TSMC Posts Strong Q4 as AI Demand Fuels Surge in Orders

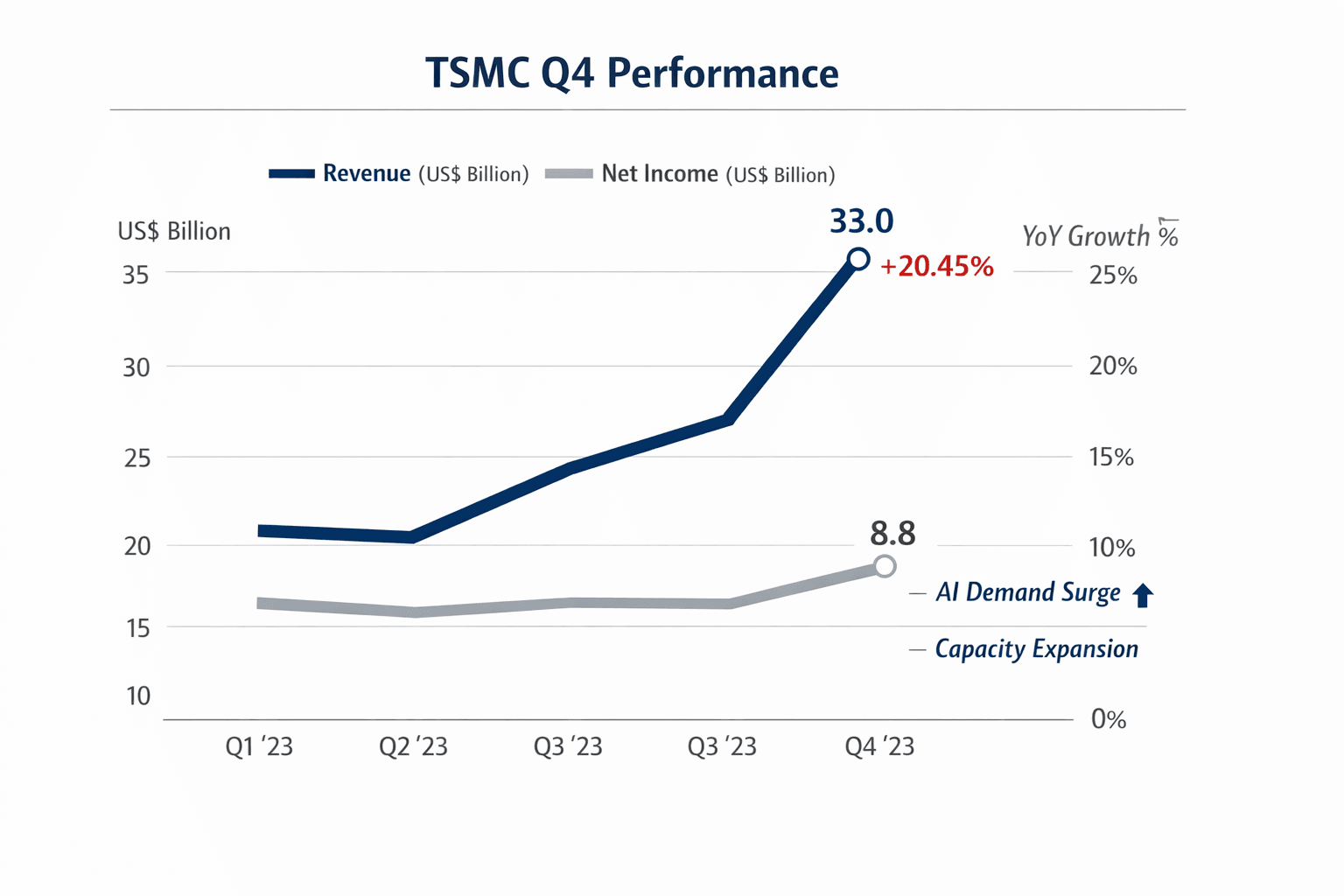

Taiwan Semiconductor Manufacturing Co. reported a stronger-than-expected fourth quarter, with revenue rising about 20.45% year-over-year to NT$1.046 trillion (roughly US$33 billion). The result, an upward revision to 2025 revenue guidance and a sharply higher capital spending plan underscore how AI compute needs are reshaping investment across the semiconductor supply chain.

Taiwan Semiconductor Manufacturing Co. posted fourth-quarter revenue of about NT$1.046 trillion, roughly US$33 billion, on Jan. 9, marking a year-over-year gain of approximately 20.45% and topping analyst expectations. Management and market observers tied the outperformance to sustained demand for chips that power artificial intelligence models, prompting the company to raise its full-year outlook and commit to a significant expansion of advanced manufacturing capacity.

The stronger quarterly result follows a string of record performances in 2025. In the prior quarter TSMC reported revenue of NT$989.92 billion and net income of NT$452.3 billion, reflecting steep year-over-year gains as major customers ramped orders for high-performance GPUs and data-center processors. Executives have repeatedly cited the proliferation of large AI models and increased enterprise compute commitments as primary drivers of higher utilization and bookings.

