China Exports Rebound, Shipments Shift Away from United States

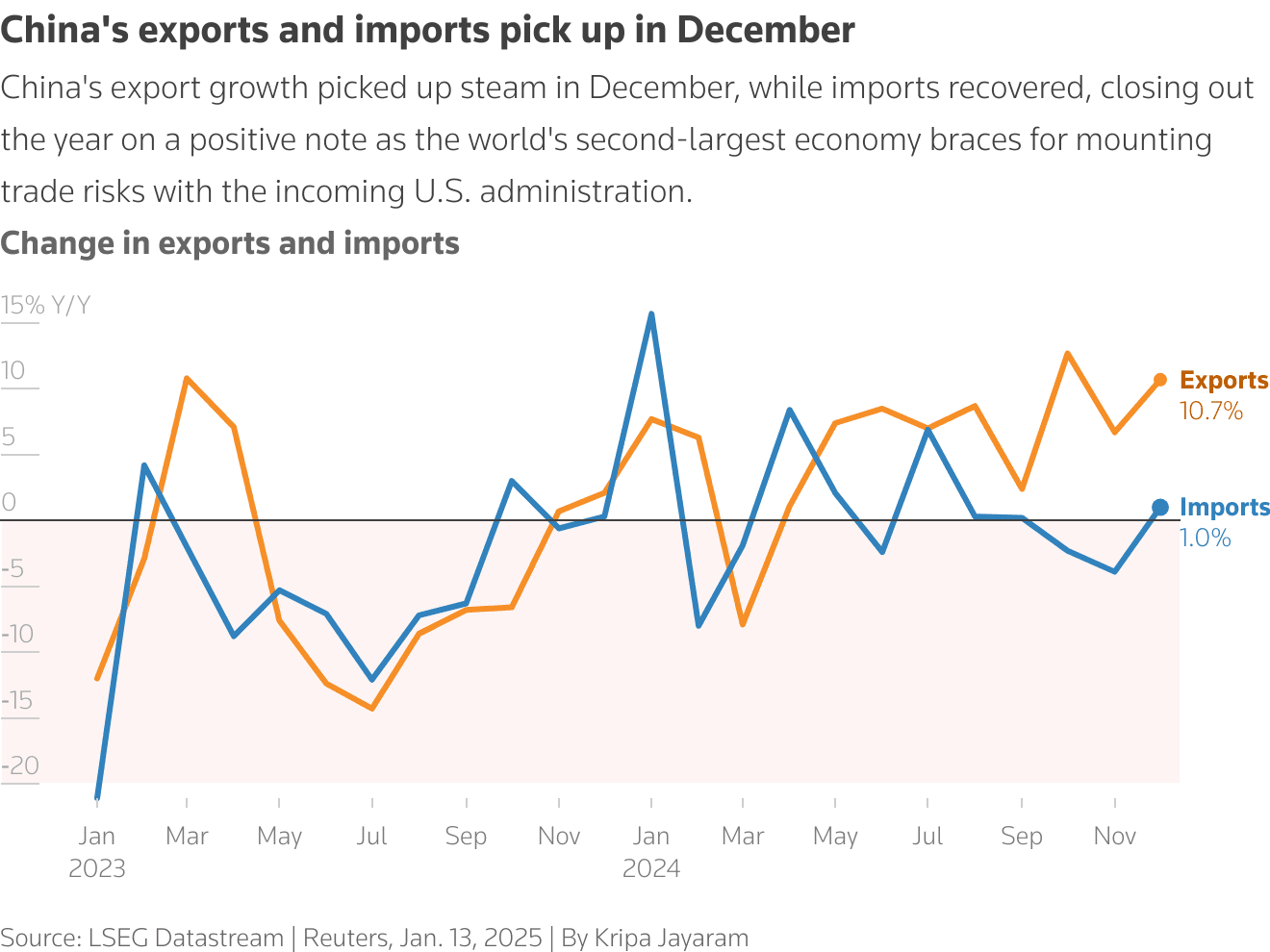

China's customs data showed exports rose 5.9 percent year on year in November, surprising markets and signaling exporters are finding demand outside the United States. The shift matters because it highlights how trade rerouting and supply chain diversification are helping Beijing sustain export growth even as domestic demand remains subdued.

China reported a stronger than expected export performance in November, with customs data showing shipments rose 5.9 percent year on year, reversing a contraction the prior month and outpacing a Reuters poll forecast of 3.8 percent. The surprise was driven largely by faster growth in sales to markets other than the United States, a pattern that has implications for global trade flows and U.S. policy makers.

Customs authorities said the improvement was concentrated in shipments to the European Union, Australia and Southeast Asia, while exports to the United States declined sharply amid elevated American tariffs. The redistribution of Chinese exports underlines a growing geographic diversification of demand for Chinese goods, and suggests exporters are adjusting sourcing and sales strategies to soften the impact of tariff measures.

Imports underperformed in November, rising 1.9 percent year on year versus expectations near 3.0 percent, a sign that domestic demand within China remains muted. Weak import growth feeds into worries about consumer and investment recovery, limiting the scope for demand driven growth and placing more weight on external demand to support factory output and employment.

The monthly trade surplus widened to $111.68 billion for November, and the gap pushed the 11 month cumulative surplus past $1 trillion for the first time. That sustained surplus amplifies concerns about global imbalances, and it will likely feed into policy debates in trading partners about the adequacy of current tariff and trade enforcement measures.

Economists examining the data pointed to trade rerouting and the diversification of Chinese supply chains as key factors allowing exporters to maintain market share into 2026. Firms have been relocating production, adjusting sales channels and deepening ties with regional partners to offset the drag from higher trade barriers in the United States. These shifts help explain why headline export growth can be robust even when shipments to one major market deteriorate.

For markets and policy makers the dynamics pose difficult trade offs. Persistent export strength supports factory activity, the balance of payments and employment, yet a reliance on external demand leaves China vulnerable to slower growth abroad. The weak import figures reduce pressure on commodity prices and limit upside for countries that sell intermediate goods to China. For the United States and other economies imposing tariffs, the data suggest that sanctions can redirect trade but may not easily erode China’s overall export momentum.

Looking ahead, analysts will watch whether November represents a temporary rebound or a durable reorientation of Chinese trade patterns. If exports continue to outpace imports, Beijing may face growing calls both at home and abroad to rebalance growth more toward consumption and investment, while trading partners will reassess the effectiveness of tariffs and incentives in shaping supply chain decisions.