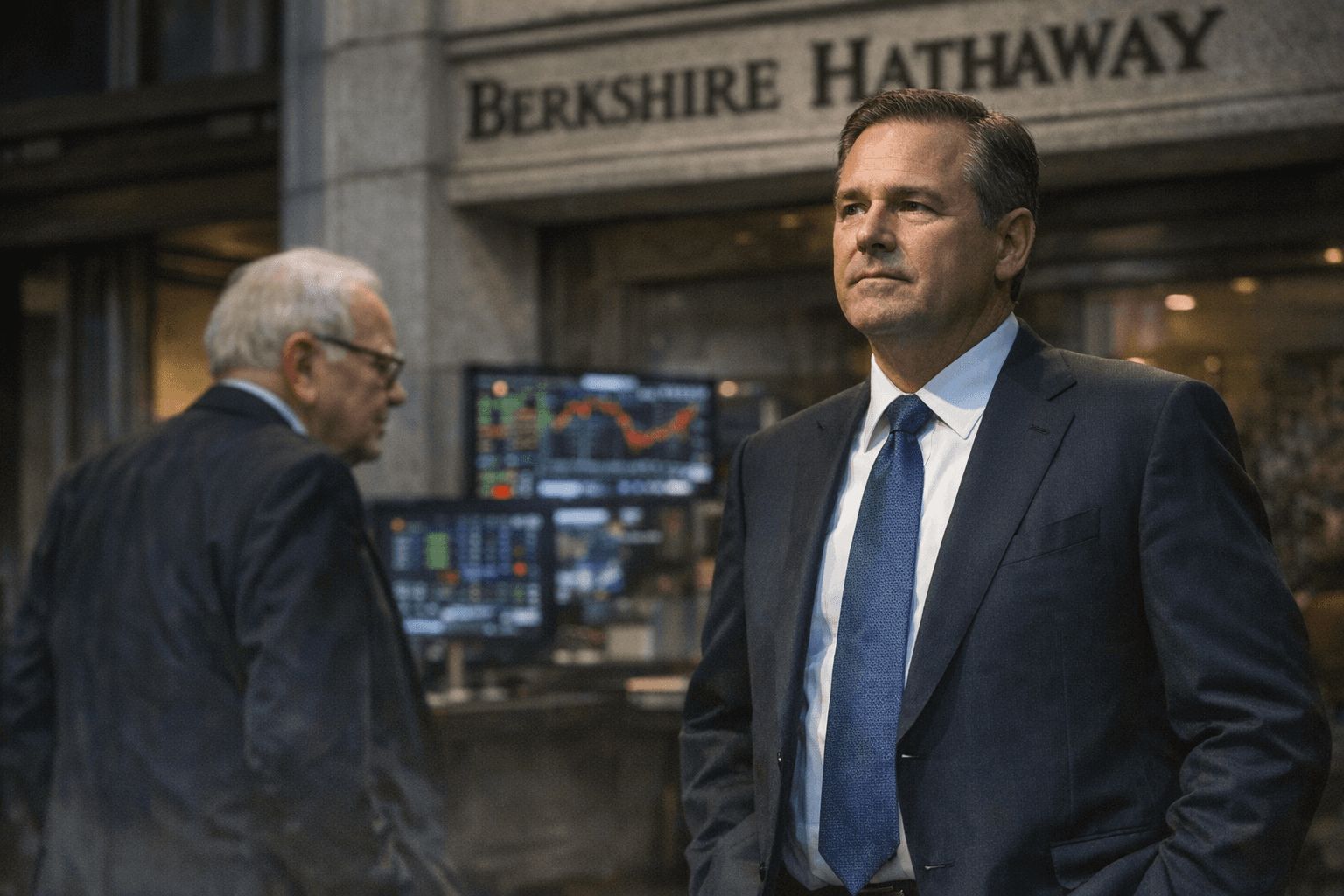

Berkshire Enters New Era, Greg Abel Takes Operational Reins

Warren Buffett is stepping back from day to day management after six decades, and Greg Abel will assume primary operational leadership as Berkshire Hathaway transitions at year end 2025. The move finalizes a long running succession process, shifting investor focus from a legendary chief executive to an executive whose background in energy and operations could reshape Berkshire's strategic trajectory.

Berkshire Hathaway announced on December 30, 2025 that Warren Buffett would step back from day to day management and that Greg Abel, the company’s vice chairman overseeing non insurance operations and Buffett’s designated successor, would assume primary operational leadership as the company completes its transition at year end 2025. The decision marks the end of a deliberate succession process that Buffett set in motion publicly in recent years and that will bring a new managerial emphasis to one of the United States’ largest conglomerates.

Buffett, who took control of Berkshire Hathaway in 1965, has served as the face and long time strategic driver of the company for 60 years. The succession plan, formalized in 2021 when he publicly identified Abel as his successor, has been closely watched by investors because Berkshire’s mix of insurance float, operating subsidiaries and a sizable public equity portfolio depends heavily on centralized capital allocation and deal making.

Greg Abel is known for his operational experience at Berkshire Hathaway Energy and for overseeing the sprawling non insurance businesses that include utilities, manufacturing, retail and services. He joined the energy business in the 1990s and rose through operational ranks to the executive suite, giving him deep experience in regulated industries and large scale project management. His promotion to primary operational leader signals a shift toward professional management and operational steadying at a time when investors are assessing how Berkshire will allocate capital without Buffett’s daily hand.

The immediate market implications are centered on questions of continuity and capital allocation. Berkshire’s long run success has relied on the company’s ability to deploy insurance float and free cash flow into acquisitions and equity investments. Investors will watch whether Abel maintains Buffett’s historic preference for large acquisitions bought at scale, or whether the company tilts toward more diverse deal structures and earlier operational integration given Abel’s background. Analysts will also scrutinize shareholder return policies, including share repurchases and dividend choices, because those levers will shape returns in the post Buffett era.

Beyond corporate strategy, the transition matters for broader market stability because Berkshire’s insurance businesses serve as both an earnings engine and a source of investable capital. Regulatory relationships, underwriting discipline and claims management are likely to remain focal points for overseers and rating agencies as operational leadership shifts.

The succession also fits a wider long term trend of leadership professionalization at giant conglomerates and investor insistence on transparent succession planning. For Berkshire shareholders the central near term question is whether Abel’s operational focus can preserve the company’s capacity for large scale investments while maintaining the unique, decentralized culture Buffett cultivated.

As the calendar turns to a new year, markets and policy watchers will use the coming months to measure execution risks and to see whether the company’s practices, from underwriting to capital allocation, remain steady under a leader whose career reflects operations and regulated industries rather than the iconic investor persona that has defined Berkshire for decades.

Sources:

Know something we missed? Have a correction or additional information?

Submit a Tip