Whidbey Island Home Market Remained Steady Despite Luxury Slowdown

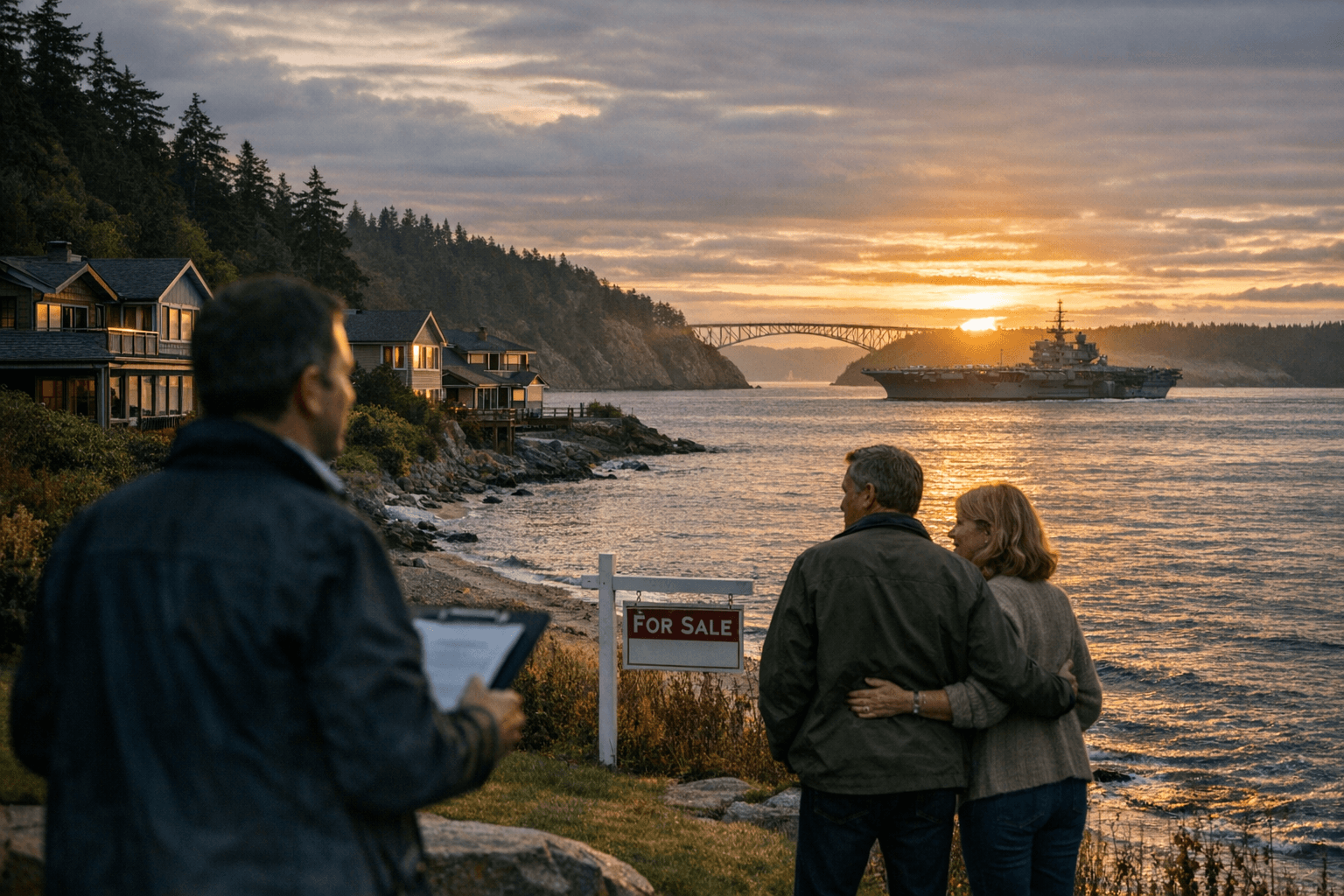

Island County’s housing market held steady in 2025, buoyed by a consistent Navy presence and limited supply even as high-end South End listings lagged. Key indicators — rising active listings, subdued new listings, and median prices above $600,000 — matter for local buyers, sellers and policymakers planning for housing and economic stability.

