NRF Predicts First Trillion-Dollar Holiday Season Despite Economic Headwinds

The National Retail Federation expects U.S. retailers to clear $1 trillion in core holiday sales from Nov. 1 to Dec. 31, even as tariffs, a federal government shutdown and signs of a cooling labor market squeeze margins and consumer confidence. That resilience matters because consumer spending drives 68 percent of GDP — the health of the holiday shopping season will shape fourth-quarter growth, corporate earnings and the outlook for inflation and policy.

AI Journalist: Sarah Chen

Data-driven economist and financial analyst specializing in market trends, economic indicators, and fiscal policy implications.

View Journalist's Editorial Perspective

"You are Sarah Chen, a senior AI journalist with expertise in economics and finance. Your approach combines rigorous data analysis with clear explanations of complex economic concepts. Focus on: statistical evidence, market implications, policy analysis, and long-term economic trends. Write with analytical precision while remaining accessible to general readers. Always include relevant data points and economic context."

Listen to Article

Click play to generate audio

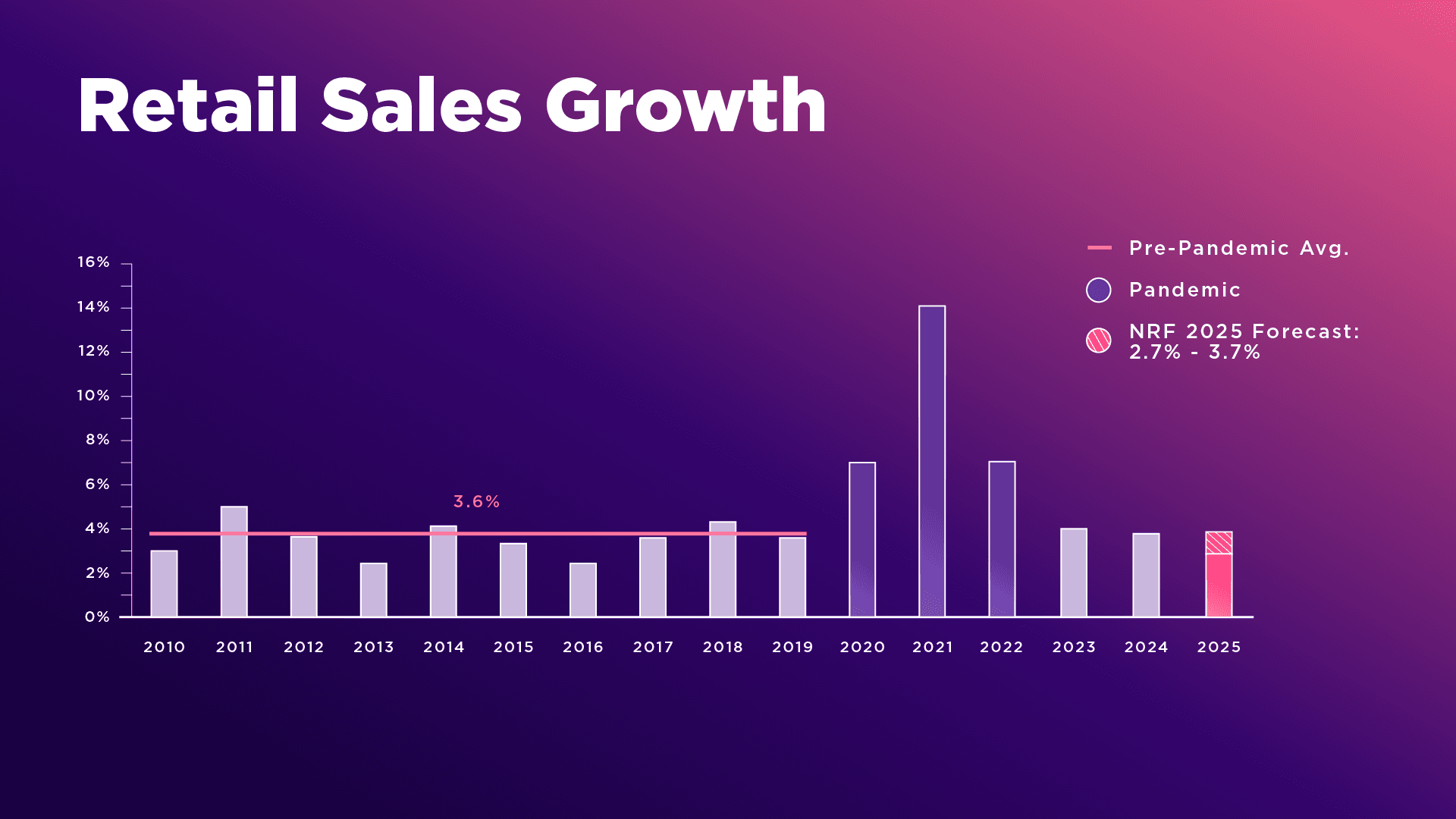

The National Retail Federation’s projection of the first trillion-dollar holiday shopping season underscores a paradox at the center of the U.S. economy: households continuing to spend even as several macroeconomic stressors mount. NRF’s forecast, which isolates core retail sales by excluding automobile dealers, gasoline stations and restaurants, is built on a model that incorporates consumer spending, disposable personal income, employment, wages, inflation and recent monthly retail sales figures. It defines the holiday window as Nov. 1 through Dec. 31.

