China Takes Most Argentine Soybean Cargoes, Tightens Global Supply

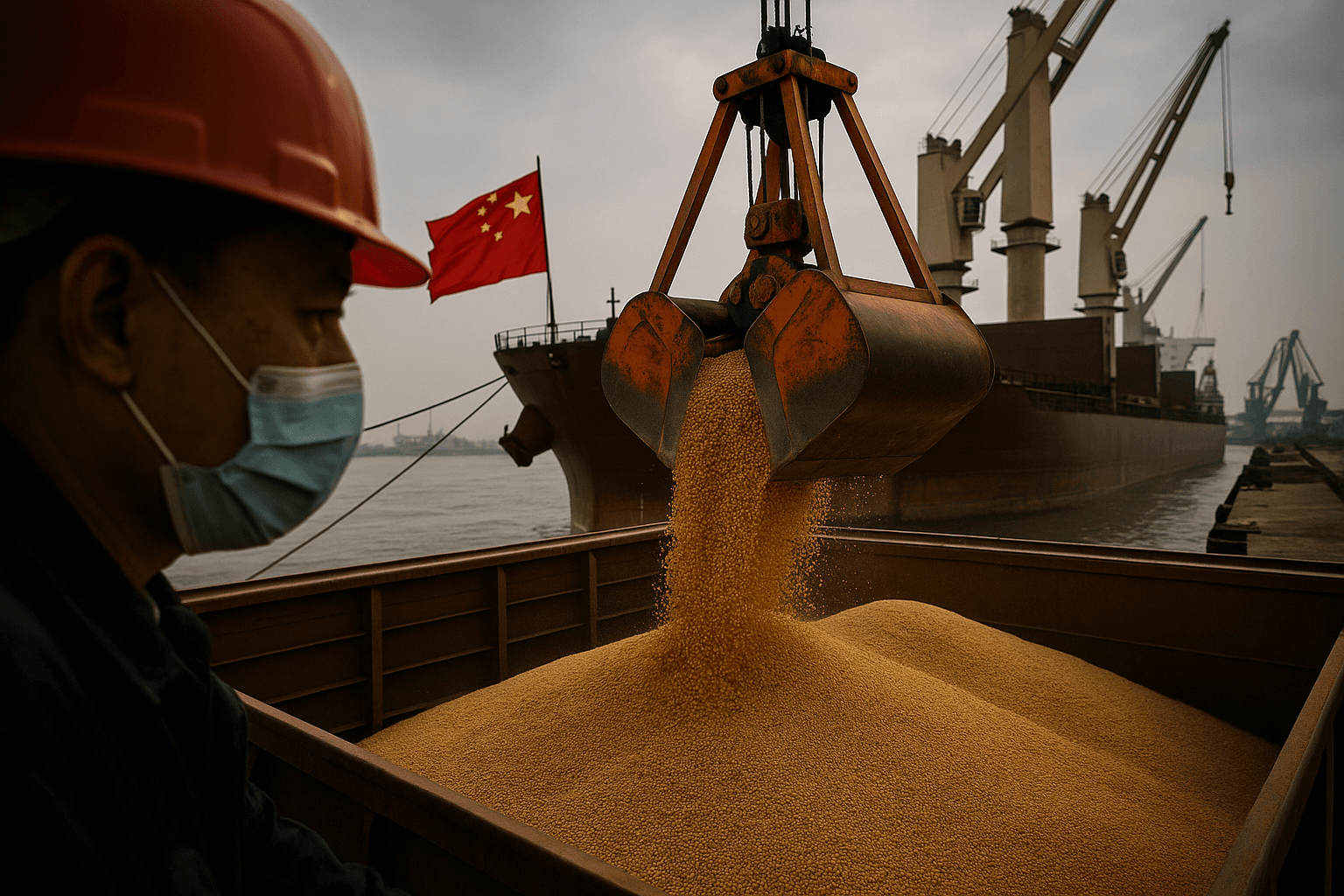

Chinese buyers purchased the majority of about 40 Argentine soybean cargoes registered during a brief Argentine tax free window for November and December shipments, traders said. The wave of purchases squeezed global supplies in a key marketing window, posing fresh challenges for U.S. soybean exporters and raising questions about Argentina’s export policy and local market effects.

%3Amax_bytes(150000)%3Astrip_icc()%2F100901867_soybeans-60844bfb2b68432a8447f18fa34d28b5.jpg&w=1920&q=75)

Traders said Chinese buyers snapped up most of roughly 40 soybean cargoes that Argentine exporters registered during a short government tax free window for November and December shipments, in a move that further tightened global oilseed supplies. The purchases came after Buenos Aires temporarily suspended export taxes to encourage shipments and boost dollar inflows, a measure that officials capped within days after demand surged well beyond expectations.

The bulk buying depressed available tonnage of South American soybeans at a moment when global crushers and processors normally lock in supplies for the northern hemisphere winter processing season. Traders estimated the registered cargoes amounted to several million tonnes of beans moving out of Argentina over the next weeks, shrinking vessels available for other buyers and complicating scheduling at already congested regional terminals.

For U.S. exporters, the episode reinforced a long running struggle to regain market share in China. Since the trade disruptions and policy shifts of recent years, large volumes of Chinese purchases have shifted to South America, and this flurry of Argentine sales is likely to leave U.S. sellers with fewer opportunities in the near term. Market participants said the transactions could intensify competition for remaining northern hemisphere shipments and sustain upward pressure on global soybean and soymeal prices until new supplies become available.

The Argentine government’s brief tax concession was intended to accelerate dollar receipts by encouraging exporters to ship ahead of normal rhythms. Instead the window drew heavy speculative and commercial demand, prompting authorities to cap the program to prevent a surge of revenue losses and logistical strain. Analysts warned that such episodic policy moves can distort domestic pricing signals. By incentivizing a concentrated wave of exports, the measure may lower local farm gate prices as producers rush to sell, while simultaneously tightening global physical availability.

Domestic implications could include downward pressure on Argentine cash prices in the short run, complicating income expectations for farmers and adding volatility to local currency dynamics as dollar inflows and export patterns shift abruptly. Logistics providers and port authorities may also face backlog challenges as a concentrated export schedule meets limited handling capacity, potentially delaying shipments beyond the initial tax free window.

On the global stage, the event underscores persistent structural shifts in oilseed flows toward South America, which has cemented its role as the world supplier of soybeans to China. Policymakers in Buenos Aires face a trade off between policies that secure short term dollar liquidity and the need for predictable export regimes that do not exacerbate price swings or disrupt international trade relationships.

Traders and analysts will be watching next moves from both Argentine authorities and Chinese buyers to gauge how quickly flows normalize and whether the episode accelerates broader market reallocation ahead of the South American harvest period in the coming months.