CoStar Asks Supreme Court to Revisit Antitrust Fight With CREXi

CoStar Group asked the U.S. Supreme Court to review an antitrust fight with rival CREXi, raising high stakes for how courts treat access to proprietary online data and services. The petition could reshape legal obligations for dominant digital platforms, with implications for investment, competition, and the future structure of commercial real estate technology.

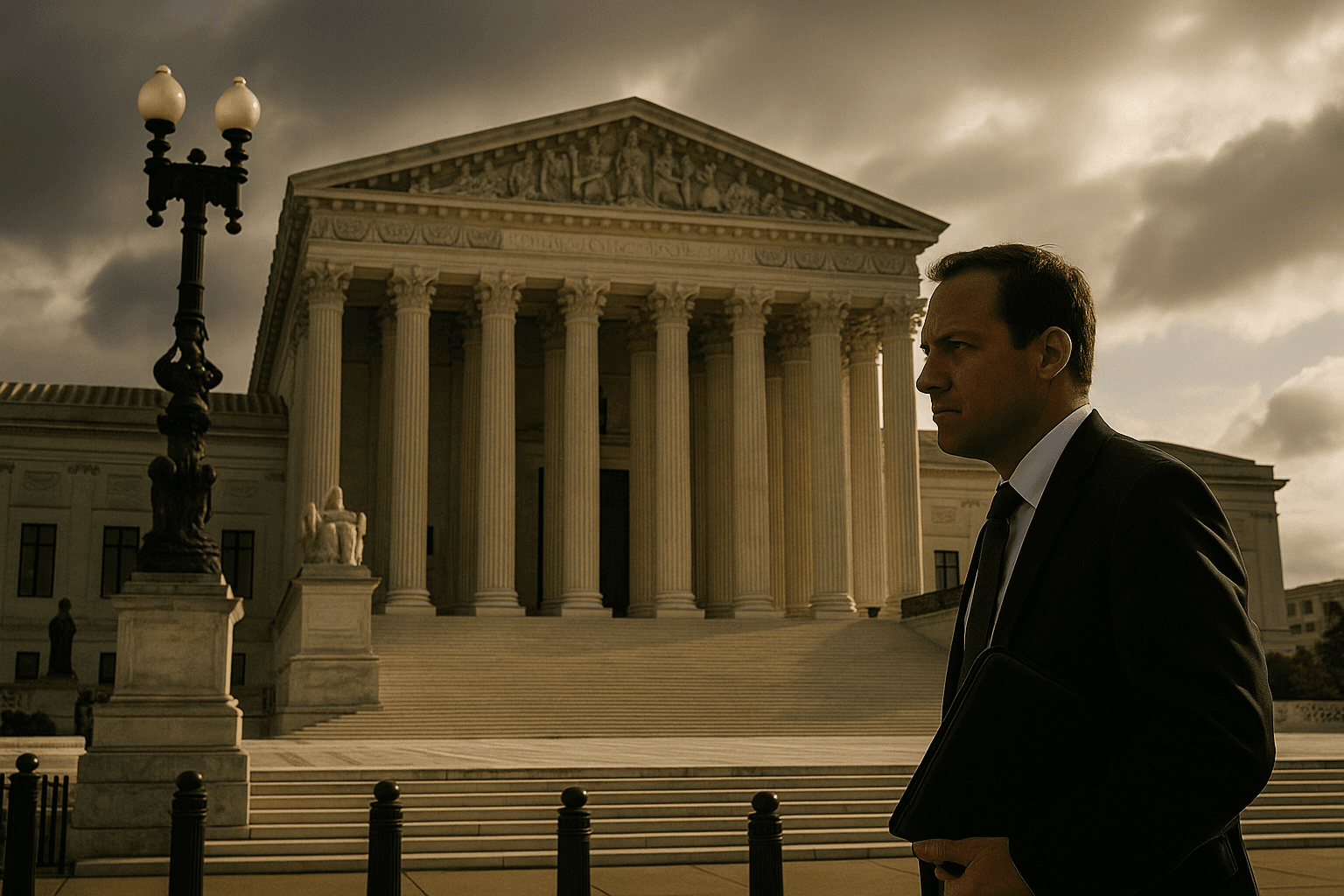

CoStar Group filed a petition with the U.S. Supreme Court on December 10, 2025, asking the justices to review an antitrust case brought by rival Commercial Real Estate Exchange Inc., known as CREXi. The move follows the 9th U.S. Circuit Court of Appeals’ June 2025 decision reinstating CREXi’s antitrust claims, which a lower court had previously dismissed. The petition is docketed as CoStar Group Inc v. Commercial Real Estate Exchange Inc., No. 25-667.

CREXi alleges that CoStar used its market position to lock brokers into proprietary platforms and to block competitors’ access to critical digital tools and data. The complaint centers on access to online listings, analytics, and data services that brokers and firms depend on to find and market commercial properties. CREXi contends that limiting access to those services has hindered competition in a market driven by scale, network effects, and real time information flows.

CoStar denies any wrongdoing and frames the case as one of fundamental property and commercial discretion. In its petition the company argues that established precedent protects a firm’s right to refuse to deal with rivals and that the 9th Circuit’s approach threatens to expand antitrust liability in circumstances where contracts are explicitly non exclusive. CoStar warns that forcing companies to share proprietary data or web services would chill innovation and investment in specialized systems that companies build at substantial cost.

Legal scholars and market participants say the Supreme Court’s response could carry wide consequences beyond commercial real estate. The question presented touches on how antitrust law applies to digital platforms that aggregate and monetize data, and whether courts can compel access to proprietary systems when a dominant firm controls essential information. A decision by the high court to hear the case would set a national rule on whether and when a refusal to deal can amount to anticompetitive conduct in modern digital markets.

Economically, the stakes are significant for buyers, sellers, and brokers who rely on the completeness and timeliness of listings and analytics. Required access mandates could reduce barriers to entry for challengers but might also weaken incentives for incumbents to invest in improving data quality or platform features. Conversely, a ruling upholding broad refusal to deal protections could entrench dominant players and increase the value of proprietary datasets, reinforcing market concentration.

The case arrives amid growing regulatory and judicial scrutiny of platform power across sectors from advertising to e commerce. For the commercial real estate technology sector, the dispute highlights the role of data as an asset and the tension between proprietary control and open access that regulators and courts are increasingly confronting. The Supreme Court has discretion whether to take the case, and if it does accept review the decision could redraw the boundaries of antitrust liability for data rich platforms and reshape competitive dynamics in industries that depend on online services.

Sources:

Know something we missed? Have a correction or additional information?

Submit a Tip