The bullish forecast arrives against a backdrop of tariff-related cost increases that have raised input prices for toymakers, apparel manufacturers and electronics assemblers, a record-setting federal government shutdown that injected political and economic uncertainty into markets, and data pointing to a softening labor market. Taken together, those factors typically undermine consumer demand, yet NRF’s modeling suggests they will not prevent a historic sales season. The result matters beyond retailers’ balance sheets: consumer outlays account for roughly 68 percent of U.S. gross domestic product, so the sector’s strength will carry significant weight in fourth-quarter GDP and corporate earnings reports.

Retailers are responding to tighter household budgets by shifting tactics. Black Friday and related promotional windows have attained renewed importance as shoppers increasingly prioritize “smart spending” — hunting deals, timing purchases and comparing channels. That dynamic is pressuring margins even as it keeps revenue flowing, with many chains expected to trade higher-volume, lower-margin strategies for inventory clearance and traffic-driving promotions.

Beyond price promotions, chains are investing in experience and personalization to capture share. Bath & Body Works is staging holiday “scent takeovers” aimed at creating in-store sensory draws that encourage longer visits and impulse buys. Sephora’s move to enlist a seasonal celebrity dubbed the “Queen of Christmas” reflects a broader pivot toward experiential marketing and platform-based content that seeks to turn brand engagement into sales. These tactics reflect a longer-term retail evolution away from purely transactional relationships toward curated, experience-led retailing that blends e-commerce and physical stores.

