China Grants Streamlined Licences for Rare Earth Magnets, Eases Exports

China granted a year long general licence to Ningbo Jintian Copper that streamlines exports of rare earth magnet products, a measure tied to recent high level talks with the United States. The licence is intended to accelerate shipments for electric vehicles, wind turbines and robotics while keeping the broader dual use export controls intact, potentially easing supply bottlenecks created by earlier curbs.

Ningbo Jintian Copper said on December 10 that it had secured a new streamlined general licence permitting the export of rare earth magnet products for one year, a step that should speed shipments for industries from electric vehicles to wind turbines and industrial robotics. The decision follows a string of similar general licences issued after recent high level discussions between Chinese and U.S. officials, and marks a calibrated effort by Beijing to loosen some trade frictions while retaining the broader dual use controls it imposed earlier this year.

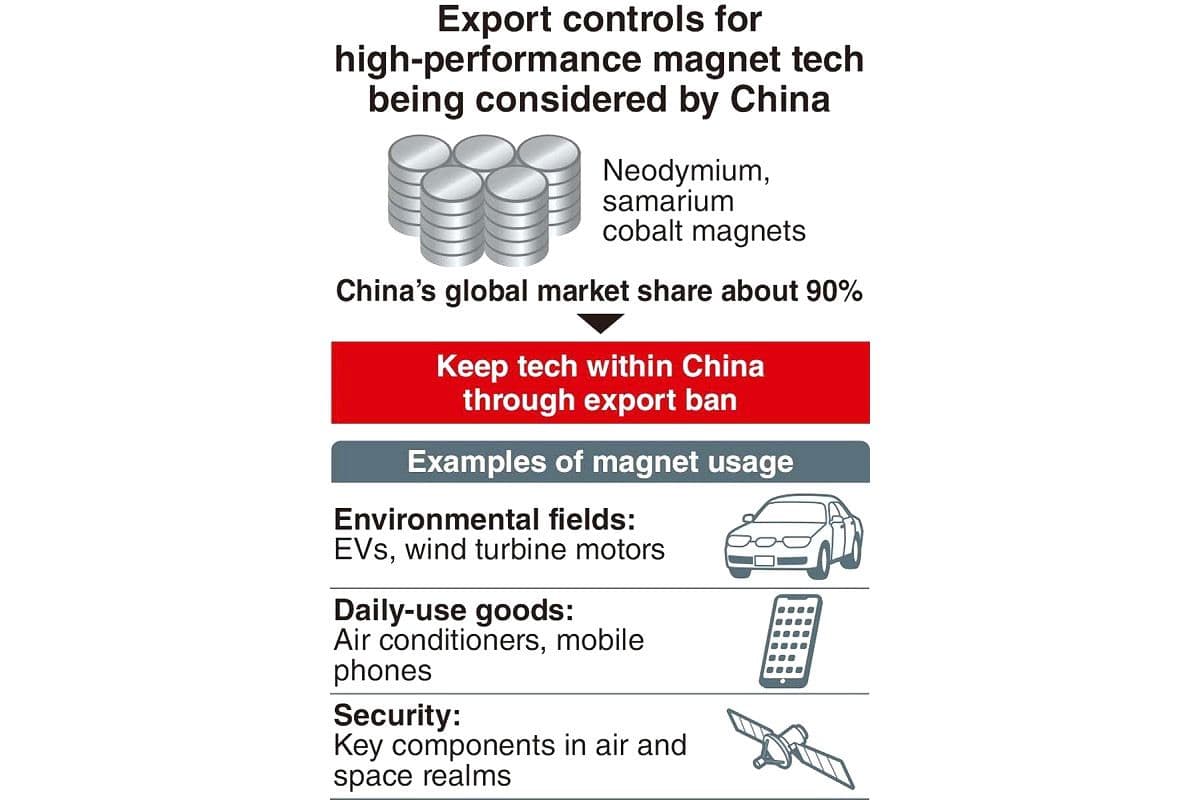

Beijing introduced tightened export controls on certain magnet products in April, citing national security concerns linked to components used in military as well as civilian technologies. Those controls disrupted global magnet supplies and prompted concern among manufacturers that rely on high performance permanent magnets for electric motor and generator assemblies. Reuters noted the April measures had caused supply disruptions, and the newly issued licences are explicitly designed to relieve select bottlenecks without undoing the overarching licensing regime.

The licences cover products that are critical inputs in electric vehicle drivetrains, offshore and onshore wind turbines, consumer and industrial robotics, and other advanced industrial applications. By granting a general licence rather than case by case approvals, Chinese authorities are enabling eligible producers to move stock more quickly to overseas customers. The licences are limited in scope and duration, signaling Beijing's intent to strike a balance between export control objectives and the economic implications of prolonged trade constraints.

Market participants and policy makers will watch how broadly the licences are applied and whether shipments under the new regime materially reduce supply tightness. Global manufacturers have faced heightened lead times and sourcing challenges since the spring, reinforcing longer term efforts in the United States, Europe and Japan to diversify supply chains, scale up domestic processing capabilities, and invest in magnet recycling. Those strategic moves predate the April controls but were accelerated by them.

Economically, the licences could blunt near term price pressures and production disruptions in sectors already under strain from electrification transitions. Demand for high performance magnets has been rising as automakers scale up electric vehicle production and as renewable energy deployments expand. At the same time, the temporary nature of the general licences and the preserved dual use framework mean uncertainty remains for longer term procurement planning and investment.

Politically, the move reflects a delicate bilateral dynamic. The issuance of licences after high level talks suggests both sides see value in stabilizing supply chains even as strategic competition continues. For Beijing, the approach allows control over sensitive technologies while reducing the economic fallout from restrictive export rules. For buyers and downstream manufacturers, the licences offer immediate relief, but also underline the vulnerability of critical supply chains to geopolitical shifts and policy decisions.

Sources:

Know something we missed? Have a correction or additional information?

Submit a Tip