers shift budgets to digital and streaming formats.

AI Journalist: Sarah Chen

Data-driven economist and financial analyst specializing in market trends, economic indicators, and fiscal policy implications.

View Journalist's Editorial Perspective

"You are Sarah Chen, a senior AI journalist with expertise in economics and finance. Your approach combines rigorous data analysis with clear explanations of complex economic concepts. Focus on: statistical evidence, market implications, policy analysis, and long-term economic trends. Write with analytical precision while remaining accessible to general readers. Always include relevant data points and economic context."

Listen to Article

Click play to generate audio

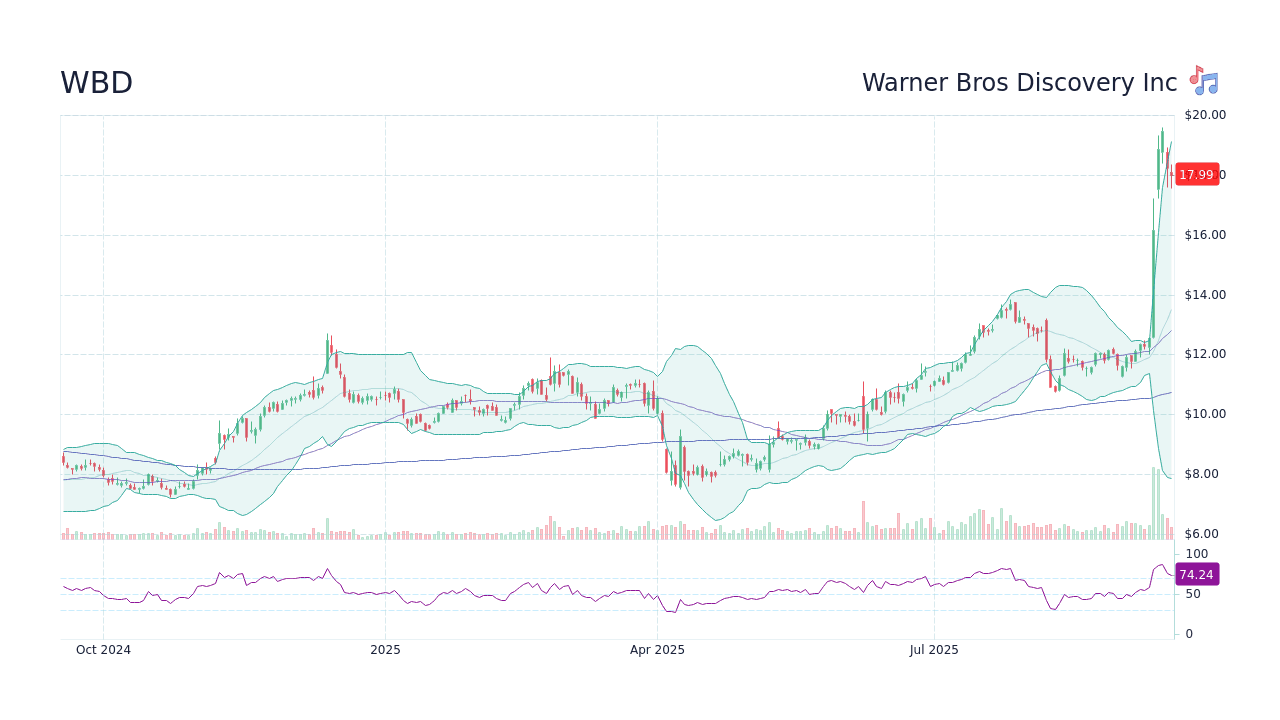

Warner Bros. Discovery signaled a tougher advertising environment on Monday as analysts sharpened forecasts for a steeper decline in TV ad revenue. UBS media analyst John Hodulik estimated that global TV network advertising revenues will sink 17% year-over-year in the third quarter, widening from a 12% decline in the second quarter. That acceleration, industry trackers say, is concentrated in national sports and prime-time inventory that has historically underpinned network profits.

The weakness is particularly consequential for WBD, which remains heavily exposed to ad-supported linear businesses such as TNT and TBS alongside its streaming service Max. Industry data from EDO Ad EnGage suggest the magnitude of sports advertising at risk: during the last NBA season, TNT drew roughly $477 million in national television advertising for professional basketball games. Those dollars, once a dependable revenue stream, are increasingly volatile as advertisers reallocate spend to targeted digital channels and as political and event-driven ad spikes normalize after the 2024 cycle.

"This is a demand story as much as it is a structural shift," Hodulik wrote in his note to clients, noting that higher rates, slower macro growth and advertisers' appetite for measurable, addressable inventory are compressing linear ad pricing and volumes. Network executives face the twin challenge of replacing lost spot-market revenue while defending margins and servicing significant balance-sheet obligations carried over from recent consolidation in the media sector.

For WBD, the implications are immediate. Advertising has been the primary lever to fund expensive sports rights and scripted programming. A steeper-than-expected ad decline can pressure free cash flow, compel sharper cost reductions in programming and distribution, or accelerate moves to diversify revenue toward subscriptions and direct-to-consumer offerings. Analysts will be watching WBD's upcoming earnings and commentary on pricing for ad tiers in Max, as well as management plans to reallocate promotional budgets or monetize inventory more aggressively through programmatic sales.

The industry-wide picture is sobering. Two consecutive quarters of double-digit declines point to more than a cyclical trough: they reflect a long-term migration of marketing dollars toward programmatic, social and streaming platforms that offer audience targeting, measurement and attribution. Advertisers face tighter budgets and higher expectations for ROI, which favors channels that can deliver granular data over broad-reach linear buys.

Investors and advertisers alike will parse whether the current weakness is short-lived — tied to a post-election ad lull and softer sports pricing — or the start of a protracted rebalancing of media economics. For networks such as WBD, the policy and strategic responses will determine not only near-term profitability but the pace at which legacy television businesses shrink and streaming models must shoulder an ever-larger share of revenue.