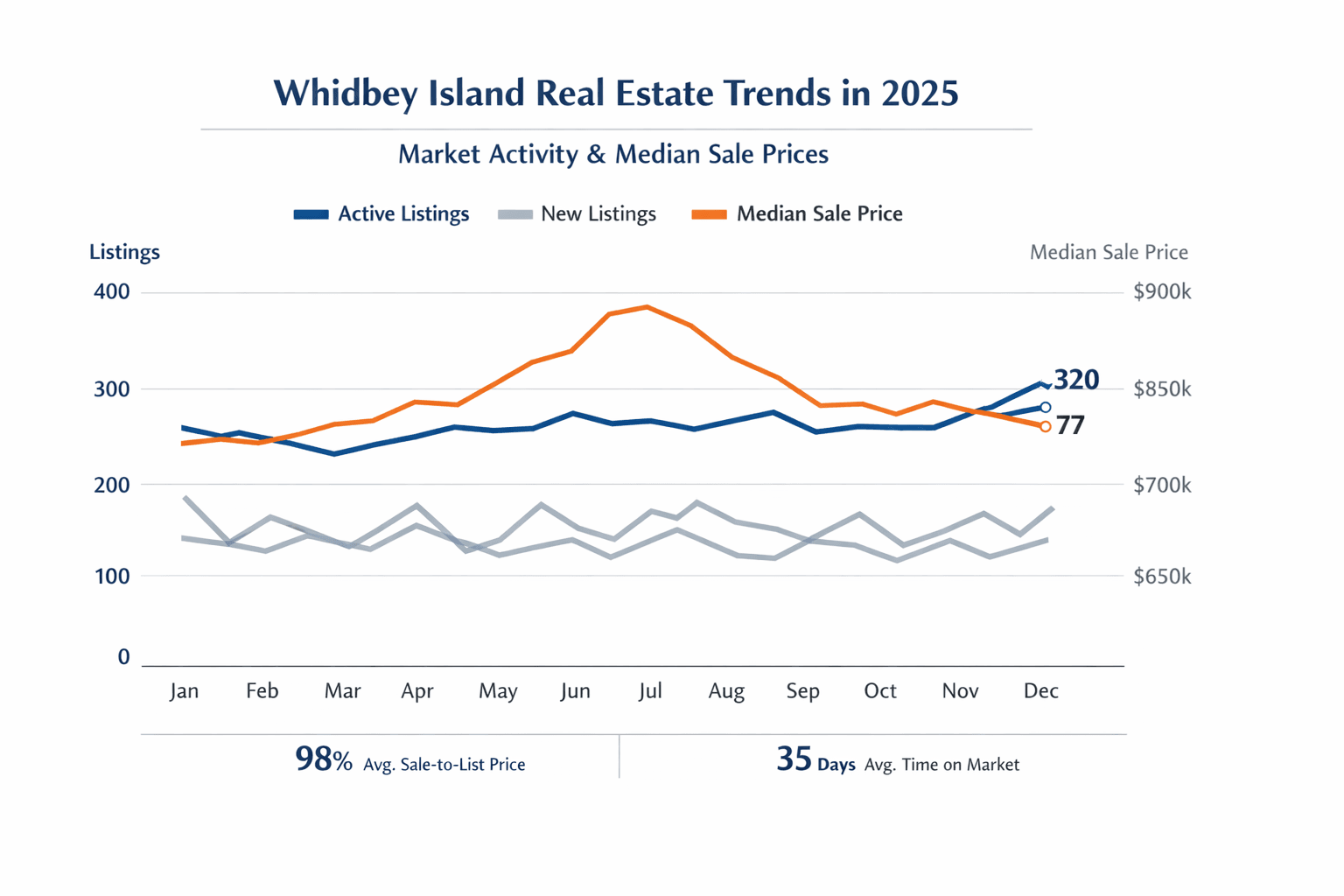

Whidbey Island’s real estate market finished 2025 largely steady, with family-oriented markets in Oak Harbor and Coupeville outperforming the luxury segment on the South End. Island County recorded 321 active listings in November, the most for that month in five years, while the 77 new listings that month were the fewest in that same period, illustrating a market shaped by constrained turnover rather than a surge in supply.

Median sale prices stayed above $600,000 through the year and peaked at $660,000 in August, signaling sustained price support even as some high-end properties languished. Christina Zimmerman, a Keller Williams Realty agent who focuses on the island, said “Home sales stayed right around 100% of the asking price. Around the fall, especially at the start of the fall, like September into the end of October, we started selling more like 98% of the asking price,” and added that “we saw things really pick up in November, and they’re holding pretty steady right now.”

Affordability dynamics varied across the island. Homes priced below $450,000 frequently drew multiple offers, making that segment particularly competitive for local buyers. By contrast, many luxury listings — typically concentrated on the South End — took longer to move, sometimes as long as 50 days, and “many homes listed for over $1 million expired,” underscoring a bifurcated market.

Local inventory turnover remains faster on North Whidbey: homes there spent about 35 days or fewer on market, compared with 60 to 90 days on the mainland. Zimmerman said mainland agents were showing up to North Whidbey because their markets were slower. She also observed “seller concessions” and noted “pent-up buyers” could return if interest rates change in early 2026, suggesting future activity is sensitive to broader financial conditions.

A steady Navy presence and a tight supply of available housing are central structural factors supporting island real estate. Zimmerman noted “I think that’s historically the case for our area,” pointing to persistent demand from service members and civilian employees as a stabilizing force.

Policy implications for Island County include the need to weigh housing supply strategies against the island’s limited developable land and the steady demand anchored by military activity. For residents, the current market favors sellers in entry-to-mid price tiers while creating marketing and pricing challenges for high-end sellers. As 2026 unfolds, small shifts in interest rates or local inventory could alter the balance between competitive bidding for affordable homes and prolonged listings at luxury price points.

Sources:

Know something we missed? Have a correction or additional information?

Submit a Tip