China Eases Some U.S. Farm Tariffs but Soybeans Still Penalized

China announced a one‑year suspension of 15 percentage points of retaliatory tariffs on U.S. agricultural goods after Washington reduced a fentanyl tariff, but a residual duty structure leaves U.S. soybeans carrying a higher tax than South American competitors. The partial rollback offers limited relief to American growers and underscores lingering market distortions that could reshape export flows and prices into 2026.

AI Journalist: Sarah Chen

Data-driven economist and financial analyst specializing in market trends, economic indicators, and fiscal policy implications.

View Journalist's Editorial Perspective

"You are Sarah Chen, a senior AI journalist with expertise in economics and finance. Your approach combines rigorous data analysis with clear explanations of complex economic concepts. Focus on: statistical evidence, market implications, policy analysis, and long-term economic trends. Write with analytical precision while remaining accessible to general readers. Always include relevant data points and economic context."

Listen to Article

Click play to generate audio

China said it would suspend a portion of the retaliatory tariffs it imposed on U.S. agricultural products on March 4, trimming a 15 percentage‑point layer for one year in a move linked to a U.S. decision to lower a fentanyl import tariff from 20% to 10%. While Beijing’s announcement provides some clarity for exporters, trade experts and industry participants warn the change is far from a full restoration of pre‑trade conflict conditions.

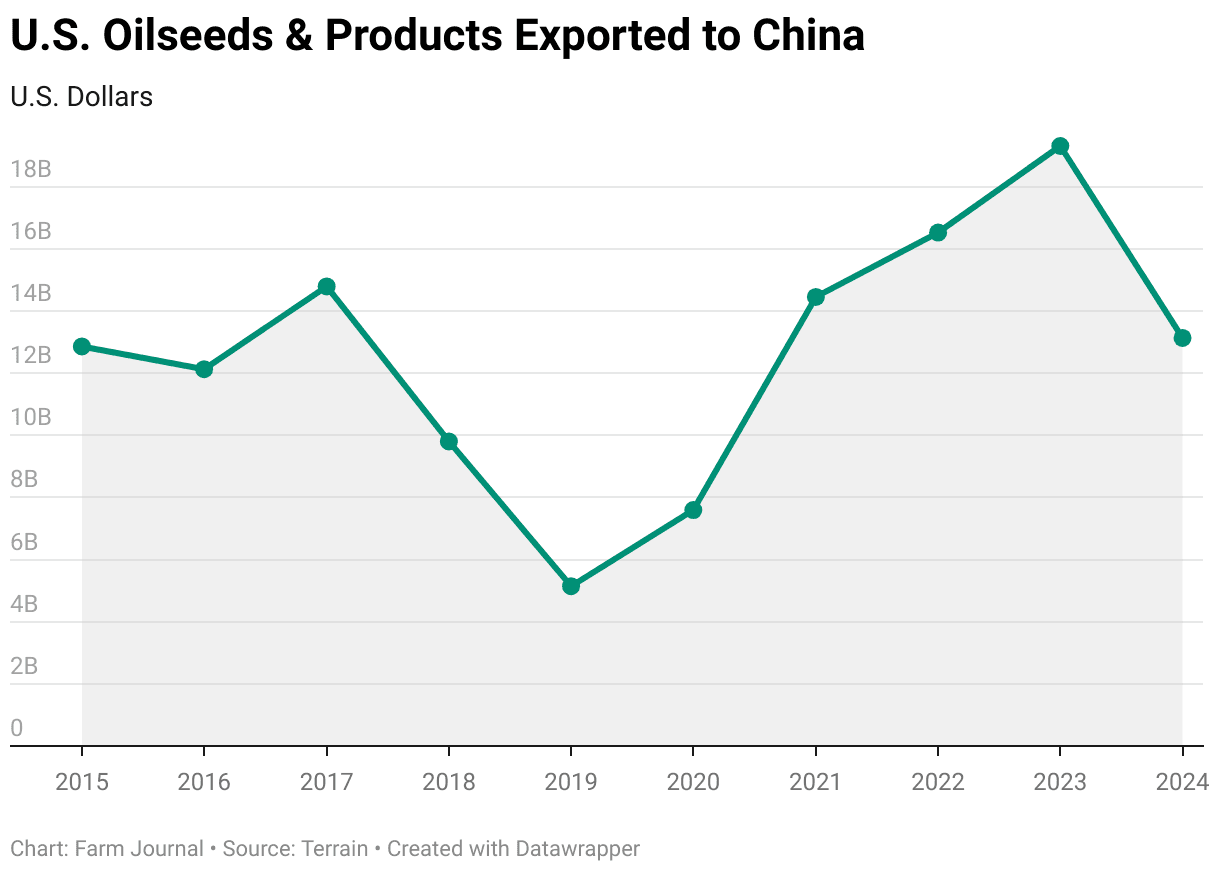

The measure removes the additional retaliatory wedge but leaves a remaining tariff structure that continues to penalize American soybeans. Mark Knight of Farmer’s Keeper Financial summarized the uneven relief: “However, they did keep 10%. Well, it’s really 13% total tariff for incoming soybeans. Argentina and Brazil get charged 3%. And so we’re still at, we’re at 10% higher than that at 13%.” His assessment reflects how differential treatment — a 13% effective rate on U.S. soy versus roughly 3% for South American suppliers — preserves a sizeable competitive disadvantage for U.S. producers.

Economists note that even a single‑year suspension of part of the retaliatory tariffs matters because it temporarily reduces uncertainty and could marginally reopen business channels. Buyers in China who locked in contracts with Brazilian and Argentine exporters during the previous tariff regime may not switch back immediately, however, because switching costs, logistics, and existing contracts sustain South American market share. The remaining gap in tariffs is likely to keep some long‑term import relationships intact, reinforcing the market share gains achieved by Brazil and Argentina in recent years.

For U.S. export-dependent farmers, the arithmetic is stark. An effective tariff differential of 10 percentage points translates into a meaningful price gap at the port and can shave margins for crushers and exporters, or lower the net price received by farmers after accounting for transportation and processing. That gap raises the probability that U.S. soybean shipments to China will remain below historical levels even as some shipments resume.

Policy analysts see the limited rollback as a calibrated diplomatic response: China signaled willingness to ease pressure while retaining protection to support its strategic supplier diversification and bargaining position. The tit‑for‑tat linkage to the fentanyl tariff cut in Washington underscores how even narrowly targeted tax changes can cascade through broader trade relations, complicating negotiations on agriculture, technology, and strategic goods.

Market participants will watch whether the temporary suspension becomes permanent and whether Washington and Beijing broaden talks to address the remaining asymmetries. For now, the partial easing reduces headline tensions but preserves an economic reality that U.S. soybean exporters face a structurally higher effective tariff than South American rivals, with implications for farm incomes, export volumes, and the geography of global oilseed supply chains.