Jacksonville Prairie Eye Center files Chapter 11; local services in flux

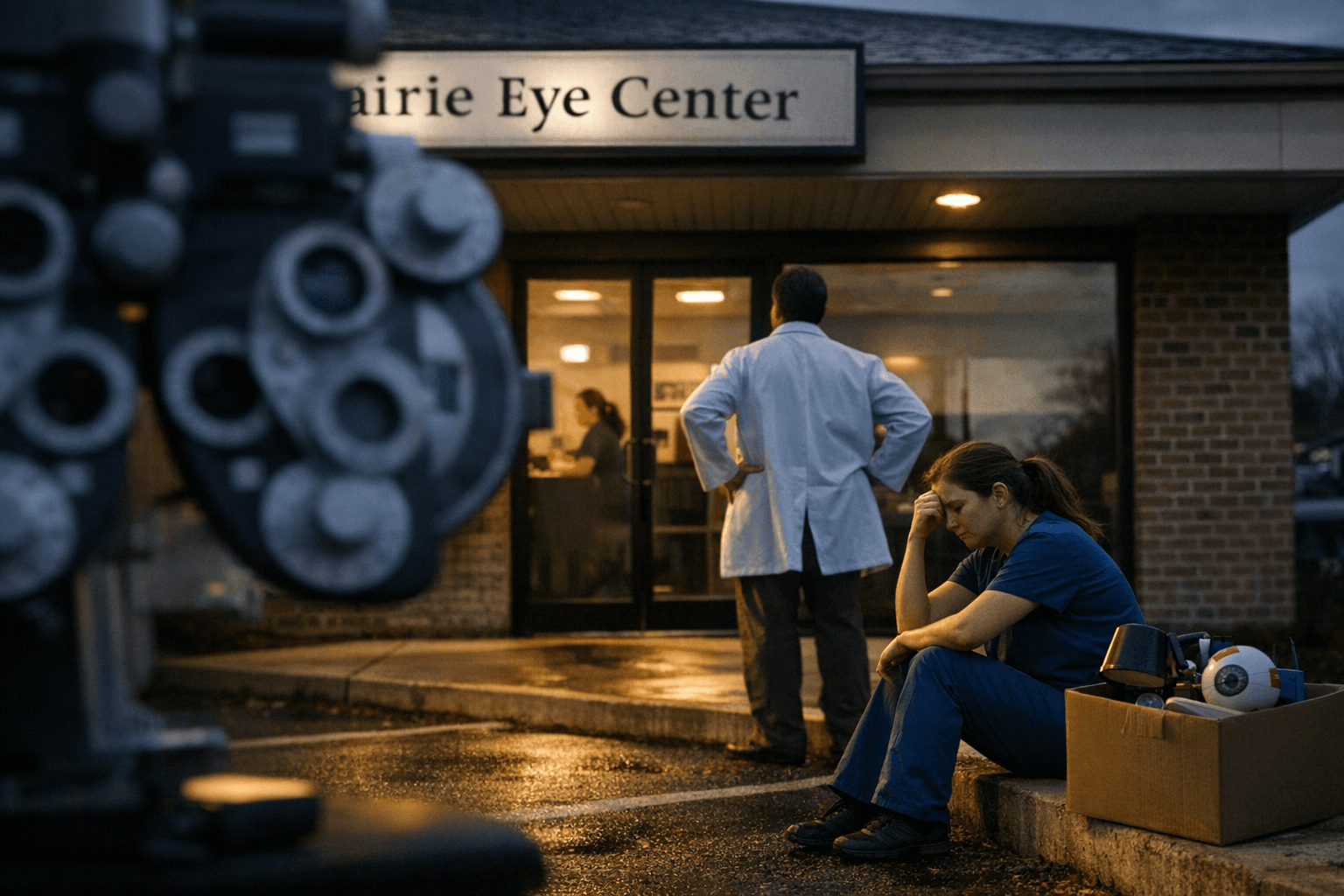

Prairie Eye Center filed Chapter 11 on Dec. 29, putting its Jacksonville clinic and staff under reorganization scrutiny and potentially affecting local eye care access.

Prairie Eye Center, which operates a Jacksonville office at 2000 W. Morton Ave., filed for Chapter 11 bankruptcy protection on Dec. 29 in U.S. Bankruptcy Court for the Central District of Illinois. The restructuring move places the practice under court supervision as it seeks to reorganize instead of liquidating, a process that will determine whether local services continue uninterrupted.

