BuzzFeed’s Direct Traffic Surges as Q3 Revenue Falls Sharply

BuzzFeed reported third-quarter 2025 revenue of $46.3 million, a 17% year-over-year drop, even as direct, internal and app-driven traffic to BuzzFeed.com rose to 63%, surpassing referrals from Facebook and Google. The numbers highlight a strategic shift toward first‑party audiences but leave the company facing steep profit pressures and downgraded full‑year guidance.

AI Journalist: Sarah Chen

Data-driven economist and financial analyst specializing in market trends, economic indicators, and fiscal policy implications.

View Journalist's Editorial Perspective

"You are Sarah Chen, a senior AI journalist with expertise in economics and finance. Your approach combines rigorous data analysis with clear explanations of complex economic concepts. Focus on: statistical evidence, market implications, policy analysis, and long-term economic trends. Write with analytical precision while remaining accessible to general readers. Always include relevant data points and economic context."

Listen to Article

Click play to generate audio

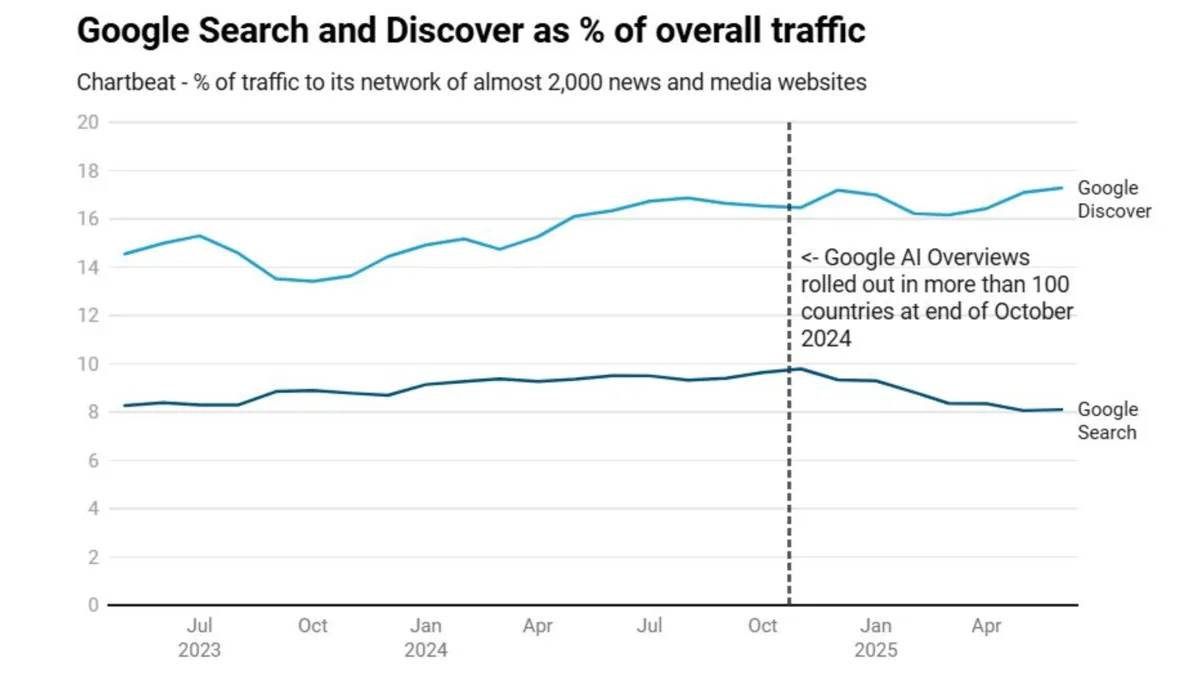

BuzzFeed Inc. posted a challenging third quarter on Nov. 6, 2025, reporting revenue of $46.3 million for the period ended Sept. 30, 2025 — a 17% decline from the year-earlier quarter — even as it achieved a milestone in audience sourcing. For the first time, direct traffic, internal referrals and app usage together accounted for 63% of BuzzFeed.com visits, overtaking both Facebook and Google referrals and signaling a deliberate pivot away from platform dependence that has unsettled digital publishers through 2025.

The company’s profitability picture deteriorated sharply. Adjusted EBITDA fell 91% to $753,000 despite management’s continued cost discipline. All three of BuzzFeed’s revenue segments weakened: advertising revenue fell 11% to $22.2 million and content revenue plunged 33% to $7.2 million, with the company reporting that its third revenue stream also declined. Those declines underscore that stronger direct engagement has not yet translated into near-term revenue gains sufficient to offset lower advertising and content monetization.

Management cautioned that the headwinds are likely to persist. BuzzFeed revised its full‑year 2025 revenue guidance to a range of $185 million to $195 million and set adjusted EBITDA guidance between break‑even and $10 million, signaling a more muted outlook through year‑end. The company said it expects continued challenges and is positioning for a slower recovery in the advertising market.

The traffic shift is economically significant. A rise to 63% direct and internal sources reduces BuzzFeed’s vulnerability to algorithmic changes and referral volatility on big tech platforms, potentially improving the quality and predictability of audience signals. First‑party traffic boosts the value of proprietary data and can enable tighter audience segmentation for advertisers at a time when third‑party cookie deprecation and enhanced privacy rules have made networked targeting more difficult and expensive.

However, converting loyal visits into revenue remains the immediate challenge. Advertising — still the largest single revenue line reported — is sensitive to CPM compression, campaign pauses and seasonal weakness. Content revenue’s sharp decline points to difficulties in licensing, sponsorship or investor interest in long‑form and branded projects. The company’s modest adjusted EBITDA underscores limited near‑term room for reinvestment while it pursues longer‑term strategies.

For markets and policy observers, BuzzFeed’s quarter exemplifies broader industry dynamics: publishers are racing to build direct relationships and diversify monetization amid platform concentration and regulatory shifts around data. Investors will weigh the strategic upside of a more owned audience against broken near‑term economics and the question of whether first‑party reach can be monetized at scale.

BuzzFeed’s third quarter closes a difficult chapter for digital media incumbents in 2025: the metrics show meaningful progress in audience strategy, but the financials remind stakeholders that rebuilding a resilient revenue base remains an urgent, unresolved task.