Consumer Readout Tests Fed December Cut Odds as Markets Weigh

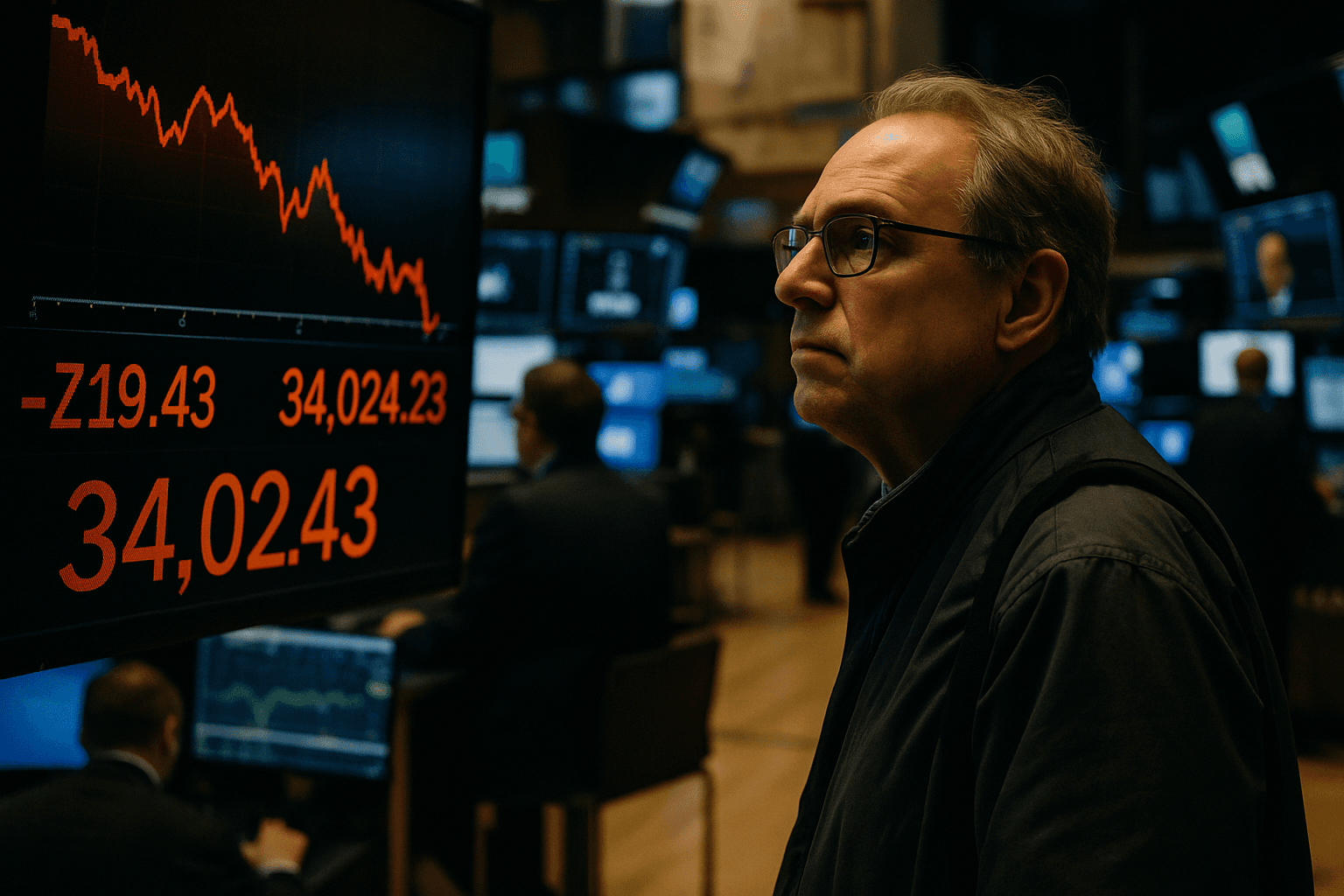

Reuters Morning Bid says investors are parsing a backlog of U.S. economic data ahead of Thanksgiving, including delayed September retail sales and producer prices, as markets price in a heightened probability of a Federal Reserve interest rate cut in December. New York Fed President John Williams’ dovish comments pushed fed funds futures to show more than a 70 percent chance of easing next month, a shift that has pushed Treasury yields lower and helped stocks rebound after a recent technology sector pullback.

Traders began Tuesday digesting a swath of delayed and incoming U.S. economic readings as markets reassess the Federal Reserve’s path for policy. Reuters’ Morning Bid, published on November 25, 2025, highlighted the backlog of data, including delayed September retail sales and producer price figures, that together could determine whether the Fed has room to pivot at its December meeting.

The immediate market reaction centered on comments from New York Fed President John Williams that Morning Bid characterized as dovish. Those remarks sent fed funds futures to price in more than a 70 percent probability of a rate cut next month. The shift in expectations put downward pressure on Treasury yields and contributed to a rally in equities after recent weakness in the technology sector.

The Morning Bid analysis flagged two dynamics that could derail the easing narrative. First, consumer readings have been mixed, leaving uncertainty about the durability of household demand that underpins much of the economy. Second, inflation persistence remains a risk, particularly if producer level pressures feed through to consumer prices. Together those forces create a delicate test for the Fed, which has repeatedly said policy will remain data dependent.

For markets, the implications are immediate. Lower expected policy rates typically reduce short term yields and steepen parts of the Treasury curve, improving valuations for rate sensitive assets. That dynamic helped risk assets recoup losses following the tech pullback. At the same time, investors are weighing whether a pre December shift in expectations is premature given the uneven data flow.

From a policy perspective, the Fed faces a familiar trade off. A December cut would mark the beginning of a loosening cycle from peak restrictive settings that were designed to bring inflation back toward target. But a move predicated on softer data could be reversed if upcoming reports show sustained inflation or renewed demand strength. The Morning Bid underscores that central bankers will be watching more than headline numbers, paying close attention to underlying trends such as wage growth, profit margins and price pressures at earlier stages of production.

Looking beyond the immediate market reaction, the episode illuminates longer term themes. Markets are increasingly sensitive to central bank communication and to the sequencing of data releases. Backlogs and delayed prints can create short run volatility as traders compress information into a narrow window. That may amplify swings in asset prices even when the underlying economic momentum is moderate.

Investors will be watching a cluster of incoming data to see whether today’s market pricing holds. Retail sales, producer prices and a range of consumer metrics will be parsed for signs that inflation is truly cooling and that household activity is softening sufficiently to justify a policy pivot. The outcome will determine whether the Fed can cut confidently in December or whether markets must recalibrate again as the year ends.