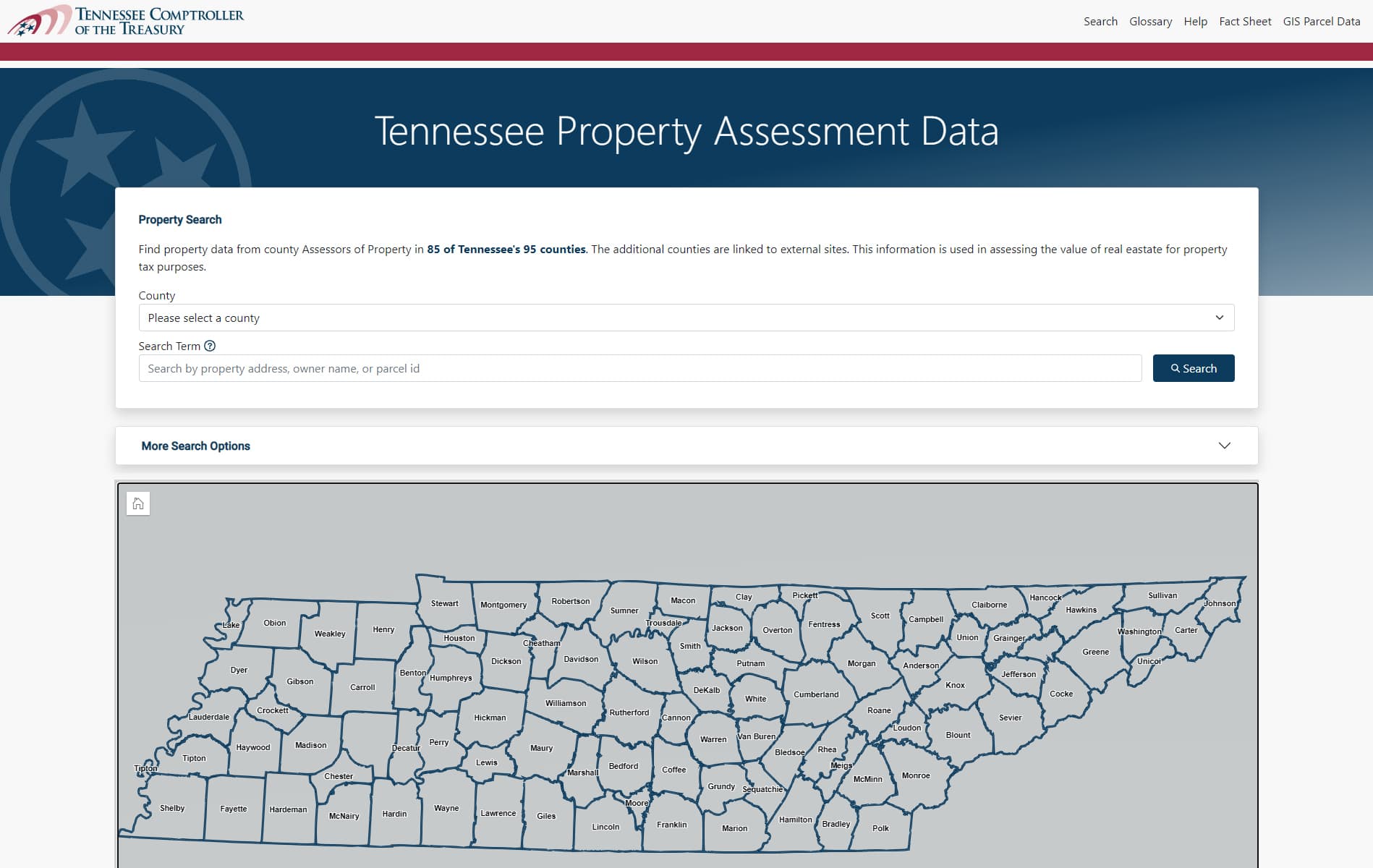

Eight Morgan County property sales total $2.06 million last week

Eight property transactions were recorded Jan. 10, totaling $2.06 million; homebuyers and investors should note a $1 million commercial-sized sale and several residential transfers.

Eight property transactions were recorded in Morgan County for the week ending Jan. 5 and reported Jan. 10, 2026, bringing $2,062,400 in recorded sale value to the county. The mix included residential homes, a vacant lot, a trustee transfer and a high-value parcel that dominated the totals.

The largest transfer was Hannel Oil Co. selling the property at 2003 W. Morton Ave. to Ahnik Investment LLC for $1,000,000. That single deal accounted for nearly half of the week’s total dollar volume and skewed the average sale price upward. Excluding that outlier, the seven other transactions totaled $1,062,400, and the overall average across all eight sales was $257,800 while the median sale price was about $155,950—a sign that typical residential trades in this sample were far below the mean.

Residential sales included Shaw A. Dahman and Janet Louise Dahman conveying 1305 W. Lafayette Ave. to Stephanie Bayburt for $119,000; Johnathon P. Flynn and Ashley K. Flynn selling 1503 Mound Ave. to Quinton and Brandi Wadkins for $305,000; Sharon and Dorothy Middendorf selling 33 Windrush Drive to Erica Miller for $141,900; Brenda Lee Rausch transferring 1 Jones Place to Frank W. Jennrich for $170,000; and trustee Steven L. Wheeler selling 207 Mound Place to Daniel J. Beams and Stacey R. Roberts-Beams for $129,000. A vacant lot in Franklin moved from Wendell M. and Freda D. Robson to Mark C. and Meredith A. Williams for $2,500. Federal National Mortgage Association, known as Fannie Mae, conveyed 414 Pendik Road to Benjamin Schultz for $195,000.

For local homeowners and prospective buyers, several takeaways matter. The presence of Fannie Mae as a seller indicates some bank-owned inventory remains in circulation, which can create opportunities for buyers seeking negotiated sales but also reflects prior mortgage stress in the market. The trustee transaction and the $2,500 vacant lot sale show a range of parcel types changing hands—from estate or trust management to small infill or investment lots.

From a market perspective, a $1 million transaction tied to a business-named seller suggests investor interest in commercial or high-value parcels inside Morgan County limits. That can affect nearby residential comps if the property is redeveloped or repurposed. For county finances, recorded sales trigger reassessments and potential tax-base shifts, though individual tax impacts depend on assessment cycles and exemptions.

Our two cents? If you’re buying, selling, or tracking neighborhood values, pull the deed at the county recorder’s office, confirm zoning with planning and inspect properties carefully. Small weekly tallies like this won’t rewrite the housing market, but they offer early signals—keep an eye on institutional sellers and high-dollar lots that can change local comps and development patterns.

Sources:

Know something we missed? Have a correction or additional information?

Submit a Tip