Arabica Futures Jump to Four-Week High on Brazil Weather Concerns

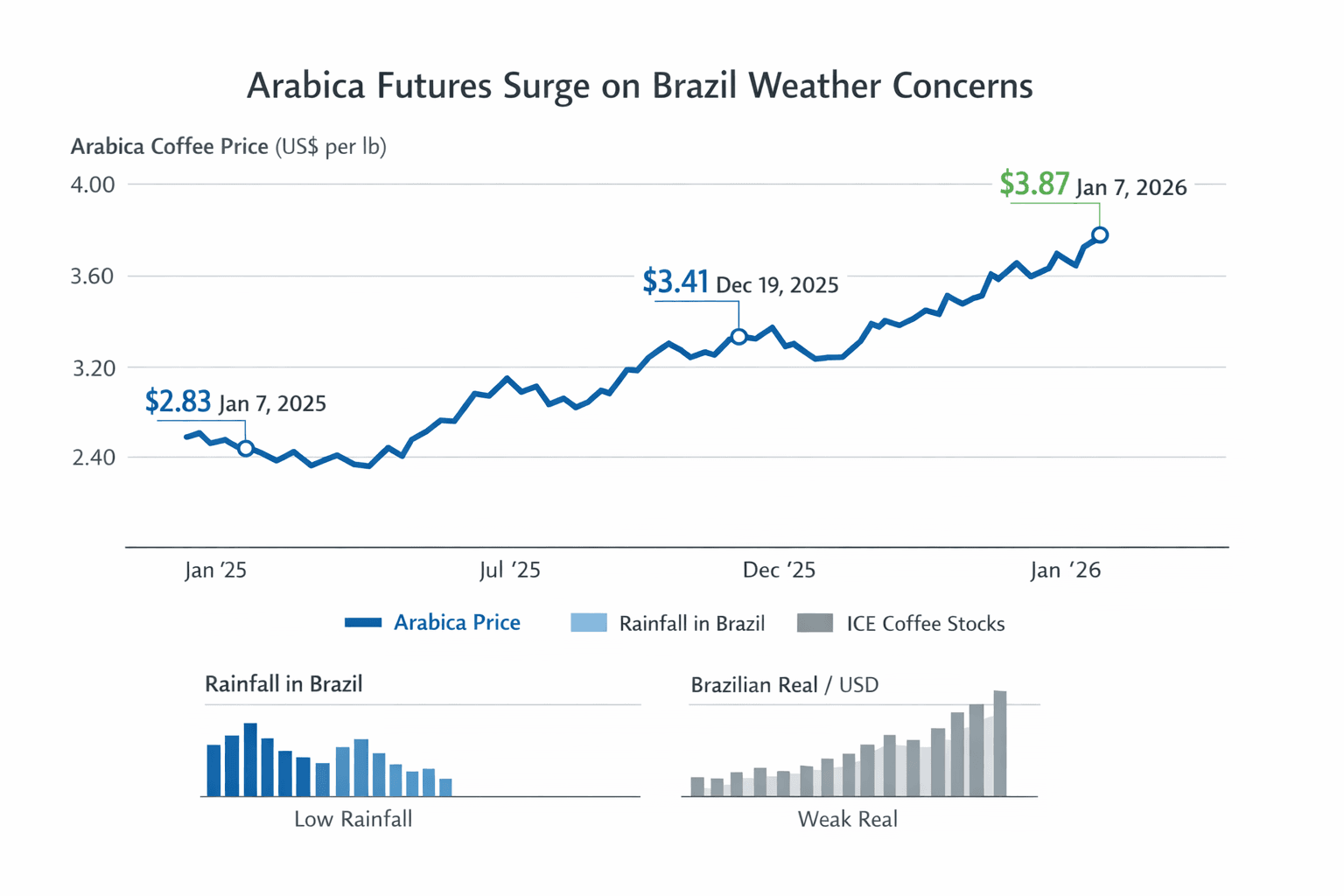

Arabica coffee futures rose to US$3.87 per pound on January 7, 2026, a four-week high that marks a sharp rebound from a December trough and a substantial year-on-year gain. The move reflects below-average rainfall in Brazil, a stronger Brazilian real versus the US dollar, and thin ICE-monitored inventories, all of which matter for buyers, roasters, and cafes planning coffee purchases.

Arabica futures climbed to US$3.87 per pound on Wednesday, January 7, 2026, reaching a four-week high as the market reacted to supply and currency pressures. The price represents a notable rebound from a December low near US$3.41 per pound on December 19, 2025, and stands materially higher than the US$2.83 per pound recorded on January 7, 2025.

Traders cited a combination of weather and currency moves as the immediate drivers. Below-average rainfall across key Brazilian growing areas raised concerns about crop stress and potential impacts on green-bean availability. At the same time, a firmer Brazilian real against the US dollar has tightened the pass-through of Brazilian exports into global dollar-priced markets, supporting higher dollar-based Arabica quotations.

Stocks monitored by ICE remain low, amplifying sensitivity to short-term shocks even as trade flows adjust. Recent tariff changes that eased Brazilian coffee access to the United States have improved logistical channels, but have not fully damped upward pressure on prices given the other supply-side signals.

The rise in Arabica comes alongside strength in Robusta markets. March Robusta futures were up about 1.6 percent, and Vietnam reported increased robusta exports, which provides some relief for blends and instant-coffee supply chains that use higher shares of Robusta. Still, Robusta gains do not remove immediate stress on pure Arabica lots that specialty roasters and single-origin buyers prioritize.

Practical steps for coffee operators and buyers include checking inventory levels and delivery schedules now, evaluating forward-contract options to lock in supply, and comparing offers from multiple origins to manage cost risk. Monitor Brazilian weather forecasts and moves in the Brazilian real, and watch ICE inventory updates for clues about whether this rally has staying power.

What to watch next: rainfall forecasts in Brazil through the end of January, continued currency fluctuations between the Brazilian real and the US dollar, and weekly ICE inventory reports. Those factors will determine whether the early January rebound develops into a sustained trend that affects green-bean costs and retail prices through the year.

Sources:

Know something we missed? Have a correction or additional information?

Submit a Tip