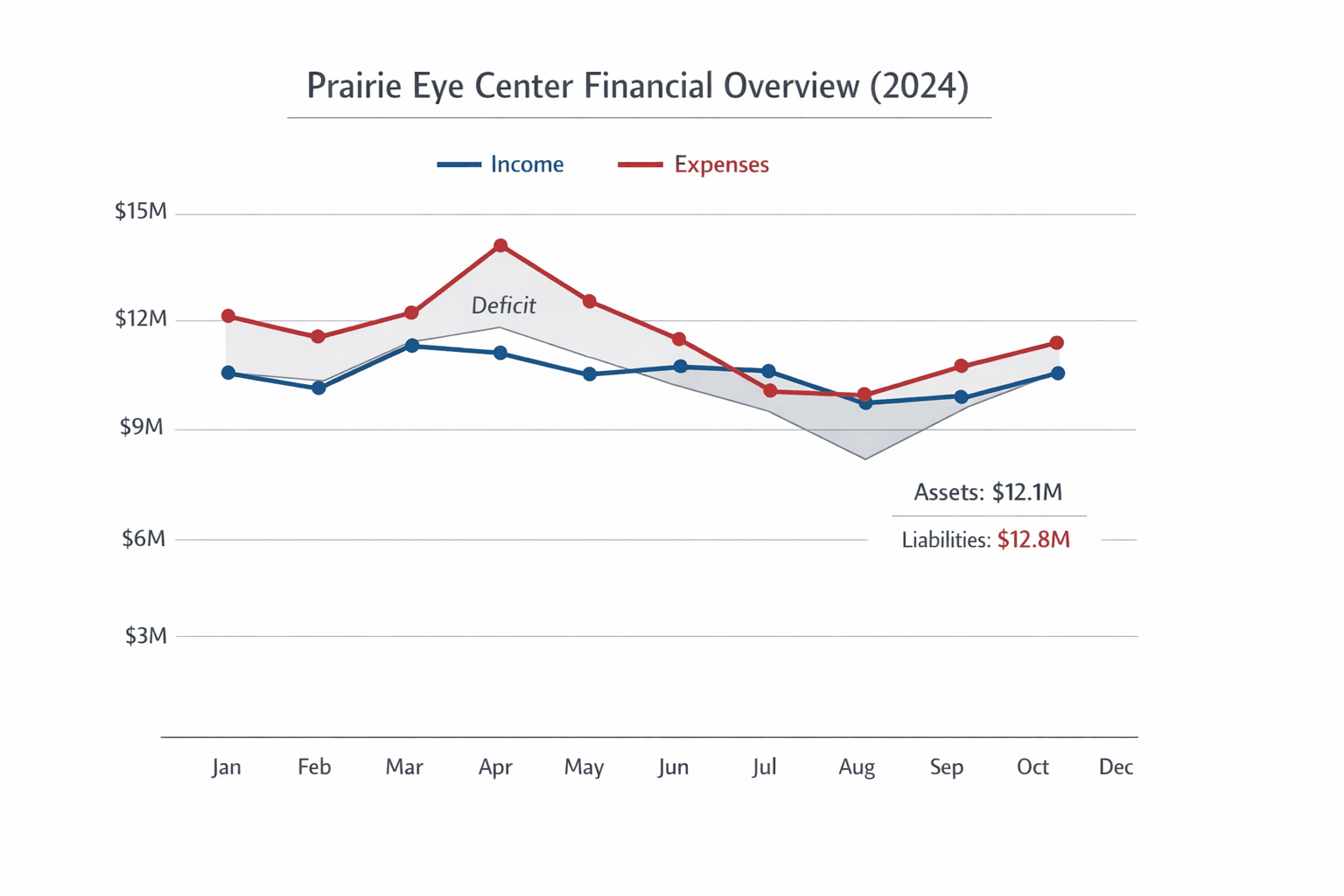

Court filings show the practice finished 2024 with about $12.1 million in income against roughly $12.8 million in expenses, a deficit of approximately $634,899. Records also list about $5.3 million in assets and roughly $10.6 million in liabilities. The filings indicate Prairie Eye Center spent more than it earned in seven of 12 months in 2024, a pattern that points to persistent cash-flow pressure rather than a single one-time shortfall.

This is the practice's second attempt to pursue Chapter 11 protection. An earlier petition filed Feb. 7 was denied Dec. 16 because required documents and statements were missing from the record. The previous denial adds a procedural wrinkle: the new filing will be scrutinized in light of prior deficiencies, potentially affecting how quickly a reorganization plan moves forward.

For Morgan County residents, the immediate concern is continuity of care. The Jacksonville office is a local access point for optometry services, including routine exams, follow-ups, and prescription management. Bankruptcy under Chapter 11 does not automatically close clinics; many businesses continue operating while they negotiate with creditors and craft a plan to return to profitability. However, creditors or court rulings could lead to changes in ownership, reductions in service hours, staff layoffs, or, in worst-case scenarios, a conversion to liquidation if reorganization fails.

Patients should be prepared for possible disruptions: confirm upcoming appointments directly with the Jacksonville office, verify that prescriptions and optical orders are in process, and check with insurance providers about coverage if services are transferred or consolidated. Staff and community members may face uncertainty about jobs and schedules while the case proceeds.

Economically, the filing highlights the thin margins in many local healthcare practices, where revenues can be volatile and liabilities can outstrip modest asset bases. A $5.3 million asset base against $10.6 million in liabilities signals significant creditor claims that will shape any reorganization plan and influence whether the clinic can sustain operations during the process.

Our two cents? If you or a family member rely on the 2000 W. Morton Ave. clinic, call to confirm care, ask your insurer about continuity provisions, and request copies of recent records or prescriptions now so you’re not caught off guard if schedules or ownership change.

Sources:

Know something we missed? Have a correction or additional information?

Submit a Tip