CEO C.C. Wei, discussing the company’s position on the call, said, “Recent developments in AI market continue to be very positive,” and management described growing demand from chip designers and cloud operators as strengthening TSMC’s conviction in the "AI megatrend." Major customers including Nvidia, AMD, Broadcom and Apple account for a large share of advanced-node orders, while hyperscalers and AI firms are committing multi-gigawatt power footprints that translate into ongoing demand for wafer capacity.

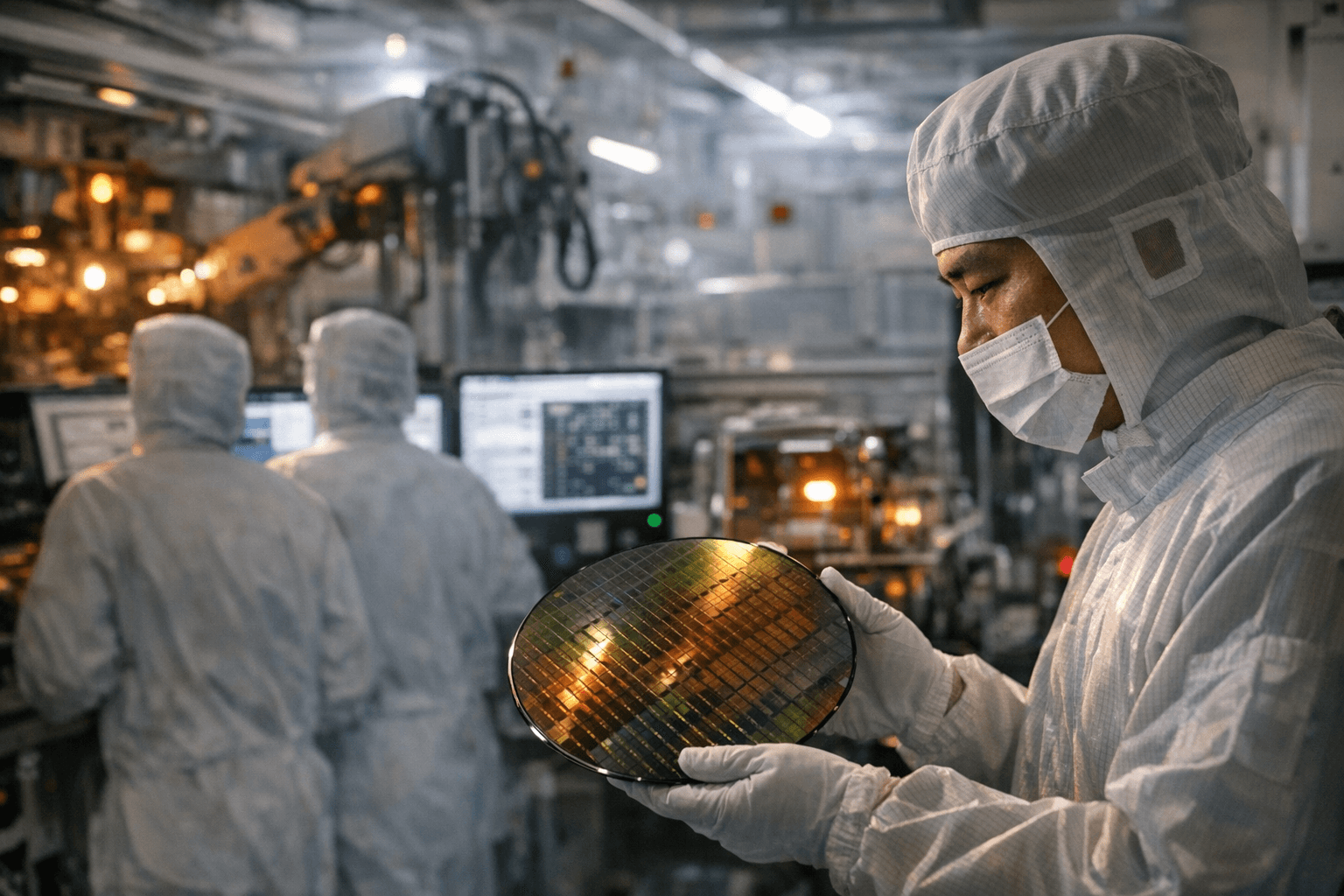

Process technology is central to TSMC’s revenue mix. Industry data and company disclosures indicate strong traction at cutting-edge nodes, with 3nm and 5nm processes representing a substantial portion of wafer sales. One industry estimate places 3nm and 5nm at roughly 60% of total wafer sales, while 4nm and 5nm lines are running at high utilization. TSMC is investing in next-generation 2nm development and advanced packaging solutions such as chip-on-wafer-on-substrate to sustain performance gains demanded by AI accelerators.