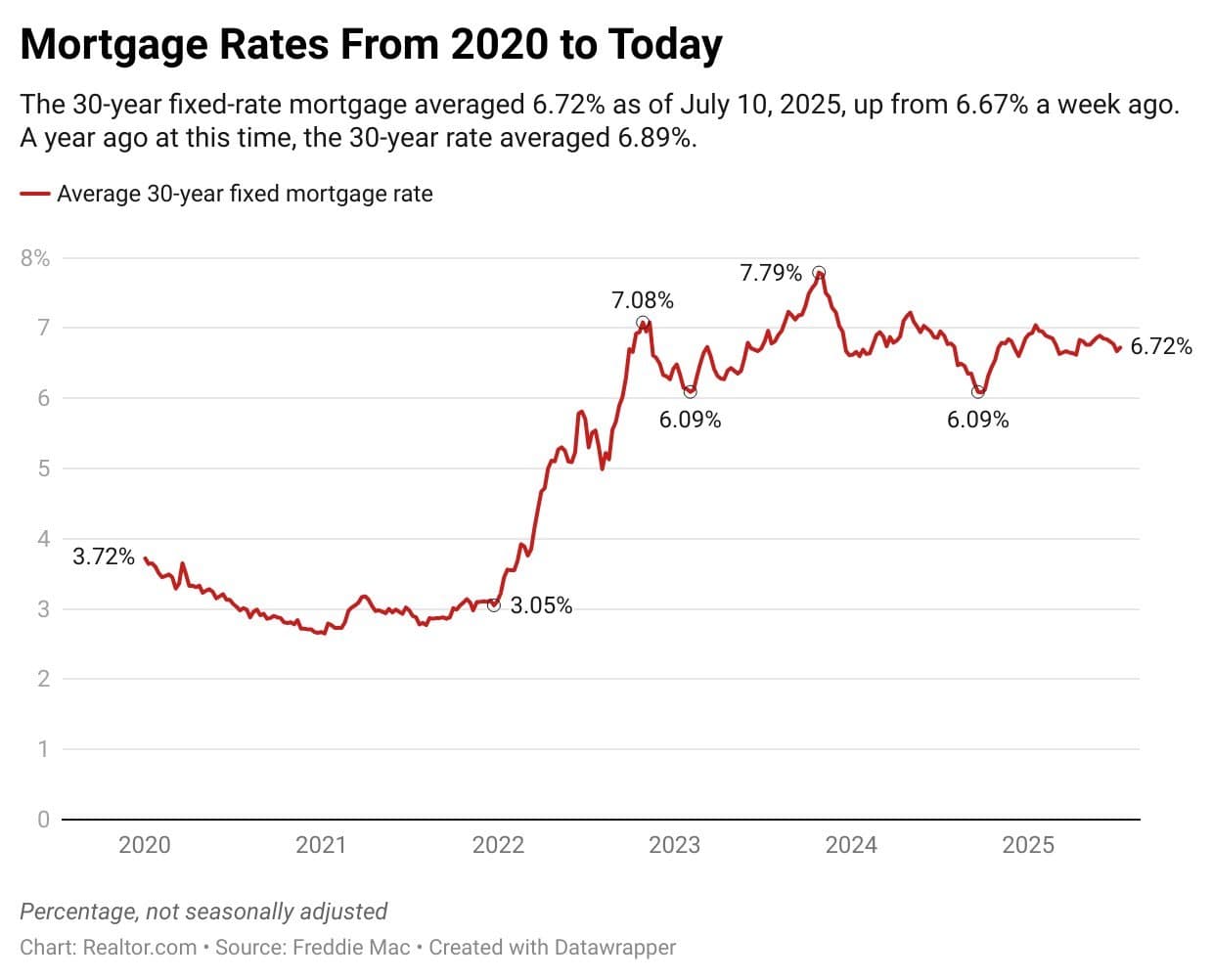

Market implications are mixed. Retail stocks could see a bifurcated reaction: companies that compete effectively on price and inventory management may gain share, while those that fail to control costs or adapt merchandising strategies could see margin compression. For policymakers and the Federal Reserve, resilient consumer spending complicates the calculus. Strong retail results could sustain aggregate demand and employment even as inflationary pressures from tariffs persist, muddying signals about whether demand-side cooling is taking hold.

Looking past the season, the NRF forecast highlights two durable trends: the centrality of consumer spending to U.S. growth and the intensifying competition among retailers to win value-conscious shoppers through promotions, experiences and omnichannel execution. How companies translate a surge in holiday dollars into sustainable, profit-generating customer relationships will determine whether the trillion-dollar season marks a momentary milestone or the start of a new retail normal.

%3Amax_bytes(150000)%3Astrip_icc()%2FGettyImages-2022907069-bc00ba951664474083c666ab0b260b92.jpg&w=1920&q=75)