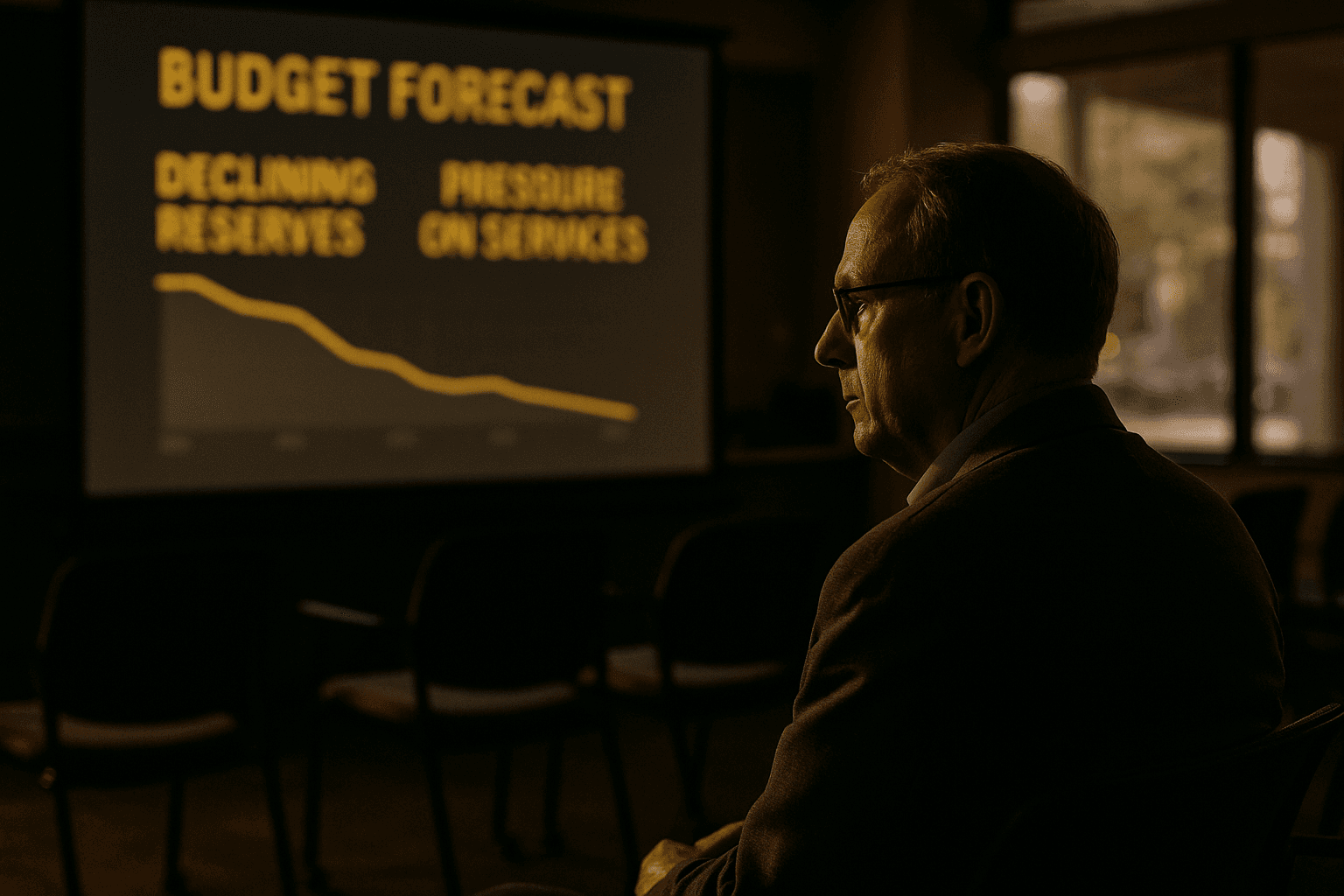

Eugene Budget Forecast Shows Shrinking Reserves, Pressure on Services

The city presented an updated financial forecast and a 2025 to 2027 supplemental budget that projects declining reserves due to lower revenues and rising costs. Local services could face pressure by 2027 unless the city reduces general fund spending or finds new revenue sources.

City finance leaders presented an updated forecast and the 2025 to 2027 supplemental budget to Eugene's Budget Committee on Wednesday, December 3, and warned that reserves are expected to dip as revenues decline and costs rise. The supplemental budget makes adjustments to the two year budget adopted in June, reflecting grant changes, audits and recent council direction. The budget remains balanced for the current cycle, but officials said action will be needed to hold long term savings on target.

Senior Financial Analyst Maurizio Bottalico told the committee that to maintain the city savings trajectory the general fund would need to reduce spending by about $2.2 million per year beginning in 2027. That exercise follows a June decision to raise the stormwater fee, a step taken then to narrow an $11.5 million general fund shortfall and avoid immediate cuts. City leaders are now balancing near term stability with growing medium term risk to reserves.

Much of the tightening reflects weaker revenue projections. The city lowered long term assumptions for assessed property value growth and trimmed its assumed property tax collection rate. Higher than expected inflation is also increasing operating costs, and officials now project more than $1 million of additional general fund spending each year on an ongoing basis. Those combined trends push the city savings target downward. Eugene aims to hold a general fund savings account equal to 4 percent of biennial expenses. The updated trajectory shows savings slipping to about 3.6 percent.

To address future pension costs the supplemental budget allocates $8 million into a PERS employer incentive fund. That contribution is intended to lower the city pension burden over the next six years, with the program beginning on January 1. City officials see the pension fund move as a strategic investment to reduce structural costs that could otherwise compound pressure on ongoing operations.

For Lane County residents the forecast matters because general fund pressure often translates into constraints on public services, infrastructure maintenance and long term investments. City leaders now face choices about spending priorities, service levels and potential revenue options as they prepare the supplemental budget for final adoption by the City Council.