China growth falters in November, data heighten calls for reform

Official activity data showed China’s recovery losing momentum in November, with industrial output at a 15 month low and consumption weakening sharply. The miss in factory and retail figures, alongside a deeper contraction in investment, raises pressure on policymakers to pivot toward fresh stimulus and structural reforms ahead of 2026.

BEIJING, Dec 15. Official data released on Monday showed China’s post COVID recovery lost momentum in November, as factory output growth slowed to a 15 month low and consumption failed to rebound as authorities had expected after reopening.

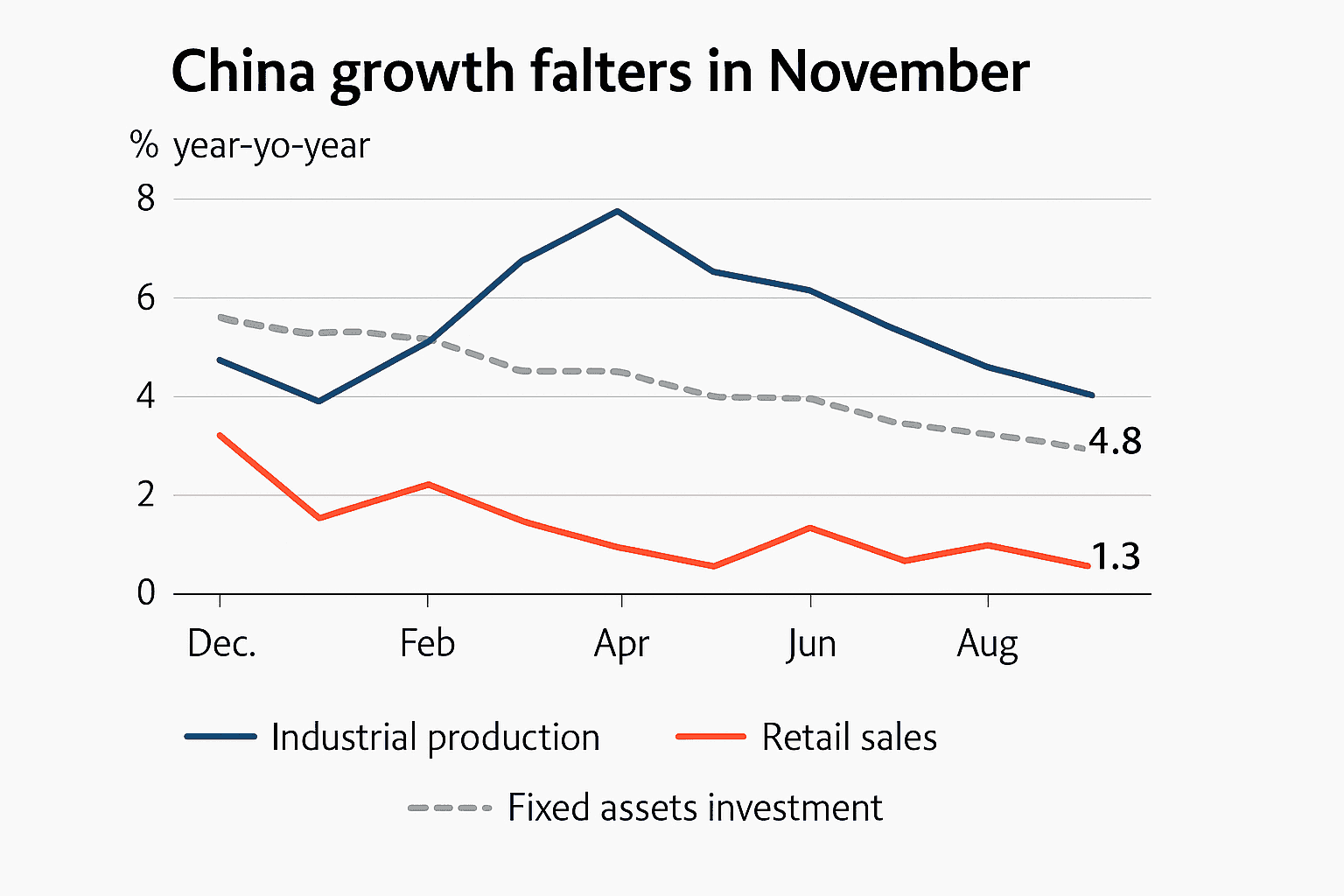

Industrial production rose 4.8 percent year on year in November, below economists’ consensus for a 5.0 percent gain and the weakest pace since August 2024. Retail sales expanded just 1.3 percent year on year, a marked slowdown from October’s 2.9 percent increase and far short of a median forecast near 2.8 percent. Investment in fixed assets, including real estate, contracted 2.6 percent for the January to November period, slightly worse than economists’ estimates of a 2.3 percent decline.

Taken together, the numbers paint a picture of demand that remains subdued despite the abrupt end to strict zero COVID restrictions last year. Industrial strength appeared uneven, while household spending has not powered the recovery the government and markets anticipated. The property sector continued to weigh on overall investment, confirming that lingering stress in housing markets is transmitting into broader economic activity.

Markets reacted to the downside surprise in activity data, deepening concerns among investors and economists about the durability of growth. The shortfall in industrial output and weak retail sales underscore a policy dilemma for Beijing. Authorities must balance efforts to rein in excess supply and financial risk with measures to revive demand and stabilize the property market, a trade off that has complicated the policy response this year.

The November prints intensify calls for new growth drivers heading into 2026. Fiscal stimulus, targeted monetary easing, accelerated infrastructure projects and measures to shore up troubled property developers are among the tools analysts say could be employed. Any policy shift will be watched closely for its scale and focus, because past stimulus rounds have had mixed effects on long term productivity and debt dynamics.

Economists caution that structural reforms will be necessary to sustain higher quality growth. Longer term challenges include reorienting investment toward innovation and services, improving social safety nets to support consumption, and addressing overcapacity in traditional industries. Without such reforms, temporary policy support may only buy time while underlying imbalances persist.

The weak November data will also have implications for global markets and trading partners. Slower Chinese demand reverberates through commodity markets and supply chains, and could dampen the export outlook for economies tied to Chinese consumption and industrial activity.

Beijing faces a narrow window to set policy priorities for 2026. The immediate task is to arrest the slide in consumption and investment, while a broader agenda is likely to demand structural measures that shift growth onto a more sustainable footing. Official revisions to the published data or follow up announcements from the People’s Bank of China and State Council will be closely monitored for signals of the policy path ahead.

Sources:

Know something we missed? Have a correction or additional information?

Submit a Tip