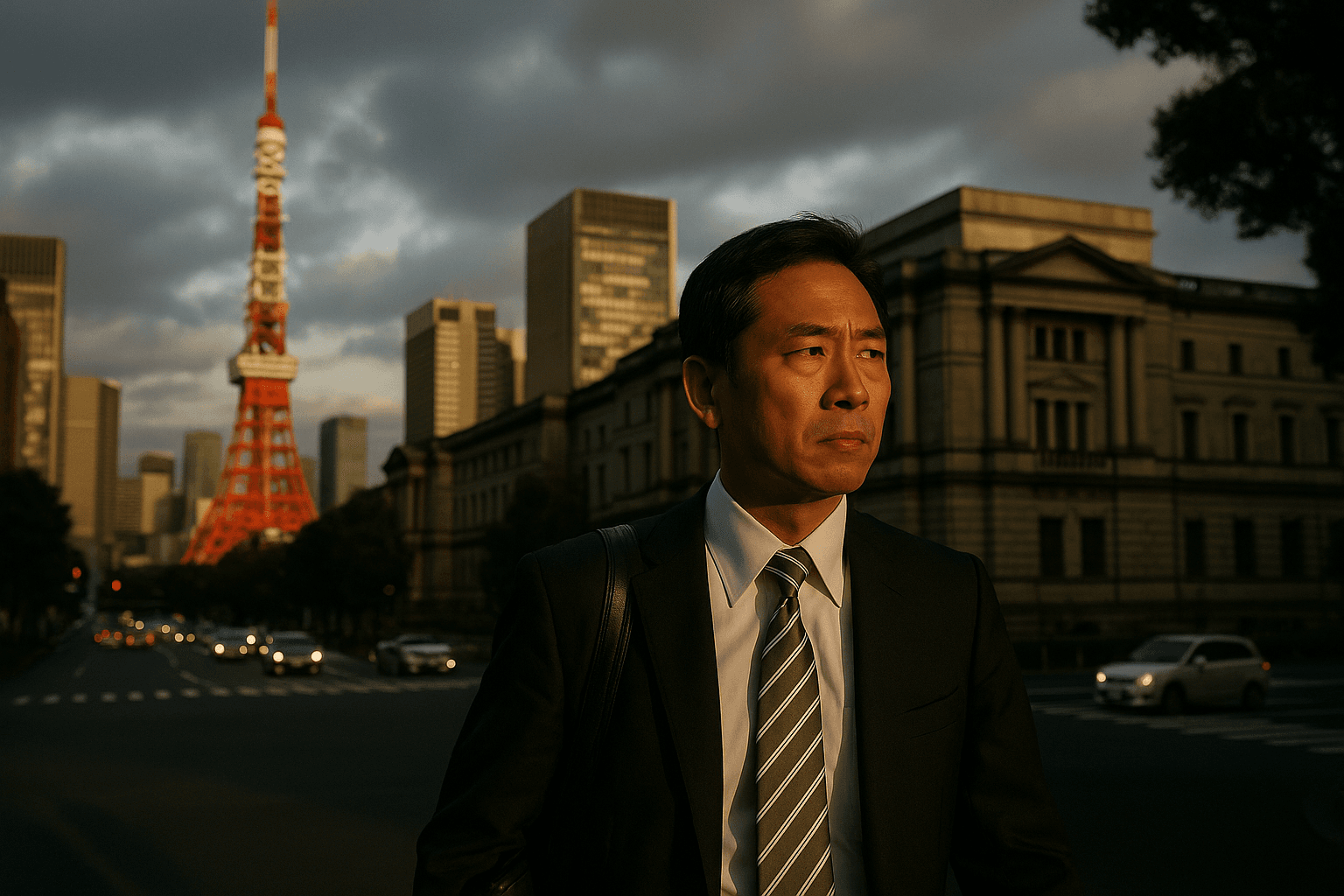

Japan business mood hits four year high, strengthening bets on BOJ rate rise

The Bank of Japan’s quarterly Tankan survey shows large manufacturer sentiment at +15 in December, the strongest reading since December 2021, reinforcing market expectations of an imminent BOJ rate increase. A separate monthly manufacturers poll painted a softer picture, underscoring mixed signals for policymakers weighing growth, fiscal risks and inflation.

The Bank of Japan’s quarterly Tankan survey shows large manufacturer sentiment at +15 in December 2025, up from +14 in September and the highest reading since December 2021. The pickup reflects improved confidence among major exporters and concrete plans for higher capital expenditure, a dynamic that markets say increases the likelihood of a policy tightening by the BOJ this week.

The +15 outcome matches consensus in market polls and highlights resilience among large firms even as global demand softens. Tankan readings are closely watched for signals on investment intentions and pricing power, and the stronger tone among big manufacturers adds to the case for the central bank to continue normalizing policy after years of ultra accommodative settings.

Yet the picture is not uniformly positive. A separate monthly manufacturers poll, which serves as a leading indicator for the quarterly Tankan, registered a decline to +10 in December from a near four year high of +17 in November. The monthly series showed sectoral strains, with steel and nonferrous metals plunging to -33 in December from -11 in November. The textiles, paper and pulp sub index was reported as flat for a second consecutive month.

The divergence between the two measures stems largely from differences in coverage and timing. The BOJ’s Tankan is a broad quarterly census based on large firms and their investment plans, while the monthly poll surveys a different sample and can pick up shorter term swings in particular industries. That means the quarterly gain points to sturdier long run capex intentions among large firms even as some sectors see near term weakness.

Policymakers will weigh those mixed signals against broader economic strains. Revised data indicate the economy contracted more than initially estimated in the third quarter, and government plans for large scale spending under Prime Minister Sanae Takaichi have raised concerns about Japan’s fiscal trajectory. Analysts note that expectations of a BOJ rate increase this month have themselves become a headwind for some companies and households, complicating the policy trade off.

For markets the Tankan’s strength is consequential. Investors rapidly price in central bank moves, and a materialfirming in corporate spending intentions tends to push up expectations of higher interest rates and a stronger yen. For the BOJ, the challenge is to reconcile a pick up in large manufacturer confidence and capex with softer readings in smaller sectors and the fiscal backdrop.

In the near term the Tankan gives the BOJ cover to proceed cautiously with policy normalisation, but the central bank must remain alert to downside signals from monthly indicators and GDP revisions. Over the longer term a sustained improvement in corporate investment would support productivity and growth, and could mark a structural shift in Japan’s post pandemic recovery path.

Know something we missed? Have a correction or additional information?

Submit a Tip