Mexico tariff hike threatens $1 billion in India car exports

Mexico announced plans to raise tariffs by up to 50 percent on certain auto imports, a move Reuters says will directly affect roughly $1 billion of car shipments from India. The decision could reshape trade flows, pressure automaker margins, and prompt intense negotiations with New Delhi over exemptions and relief.

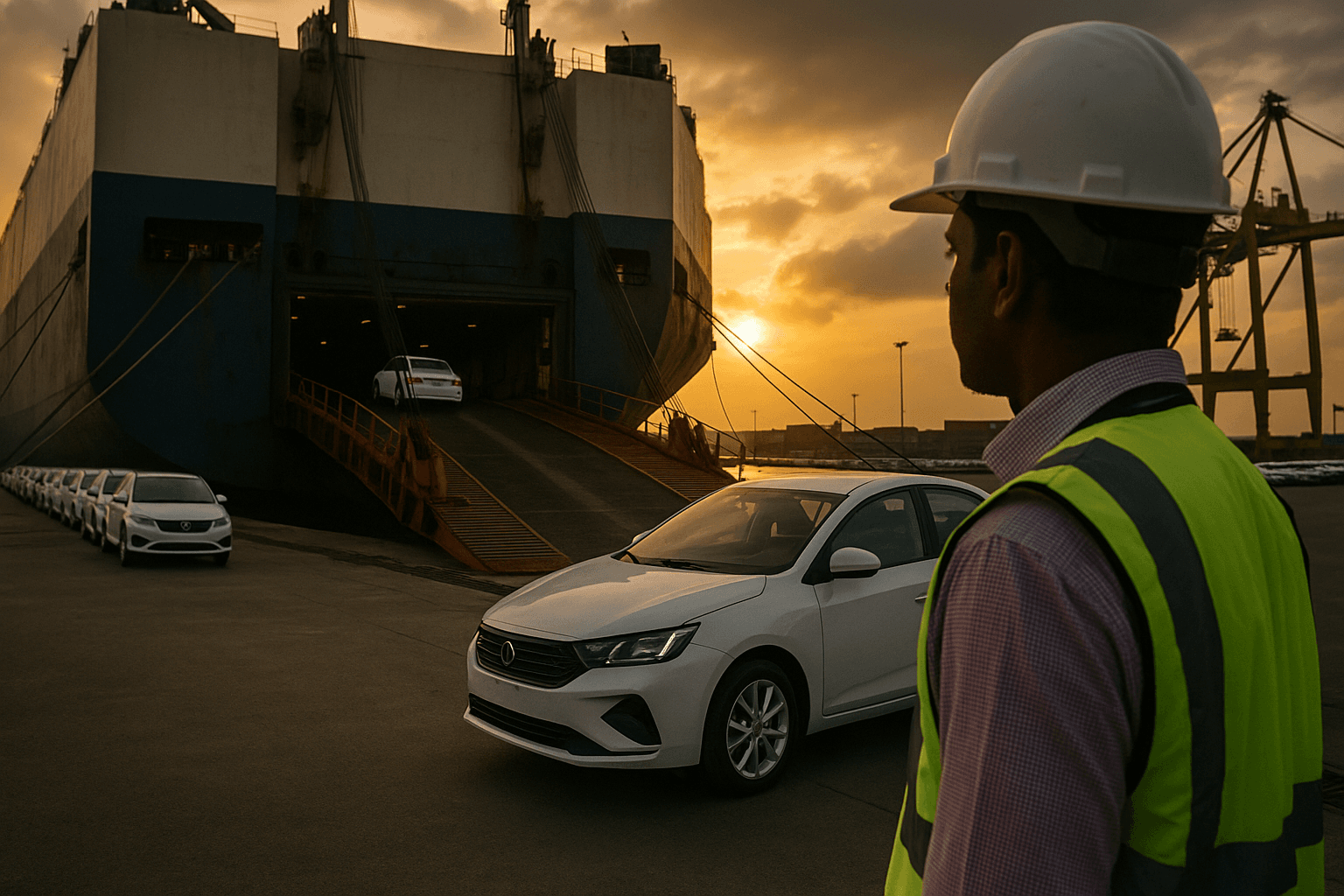

Mexico is moving forward with planned tariff increases on select auto imports that industry sources and an internal letter reviewed by Reuters say will target roughly $1 billion in car shipments from India. The government announced the tariffs on December 11, 2025, saying they are intended to protect Mexico's domestic industry, even as automakers and exporters lobbied for exemptions and diplomatic channels with New Delhi have opened to try to blunt the impact.

The tariff increases will reach up to 50 percent on affected models and components, a level that industry analysts say would materially change the economics of current supply arrangements. Indian manufacturers that have expanded exports to Mexico in recent years will face immediate margin pressure, and some shipments could be rerouted or delayed as companies assess contract terms, customs classification and the cost of additional duties.

Automakers and parts suppliers had sought carve outs through formal requests and lobbying efforts, arguing that many imports are integrated into broader global supply chains that support production and exports beyond Mexico. Those appeals appear to have failed to stop the measure for now, Reuters sources said, leaving manufacturers to calculate whether to absorb the costs, pass them on to dealers and consumers, or shift production and sourcing strategies.

The decision is likely to create short term disruption in logistics and inventory. Shipments already in transit from India could face unexpected duties at Mexican ports, adding to landed costs and complicating pricing for dealers. Logistics providers and freight forwarders said lead times and warehousing needs could increase as companies seek to avoid punitive duties or renegotiate terms with suppliers.

Beyond immediate commercial dislocation, the tariffs signal renewed political emphasis on protecting local manufacturing and employment. Mexican authorities framed the move as defending domestic capacity, a rationale that resonates in countries where competition from lower cost producers has eroded some local production lines. The move also introduces a delicate diplomatic negotiation with New Delhi, where Indian officials are likely to press for exemptions or compensatory measures to reduce harm to exporters.

Market implications extend beyond bilateral trade. Higher tariffs in Mexico could prompt Indian exporters to pivot to other Latin American markets, but capacity and regulatory hurdles will limit rapid redirection. Multinational automakers that use Mexico as an export hub for North American markets may also reassess regional sourcing, accelerating longer term trends toward diversification, near shoring and more resilient supplier networks.

Policy experts caution that while the tariff hike could provide temporary relief for some Mexican producers, it risks increasing consumer prices and inviting legal challenges at trade forums. If other countries adopt similar protectionist measures, the cumulative effect could fragment integrated auto supply chains and raise costs across vehicle ecosystems.

For now the immediate figures are stark. Roughly $1 billion in India car shipments are directly at risk and duties could climb as high as 50 percent. How quickly Mexico and India reach a negotiated outcome will determine whether the impact is a period of short term disruption or the start of a broader realignment in global auto trade.

Sources:

Know something we missed? Have a correction or additional information?

Submit a Tip