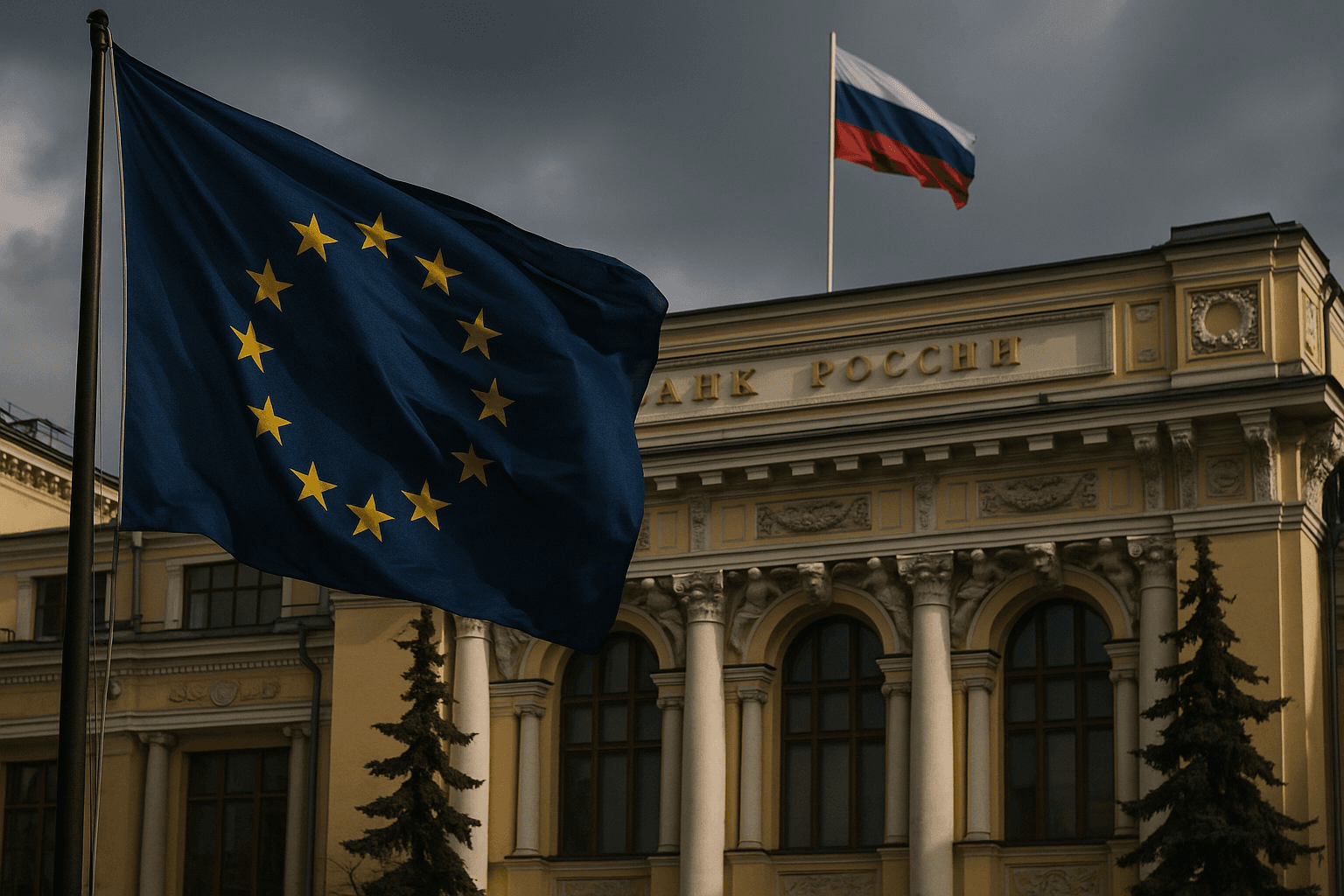

EU Agrees to Indefinitely Immobilise Russian Central Bank Assets, Clears Way for Major Ukraine Loan

European Union ambassadors voted to indefinitely immobilise about €210 billion in Russian central bank assets held in Europe, replacing the previous six monthly unanimous renewal that left the funds vulnerable to a single veto. The move is designed to underpin a proposed up to €165 billion multi year loan for Ukraine and to ensure those assets remain under EU jurisdiction until Moscow compensates for war damages.

On December 13, 2025, European Union ambassadors agreed to immobilise approximately €210 billion in sovereign Russian assets held in Europe indefinitely, a decision intended to prevent the funds from being reclaimed or redirected before Russia compensates Ukraine. The assets, frozen after Moscow’s 2022 full scale invasion of Ukraine, include about €185 billion held at Euroclear in Brussels and about €25 billion held in private banks across the union.

The measure uses Article 122 of the EU treaties, a provision for economic emergencies that requires a qualified majority among member states and bypasses the European Parliament. Under the new legal framework the funds cannot be transferred back to the Russian central bank, and the former six monthly unanimous renewal process that risked a single member state blocking extensions is no longer required.

EU Council President António Costa framed the decision as both a legal safeguard and a political commitment. He said the move would “keep Russian assets immobilized until Russia ends its war of aggression against Ukraine and compensates for the damage caused,” and described the next step as “securing Ukraine’s financial needs for 2026–27.” Leaders will press the matter at a summit scheduled for December 18 where negotiators are expected to finalise the shape of the proposed assistance.

The immobilisation is explicitly tied to an EU proposal to leverage the frozen assets to underwrite a large multi year financial package for Kyiv, with officials discussing a facility of up to €165 billion to cover military and civilian needs through 2026 and 2027. The decision does not itself transfer money to Ukraine, but officials described the legal stabilisation as a precondition for creating an instrument that would underwrite loans or reparations related to Russia’s aggression.

Member state sensitivities shaped the timing and form of the vote. Belgium, which hosts Euroclear and therefore holds the bulk of the frozen assets, sought stronger legal clarity to insulate holdings from legal challenge and national political pressure. The qualified majority mechanism was also intended to reduce the leverage of Moscow friendly governments within the European Union that could block unanimous renewals.

The move also addresses international legal and diplomatic risks. EU officials said the decision would guard against attempts by non EU actors to seize or redirect the assets in future negotiations with Moscow. The Russian central bank has maintained that such use of its reserves would be illegal. Brussels officials also signalled that any Russian court ruling against Belgium would not be recognised across the union.

Even as the immobilisation clears a major procedural obstacle, member states face intensive negotiations over the precise structure of the loan or reparations mechanism, the governance of any facility, and legal safeguards to withstand Russian and third party challenges. The outcome will reverberate beyond Kyiv and Moscow, establishing new precedent on how democracies can immobilise and repurpose frozen sovereign assets to respond to aggression while navigating complex legal and diplomatic constraints.

Know something we missed? Have a correction or additional information?

Submit a Tip