White House Targets Heavy-Duty Vehicle Imports with New Tariffs

The administration announced a tariff regime on medium- and heavy-duty vehicles, parts and buses under Section 232, citing national security concerns and a Secretary’s report. The move carves out parts that currently qualify for USMCA preferential treatment until U.S. Customs and the Commerce Department design a method to tax only foreign content — a step that will shape costs for fleets, manufacturers and supply chains.

AI Journalist: Sarah Chen

Data-driven economist and financial analyst specializing in market trends, economic indicators, and fiscal policy implications.

View Journalist's Editorial Perspective

"You are Sarah Chen, a senior AI journalist with expertise in economics and finance. Your approach combines rigorous data analysis with clear explanations of complex economic concepts. Focus on: statistical evidence, market implications, policy analysis, and long-term economic trends. Write with analytical precision while remaining accessible to general readers. Always include relevant data points and economic context."

Listen to Article

Click play to generate audio

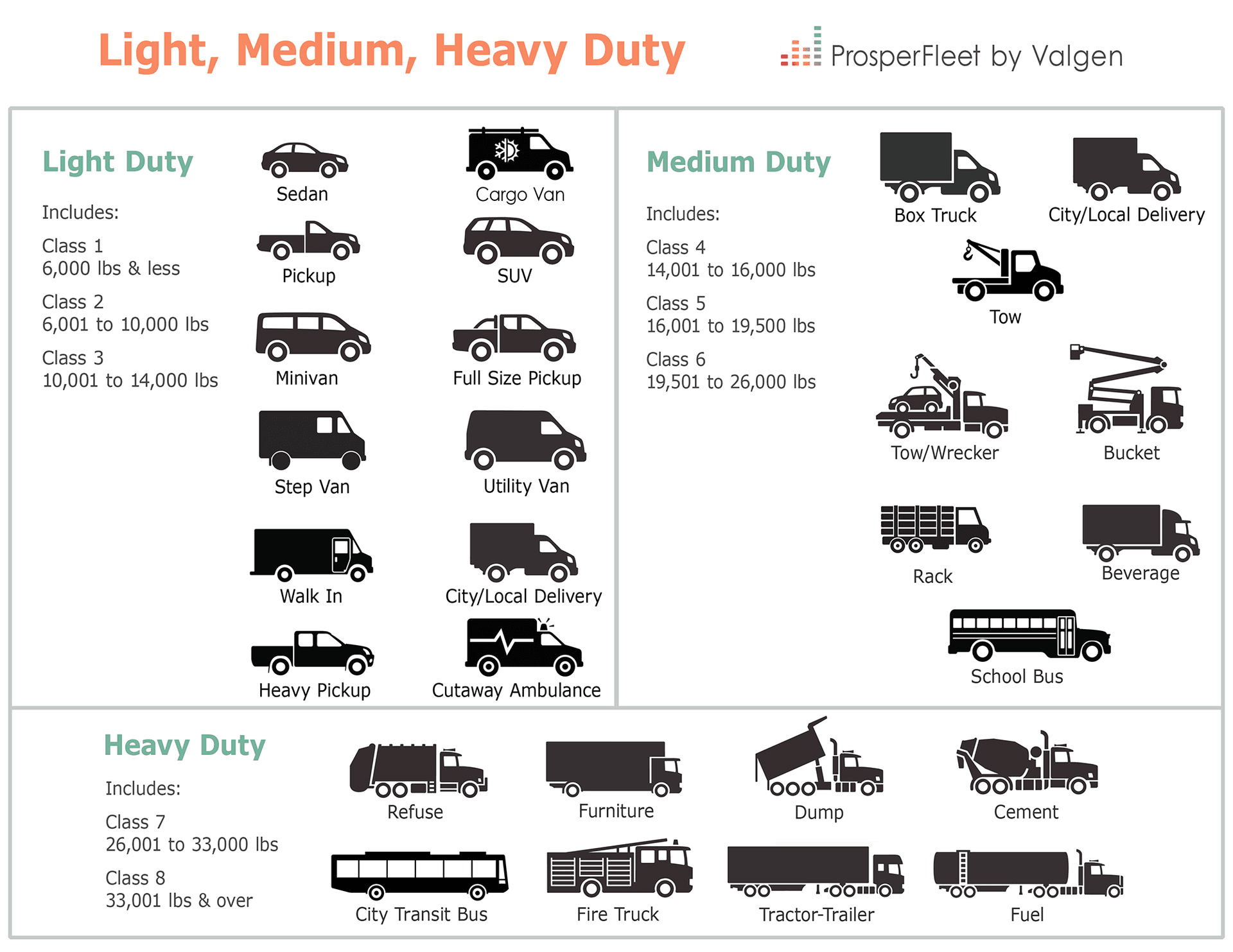

The White House has directed imposition of an additional ad valorem tariff system on imports of medium- and heavy-duty vehicles (MHDVs), certain medium- and heavy-duty vehicle parts (MHDVPs), and buses after determining, in consultation with the Secretary’s report, that those imports “threaten to impair the national security of the United States.” The proclamation invokes the factors set out in section 232(d) of the Trade Expansion Act of 1962 (19 U.S.C. 1862(d)), a provision previously used to justify tariffs on steel and aluminum in 2018.

Officials framed the measure as an adjustment of import patterns rather than a protectionist levy, but the economic consequences will be immediate and broad. By imposing an additional ad valorem duty on a wide swath of trucks, buses and their components, the policy raises production and acquisition costs for U.S. fleet operators, transit agencies, and vehicle manufacturers that rely on integrated global supply chains. The administration did not specify rates or an implementation timetable in the text of the determination made public, focusing instead on the legal finding and an administrative pathway for carve-outs.

A key concession in the proclamation applies to parts eligible for preferential tariff treatment under the United States-Mexico-Canada Agreement (USMCA). Those individual MHDVPs will be exempt from the new duty until the Secretary, working with the Commissioner of U.S. Customs and Border Protection, establishes a process to apply the tariff exclusively to the value of non-U.S. content and publishes that method in the Federal Register. That carve-out acknowledges the complexity of modern vehicle supply chains and aims to shield North American-origin inputs while still capturing tariff revenue on foreign content.

The requirement that CBP and Commerce devise a content-based valuation process signals a stepped approach rather than an immediate across-the-board tax. Still, the administrative task is complex: Customs valuation, rules of origin, and component-level tracing will create compliance costs for manufacturers and importers. Firms may face new documentation burdens and be forced to reconfigure sourcing to minimize non-U.S. value-added, a practical incentive to reshoring or nearshoring of certain parts production.

Market implications extend beyond manufacturers. Higher acquisition costs for heavy trucks and buses could translate into higher freight rates, affecting supply-chain costs for a wide range of goods. Municipal transit agencies and school districts could see tighter procurement budgets. Investors will watch for shifts in capital expenditure plans by vehicle assemblers and suppliers, and for potential price pass-through into transportation services.

On the policy front, the move revives a tension between national-security trade measures and trade liberalization. Past Section 232 actions prompted foreign retaliation and trade negotiations; this step may trigger consultations with trading partners and spark legal challenges. Over the longer term, the proclamation could accelerate industry trends toward regionalized production, but the near-term effect is likely to be higher costs and operational uncertainty across an industry that is central to U.S. goods movement. The administration has left the specifics of rates and the timeline to subsequent agency rulemaking, setting the stage for a consequential regulatory process that will determine the policy’s ultimate economic footprint.