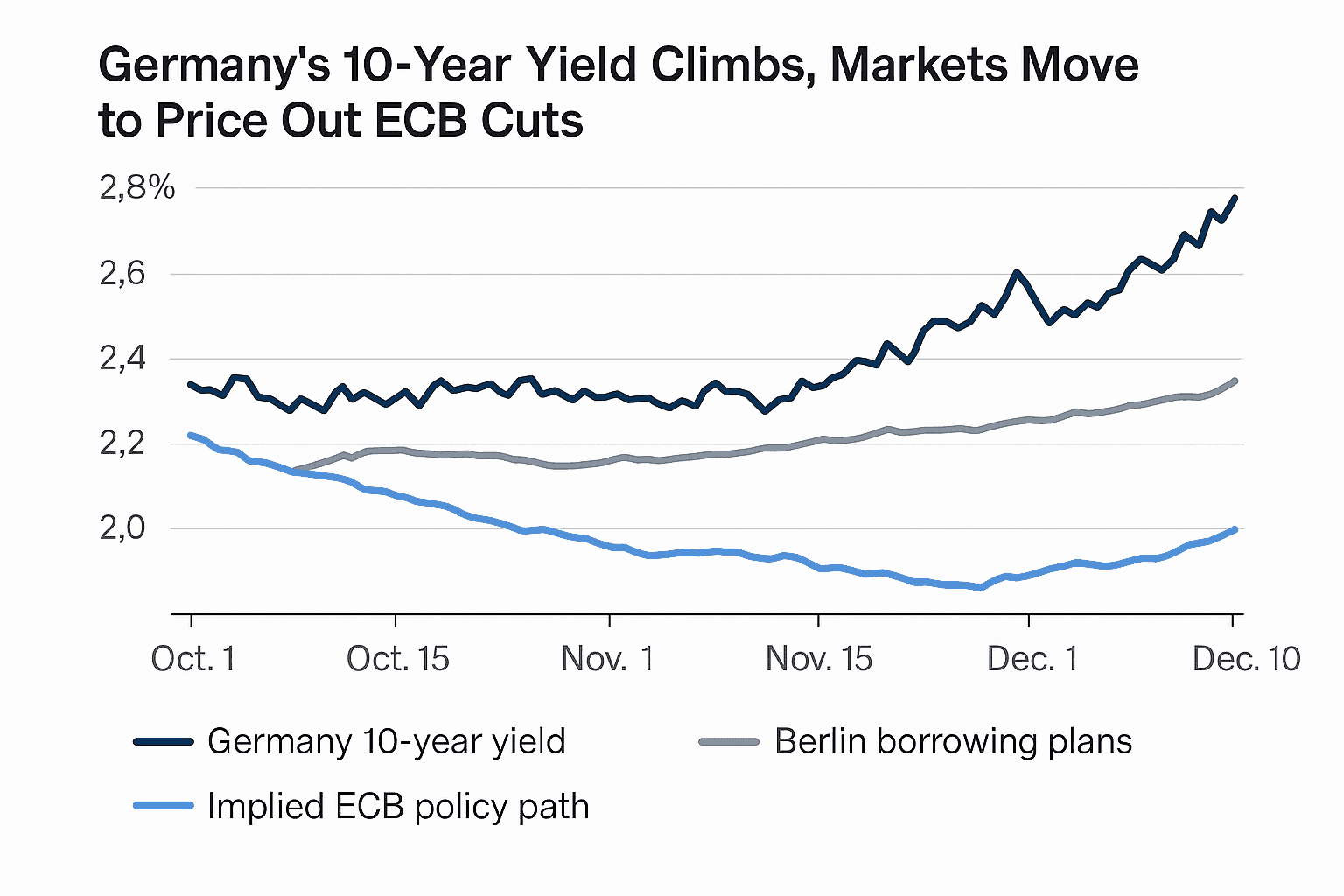

Germany’s 10 Year Yield Climbs, Markets Move to Price Out ECB Cuts

Germany’s 10 year bund yield rose to its highest level in about nine months as traders dialed back expectations of imminent European Central Bank easing, a move that raises borrowing costs across the euro area. The shift reflects fresh German fiscal plans and policy signals from ECB officials, and it will shape funding costs for governments, businesses and households ahead of major central bank meetings.

Germany’s 10 year bund climbed to its highest level in roughly nine months on December 10, as investors reassessed the outlook for European Central Bank policy and priced out near term rate cuts. The move followed a string of ECB comments and policy signals that suggested officials were less certain about easing, combined with Berlin’s announcement of stepped up borrowing and spending plans that will add supply to the core sovereign market.

The rise in German yields rippled across the core euro area. French sovereign yields and other benchmark rates also increased, compressing valuations in European equity markets as investors adjusted discount rates and growth expectations. Traders cited broader fiscal developments in Europe and a recalibration of the inflation trajectory as reasons to update pricing for monetary policy. Market participants pointed to growing odds that the ECB could defer easing, or even pivot toward a more cautious stance if inflation risks reappear.

This repricing has tangible economic consequences. Higher benchmark yields lift interest costs for governments issuing debt and can feed through to corporate borrowing and mortgage rates. For Germany, the combination of increased borrowing and higher yields raises the budgetary arithmetic for planned spending, complicating fiscal calculations even as policymakers aim to support investment and social programmes. Across the euro zone, banks and nonbank lenders face a higher funding backdrop that could restrain credit growth and weigh on consumption and investment into 2026.

The move also aligns with shifting global rate dynamics. With key U.S. and international central bank meetings on the calendar, investors are weighing a complex mix of data, supply and central bank rhetoric. ECB officials have flagged that the next rate move could be up if inflation pressures re-emerge, a conditional stance that has prompted traders to leave less room for immediate cuts. That conditionality contrasts with prior market expectations of near term easing and has increased volatility in fixed income markets.

Analysts warned that a sustained period without ECB easing would keep euro area borrowing costs elevated relative to earlier expectations, complicating balance sheet decisions for governments and firms. Longer term, the episode underscores how fiscal policy choices in big economies like Germany can amplify market responses to central bank communication, particularly when inflation remains above target or volatile.

Investors will be watching incoming data on price pressures, wage growth and demand, along with any further signals from ECB policymakers, for clues on the path of rates. For now, the repricing on December 10 has reset market expectations, raising the cost of financing across the euro area and underscoring the fragile interplay between fiscal decisions and monetary policy in a period of shifting global rates.

Sources:

Know something we missed? Have a correction or additional information?

Submit a Tip