Asian Markets Cautious, Await Fed Decision Amid Divergent Views

Asian shares opened cautiously on Monday as investors count down to a closely watched Federal Reserve meeting later this week where markets largely expect a quarter point rate cut. The outcome matters for global asset prices, because a fractious Fed meeting or signs of remaining resistance among officials could prompt renewed volatility across equities, bonds, currencies and commodities.

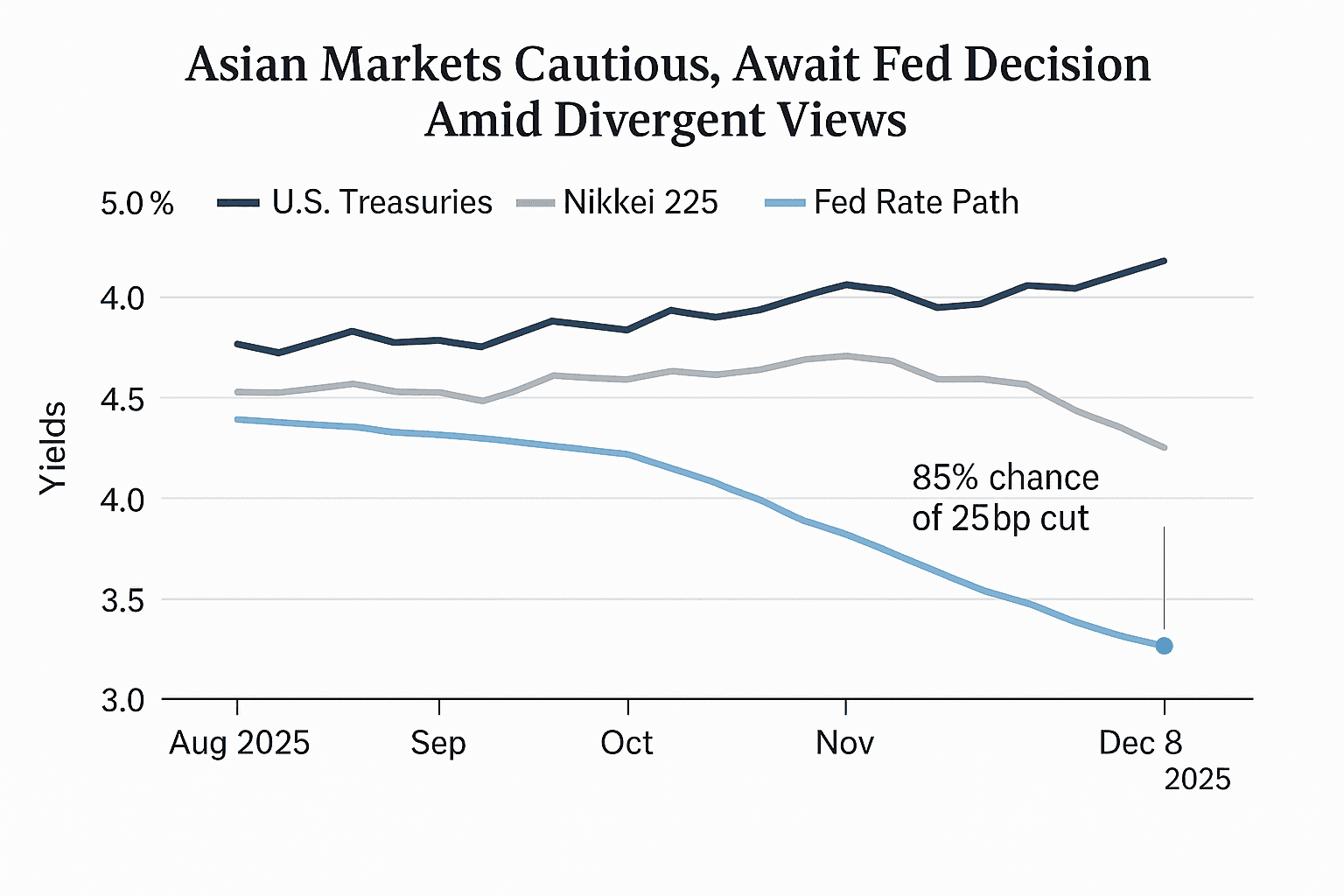

Asian stock markets began the week in a cautious mood on December 8, 2025 as traders positioned for the U.S. Federal Reserve meeting later this week. Market pricing implied roughly an 85 percent chance of a 25 basis point reduction from the current 3.75 percent to 4.0 percent target range, but analysts warned the decision and the accompanying statement could be fractious, with some Federal Open Market Committee participants expected to oppose an immediate cut.

The mood of caution showed up in regional indices, with Japan’s Nikkei and South Korea’s KOSPI each slipping about 0.3 percent in early trading. U.S. Treasury yields ticked up slightly and the U.S. dollar stabilized after recent declines, reflecting investor focus on how the Fed will communicate both its near term policy path and longer run projections. Market participants say a sharp shift in the statement or dot plot could alter expectations for 2026 monetary easing and quickly reverberate through global markets.

A Reuters poll of economists found most respondents expect the Fed to deliver a quarter point reduction, while several predicted dissenters on the committee. JPMorgan economist Michael Feroli cautioned that there could be at least two dissents at this meeting, and he forecast the Fed might follow with another cut in January before pausing. That prospect of an incremental easing sequence rather than a decisive pivot helps explain why fixed income and currency markets are moving with caution, rather than committing to a sustained rally.

Other central banks meeting this week are broadly expected to hold policy steady. Canada, Switzerland and Australia are all scheduled to announce decisions, with the Swiss National Bank facing particular scrutiny because of the exceptionally strong franc. A resilient franc complicates Swiss policy choices by exerting downward pressure on imported inflation and on exporter competitiveness, increasing the political and market pressure on the SNB to consider easing measures if domestic growth weakens.

Commodities markets reacted to the easing expectations by climbing. Copper reached fresh record highs and precious metals pressed toward recent peaks as lower expected interest rates reduce the opportunity cost of holding non interest bearing assets. Oil prices edged higher amid persistent geopolitical supply concerns, contributing to a broader commodity led bid.

With so much attention on Fed communications, strategists say the immediate market risk is not the rate cut itself but the tone and projections that accompany it. A unanimous, clearly signposted easing path would likely support risk assets and soften the dollar, while a statement that highlights internal splits or signals only tentative accommodation could prompt a rapid reallocation into safe haven assets. For regional markets that have moved in step with global rate expectations, December’s Fed messaging may therefore set the tone for market direction well into the new year.