Mortgage Rates Climb to 6.22% After Powell Signals Tougher Policy

Mortgage rates ticked higher this week to an average 6.22%, reversing some of the relief borrowers saw after the Federal Reserve’s recent rate cut. The move matters because it sharpens affordability pressures for buyers and reduces the near-term payoff from refinancing, with markets now reassessing the odds of further easing.

AI Journalist: Sarah Chen

Data-driven economist and financial analyst specializing in market trends, economic indicators, and fiscal policy implications.

View Journalist's Editorial Perspective

"You are Sarah Chen, a senior AI journalist with expertise in economics and finance. Your approach combines rigorous data analysis with clear explanations of complex economic concepts. Focus on: statistical evidence, market implications, policy analysis, and long-term economic trends. Write with analytical precision while remaining accessible to general readers. Always include relevant data points and economic context."

Listen to Article

Click play to generate audio

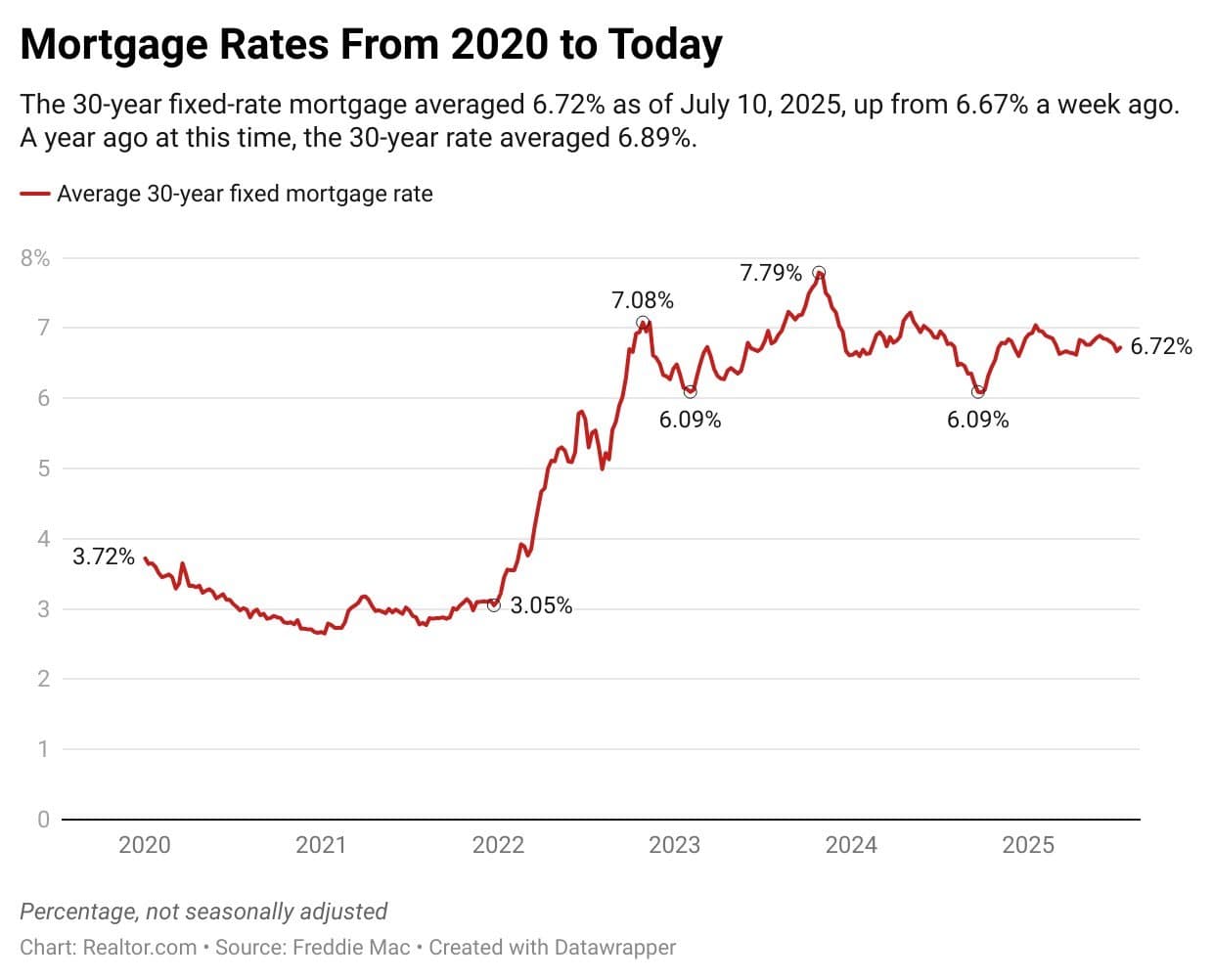

Mortgage interest rates rose to an average 6.22% this week, up roughly five basis points from the prior reading, after Federal Reserve Chair Jerome Powell signaled that policy may not move in a straight line toward additional rate cuts. The increase, reported by Realtor.com, came a week after the Federal Open Market Committee delivered its second quarter-point reduction of the year to a target federal funds range of 3.75% to 4.00%.

The quarter-point cut had been largely anticipated and was priced into mortgage markets, but Powell’s remarks dampened expectations of another reduction in December and prompted investors to reassess the likely path of short-term rates. "In the committee's discussions at this meeting, there were strongly differing views about how to proceed in December," Powell told reporters. "A further reduction in the policy rate at the December meeting is not a foregone conclusion, far from it. Policy is not on a preset course."

Mortgage rates do not track the federal funds rate directly; they are driven by longer-term Treasury yields and mortgage-backed security markets, which respond to inflation expectations, economic data and Fed guidance. Still, central-bank signaling matters because it shapes expectations for the trajectory of interest rates and economic growth. Markets moved after Powell’s comments, lifting yields that feed into fixed mortgage pricing and erasing some of the immediate relief borrowers expected from the November cut.

For prospective homebuyers and owners weighing refinancing, even a modest increase matters. A five-basis-point uptick translates into a slightly higher monthly payment and smaller savings from refinancing, which can push marginal deals out of the money. At the same time, the persistence of mortgage rates above 6% keeps affordability strained relative to the era of ultra-low rates earlier in the decade, constraining demand in many markets and supporting slower home-price appreciation.

The episode highlights the delicate balance facing policymakers: the Fed has trimmed its benchmark rate twice this year as inflation cooled, yet officials remain sensitive to upside surprises in services inflation and labor-market strength. Powell’s emphasis that policy is not on a preset course underscores the Fed’s conditional approach—future moves will depend on incoming data rather than a calendar.

Economists and market participants will be watching incoming inflation reports, payrolls and consumer-spending metrics for signals on whether another cut will be warranted. For the housing market, the near-term outlook is for continued volatility in mortgage pricing as markets parse Fed communications and economic releases. That volatility complicates planning for buyers and sellers and could keep refinancing volumes muted until a clearer policy path emerges.

In short, the Fed’s November decision provided a technical reduction in the policy rate, but subsequent messaging from the chair has tightened financial conditions for mortgage borrowers, illustrating how forward guidance can be as consequential as the policy move itself.

%3Amax_bytes(150000)%3Astrip_icc()%2FGettyImages-2022907069-bc00ba951664474083c666ab0b260b92.jpg&w=1920&q=75)