Americans Lost Over $333 Million to Crypto ATM Scams in 2025

FBI/IC3 data show reported U.S. losses to scams using Bitcoin and crypto ATMs surged to $333.5 million from January through November 2025, with more than 12,000 complaints filed. This article unpacks the numbers, how the frauds operate, victim profiles, representative cases, industry responses, law‑enforcement guidance, and wider market and policy implications.

1. FBI Losses Overview The FBI’s Internet Crime Complaint Center (IC3) reports $333.

5 million in reported losses tied to scams that use Bitcoin/crypto ATMs from January through November 2025, with more than 12,000 complaints during that period. The bureau described the pattern as a “clear and constant rise” that is “not slowing down.” These headline metrics are the central basis for law‑enforcement messaging and public warnings.

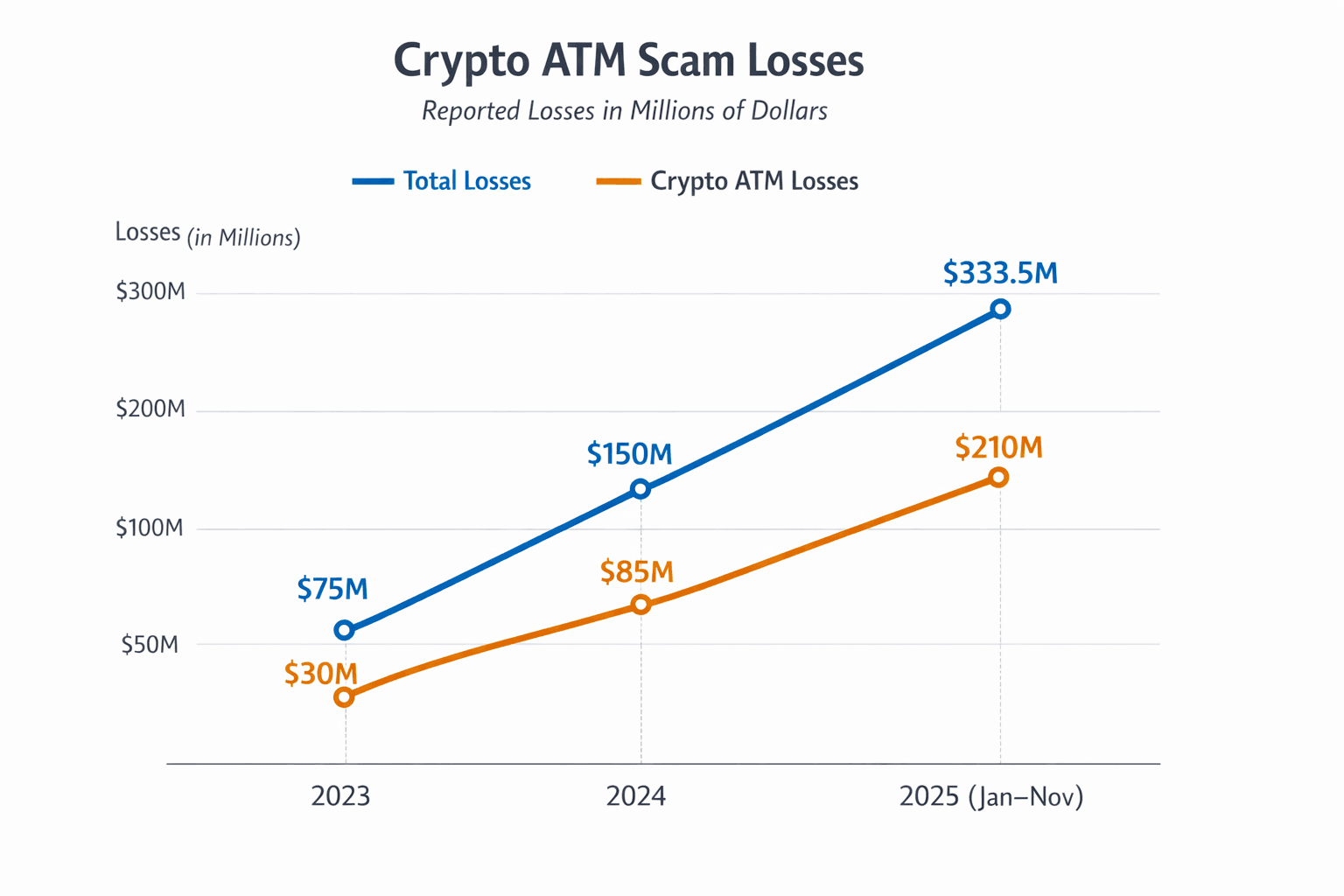

2. Year‑over‑Year Trend Losses tied to crypto ATM fraud rose rapidly from $114 million in 2023 to roughly $247 million in 2024, then to $333.

