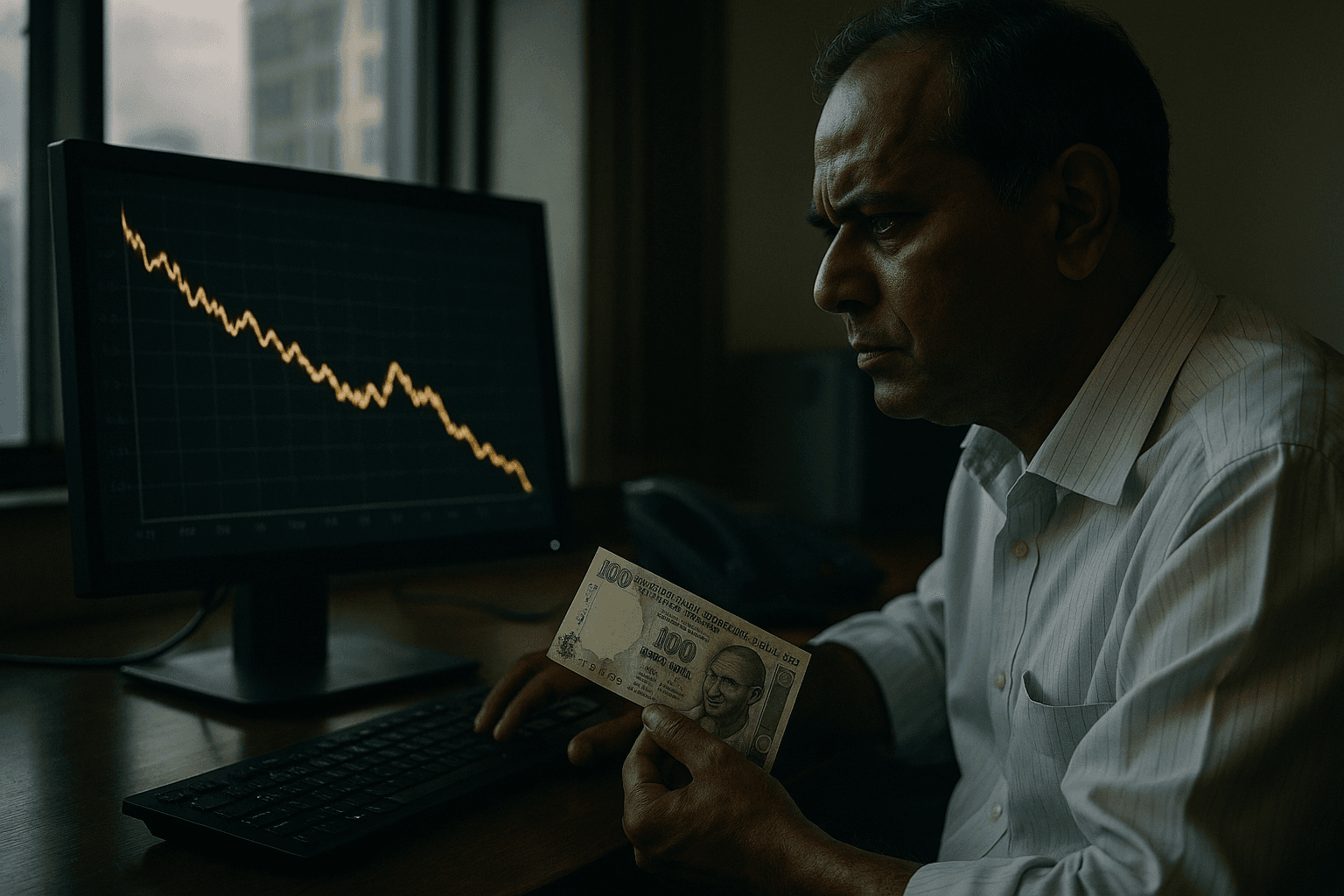

India Quietly Intervenes to Stabilize Rupee as Volatility Mounts

India’s central bank is stepping up clandestine actions to steady the rupee, using spot foreign exchange intervention, verbal signals, and indirect tools to blunt speculative pressure. The approach has calmed the currency at times, but it has also increased market uncertainty and sharpened the trade off between easing domestic interest rates and guarding against import driven inflation.

The Reserve Bank of India has intensified a calibrated, often low visibility campaign to support the rupee as currency volatility accelerates, according to market participants and traders tracking intervention flows. The central bank’s toolkit has included direct spot market purchases, carefully worded public statements, and less visible measures aimed at discouraging one directional bets against the currency.

Those actions have helped arrest episodes of sharp depreciation, restoring order in thin market windows and reducing some of the speculative momentum that feeds a weakening cycle. But the interventions have not eliminated the underlying pressures that exposed the currency in the first place. International investors and traders say the RBI’s posture has added an element of unpredictability, because market participants are uncertain about the scale and timing of future responses.

The central tension for policymakers is straightforward. With growth showing signs of strain, authorities face pressure to ease monetary policy to support domestic demand. At the same time a weaker rupee raises the cost of imports, particularly for oil and other commodities, which can feed through into headline inflation and erode real incomes. That dynamic complicates any decision to lower interest rates, since such a move could amplify capital outflows and further pressure the currency.

Market participants describe the RBI’s approach as pragmatic, combining visible interventions with so called verbal intervention to shape expectations. Verbal interventions can be effective in the short run, but they rely on credibility that is harder to maintain if the underlying macro forces run counter to the central bank’s message. Traders warn that continuing to defend the currency could become expensive and could reduce the RBI’s flexibility in future policy cycles.

The backdrop to the intervention campaign is a global environment of elevated volatility and interest rate differentials that favor dollar denominated assets. Emerging market currencies, including the rupee, have felt pressure as capital flows have prioritized higher yield and perceived safety. In this environment the RBI’s foreign exchange reserves and its willingness to deploy them become the principal line of defense against disorderly moves.

Policy makers must weigh the immediate benefit of a steadier currency against the longer term cost of repeatedly intervening. Frequent intervention can blunt exchange rate adjustment that would otherwise relieve external imbalances, and it can encourage additional speculative activity if markets sense a defensive posture. It can also complicate communication around the timing and extent of monetary easing, reducing transparency at a moment when clear guidance would help anchor expectations.

For households and businesses the practical consequences are tangible. A renewed slide in the rupee would push up the local currency cost of imported fuel and raw materials, raising production costs and consumer prices. Conversely, premature monetary easing to stimulate growth risks destabilizing the currency further, forcing a policy reversal that could roil markets.

As 2025 draws to a close, India’s central bank is navigating between immediate stability and long term flexibility, seeking to avoid a sharp currency shock without compromising its capacity to respond to future economic weakness. Markets are watching closely, mindful that the next move may set the contours of policy for months to come.