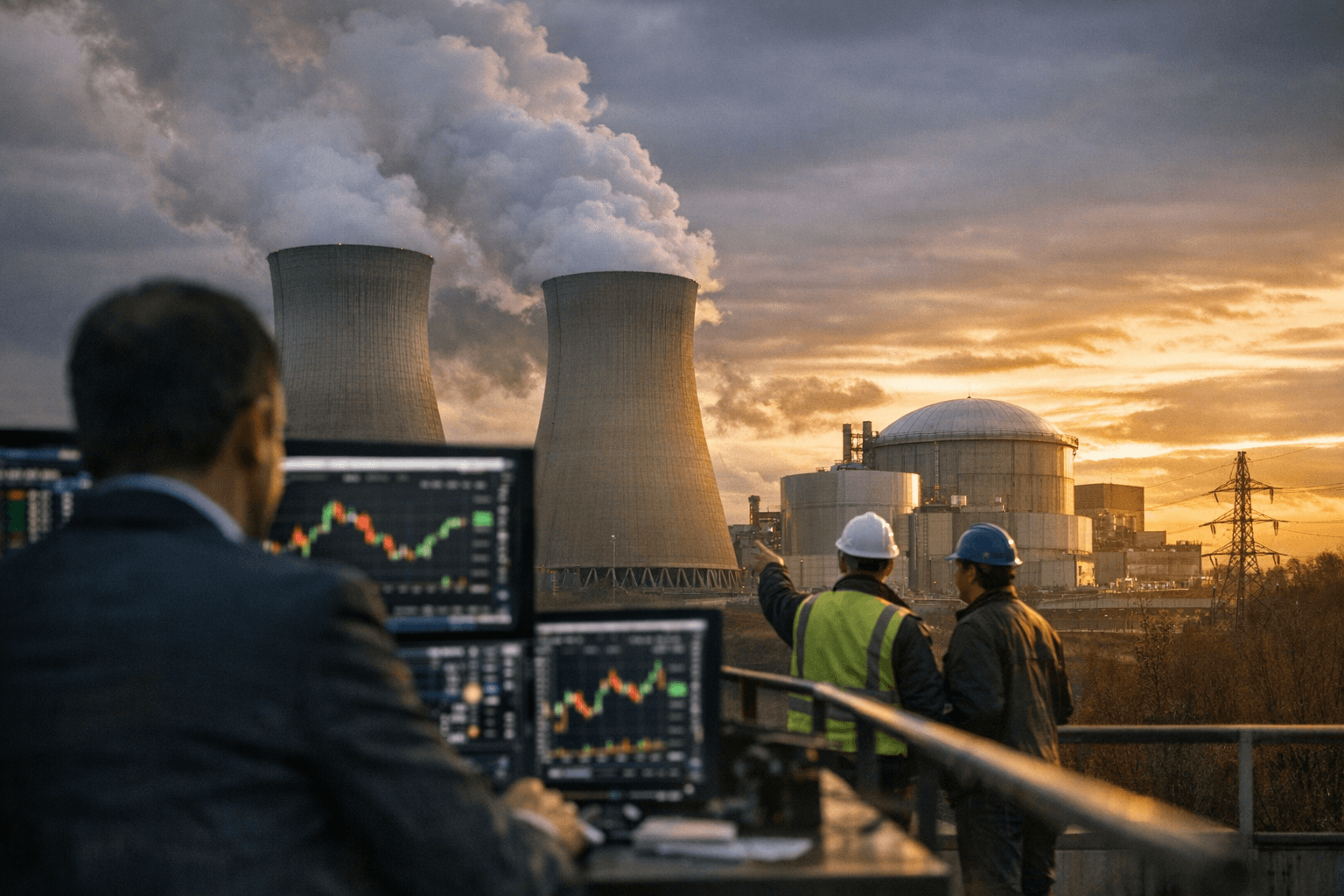

In response to the demand surge, TSMC raised its full-year 2025 revenue growth guidance into the mid-30% range, up from earlier forecasts of around 30%. The company also signaled a significant increase in capital expenditure for 2025, setting a floor at least US$40 billion for investments in fabs and packaging. By comparison, TSMC spent about US$29.8 billion on capital projects in 2024, and it plans roughly 70% of the new spending to focus on advanced manufacturing processes.

Analysts generally view the outlook as favorable, with consensus estimates pointing to continued revenue and earnings growth into 2026. Still, risks remain: softness in traditional consumer segments such as PCs and smartphones could temper demand, and geopolitical tensions and potential tariffs add uncertainty to supply chains. TSMC has sought to mitigate those risks through investments outside Taiwan, including expanding U.S. manufacturing capacity and pursuing tariff exemptions where possible.

The results on Jan. 9 crystallize a larger industry shift: accelerating AI workloads are driving both near-term revenue gains and a multiyear wave of capital commitments aimed at securing the advanced-node capacity required for next-generation compute. Balancing those investments with demand variability in other markets and geopolitical pressures will be central to TSMC’s strategy in 2026.

Know something we missed? Have a correction or additional information?

Submit a Tip