5 million through November 2025. That progression implies a roughly 117% increase from 2023 to 2024 and an additional ~35% increase from 2024 to 2025 (Jan–Nov), underscoring accelerating scale even before a full 2025 year‑end tally.

3. How the Scams Work Scammers typically call victims posing as government agencies, banks, tech‑support teams or other trusted organizations and insist on immediate payment to resolve an urgent problem or safeguard assets.

Victims are directed to withdraw cash and feed funds into nearby Bitcoin/crypto kiosks, which then send money to digital wallets—often overseas—within minutes, a speed and irreversibility that enable the fraud.

4. Infrastructure That Enables Transfers There are more than 45,000 Bitcoin ATMs nationwide that allow users to insert cash and send it to a digital wallet anywhere in minutes, according to reporting tied to the FBI data.

The breadth and speed of that infrastructure are critical: kiosks convert cash to crypto rapidly, creating limited windows for recovery once funds depart.

5. Victim Profile and Per‑Victim Losses Secondary summaries of the FBI data identify victims as disproportionately older Americans, reporting a median victim age of 71 and an average loss of about $15,600 per victim.

Note: dividing the IC3 headline totals by complaints yields roughly $27,800 per complaint ($333.5M / >12,000 complaints), so different reporting methods produce different per‑victim figures; both signals point to large financial harms concentrated among vulnerable populations.

6. Illustrative Case — Fran Bates Local affiliate coverage documented an 86‑year‑old, Fran Bates, who was filmed loading thousands into a Bitcoin ATM until a bystander contacted police; footage quoted Bates saying, “I’m in danger,” and Lt.

James Stewart responding, “Okay, no you’re not, ma’am. Okay, stop putting money in there.” An alleged scammer on the phone told Bates, “This is the security team,” illustrating the common script and the role of public intervention in stopping losses.

7. Illustrative Case — Florida Incident Another reported incident in Florida involved an 80‑year‑old man feeding tens of thousands of dollars from his life savings into a Bitcoin ATM while on the phone with unidentified scammers; police intervened but investigators said he had already lost about $50,000.

Local examples like these demonstrate the rapidity of losses and why prompt intervention is often the only practical check.

8. Industry Response and Kiosk Warnings Bitcoin ATM operators and industry representatives told reporters their machines display multiple fraud warnings—some kiosks present up to four alerts during a transaction—and they argue they are not responsible for criminals who misuse the technology.

Operators also point out that financial fraud occurs across many payment methods, but the irreversibility and speed of crypto ATM transfers put a spotlight on kiosk design and consumer protections.

9. Law‑Enforcement Guidance The FBI and other authorities uniformly warn consumers that any demand for immediate payment—especially requests for cryptocurrency—should be treated as a red flag and that consumers should contact law enforcement before sending money.

A blunt warning repeated in messaging: no legitimate government agency, bank or business will demand payment in cryptocurrency; avoiding immediate transfers is central to limiting recoverability problems.

10. Market Implications Rapid growth in reported losses will likely intensify scrutiny on crypto ATM operators, payment networks and kiosk placements; merchants and ATM networks may face pressure to tighten transaction limits, enhance identity checks, or redesign user flows to interrupt scams.

For the broader crypto market, rising fraud linked to cash‑in kiosks can fuel regulatory scrutiny that affects adoption, compliance costs and the reputational calculus for businesses using self‑service crypto on‑ramps.

11. Policy and Long‑Term Trends The IC3 figures fit a longer trend of scams migrating to fast, irreversible payment rails; regulators and lawmakers may pursue tighter Know‑Your‑Customer (KYC) rules, mandated delay mechanisms, mandatory on‑screen warnings, or clearer operator liabilities to reduce rapid cash‑to‑crypto misuse.

Over the long term, preventing this class of fraud will require coordination between law enforcement, kiosk operators, banks, and consumer‑protection agencies to change incentives and the technical balance between speed and recoverability.

12. Reporting Notes and Sources The $333.

5 million figure and the >12,000 complaint count are drawn from FBI/IC3 data for January–November 2025; prior‑year comparisons (2023: $114 million; 2024: ~$247 million) are from the same IC3 series. Details on victim age and average loss were reported in secondary summaries, and local outlets provided the illustrative case material cited above. For newsroom use, primary sourcing should include the FBI/IC3 release and the local and national reports that documented individual incidents and operator statements.

Conclusion (implicit) The IC3 data show a growing, costly exploitation of crypto ATMs that combines social‑engineering tactics with a payment rail optimized for speed and irreversibility. Policymakers, operators and consumers face practical choices—limiting instant transfers, improving on‑screen safeguards, and expanding public education—to blunt a trend the FBI calls a “clear and constant rise” that is “not slowing down.”

Sources:

Know something we missed? Have a correction or additional information?

Submit a Tip