Wyoming LLC Rules, Registered Agents Help Scam Sellers Evade Tracking

Recent reporting revealed that commercial registered agent services and Wyoming LLC friendly rules are being used by scam companies that list Wyoming addresses while operating elsewhere, making fraudulent sellers harder to trace. That practice matters to Albany County residents because it raises the cost of consumer recovery, complicates local enforcement, and threatens small business reputations and trust.

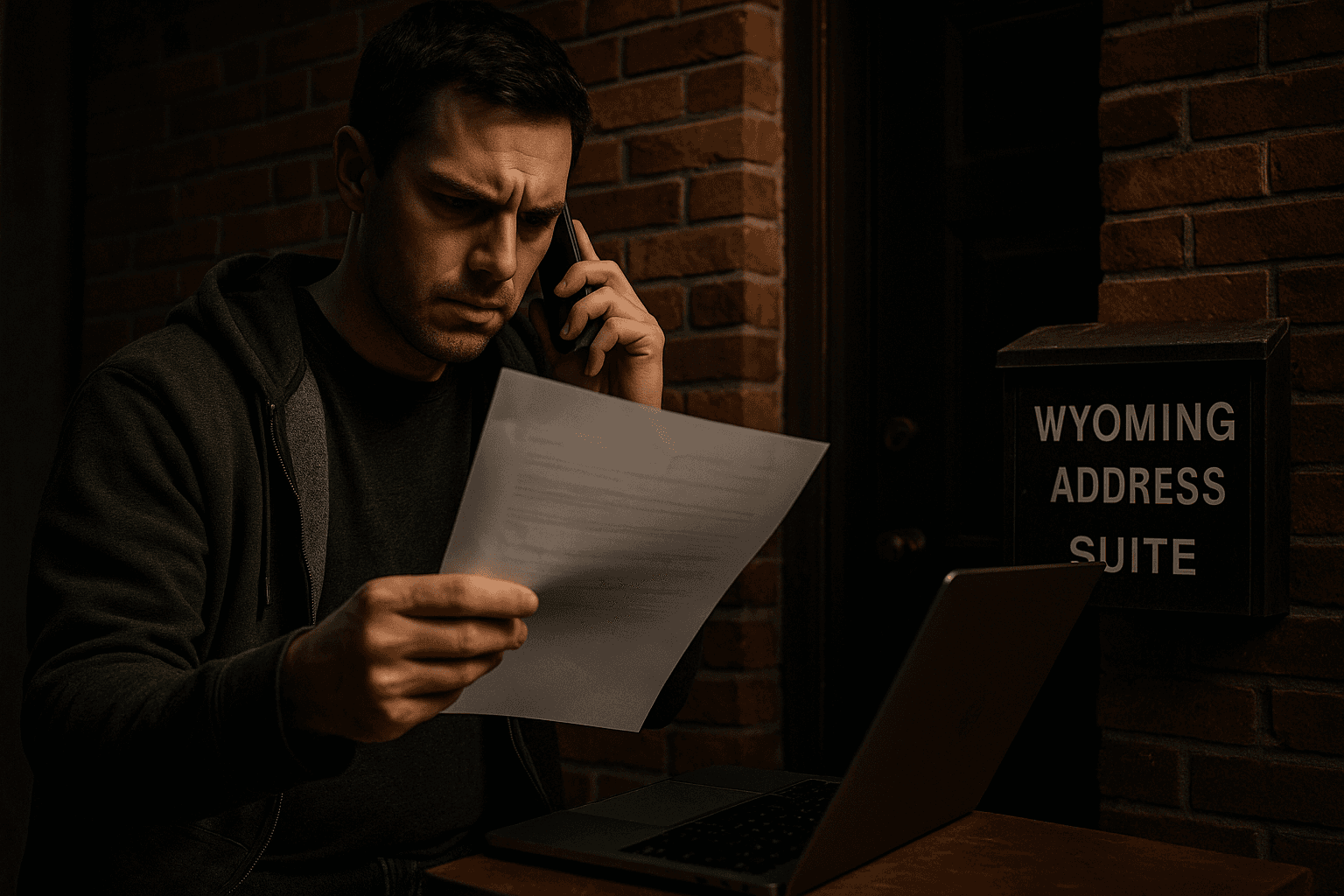

Recent reporting revealed a pattern in which fraudsters use Wyoming addresses and commercial registered agent services to mask where they actually operate. Companies can form limited liability companies in Wyoming while listing a commercial registered agent address that is often a single mailbox used by many firms. Combined with Wyoming privacy rules and tax advantages, the structure can make it difficult for consumers and prosecutors to locate operators and pursue legal remedies.

Registered agents are legally required points of contact for service of process and official notices. Commercial registered agent firms receive mail and legal documents for thousands of entities, and many companies adopt a Wyoming mailing address to take advantage of privacy protections that limit public disclosure of owners. Wyoming also offers tax incentives that make incorporation attractive to out of state sellers. For victims of scams, this setup can mean delays and extra expense in identifying who is responsible and where to file claims.

Consumer scams tied to these practices include online sellers who list a Wyoming address while shipping from other states, subscription traps that prove hard to cancel when the vendor is opaque, and business to business fraud where invoice collectors find no local presence. Law enforcement and civil plaintiffs face cross jurisdictional hurdles and added investigative costs when an apparent Wyoming mailing address obscures the seller's true operations.

State level debates are underway about how to limit abuse without stripping legitimate privacy protections. Proposals discussed include stronger beneficial owner disclosure, tighter verification requirements for registered agent filings, and penalties for deceptive listing practices. Policymakers face a trade off between transparency that helps consumers and protections that legitimate small businesses rely on for privacy and asset protection.

For Albany County residents and small business owners, the practical steps are to verify sellers, ask for local contact information, document transactions, and consult county consumer protection or legal resources if restitution is needed. As lawmakers weigh changes, local vigilance and clear records will be the most immediate tools to reduce harm and preserve fair commerce.