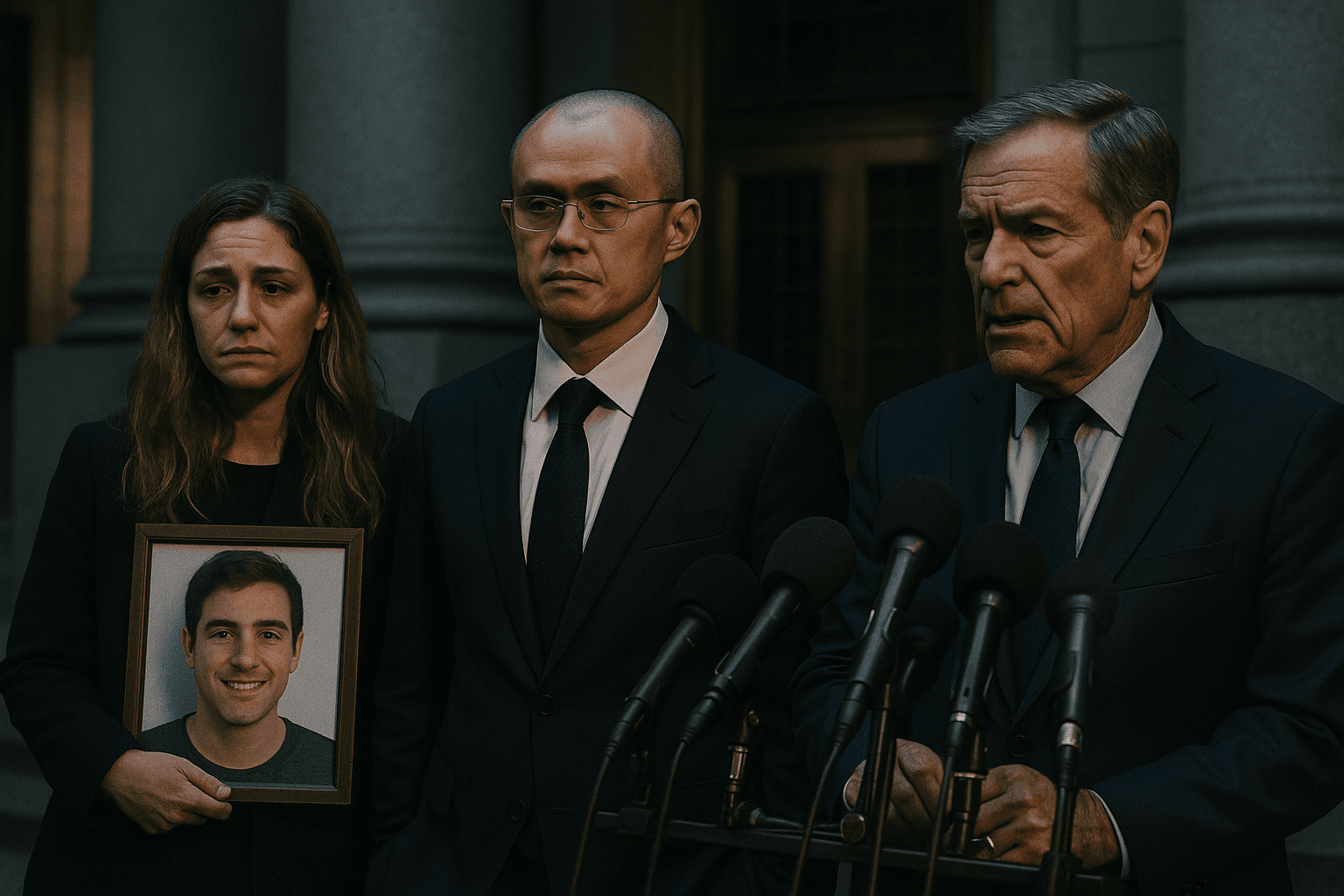

Families Sue Binance, Founder Over Alleged Billion Dollar Terror Transfers

Families of victims of the October 7, 2023 Hamas attack filed a federal lawsuit accusing Binance, its founder and senior executives of facilitating more than one billion dollars in transfers to Hamas and other U.S. designated terrorist organizations. The case, made public on November 24 and 25, 2025, could reshape regulatory and legal exposure for crypto platforms and accelerate tougher oversight of the industry.

Families of victims of the October 7, 2023 attack filed a multi hundred page complaint in U.S. District Court in North Dakota on November 24 and 25, 2025 alleging that Binance, its founder Changpeng Zhao and senior executives knowingly facilitated more than one billion dollars in transfers to Hamas and other U.S. designated foreign terrorist organizations. The plaintiffs brought the suit under the Anti Terrorism Act seeking compensatory and treble damages, a statutory remedy that can multiply awards significantly if liability is established.

The complaint, assembled by plaintiffs lawyers who say internal exchange records document repeated lapses in anti money laundering and sanctions controls, accuses the company of allowing substantial flows to continue even after prior enforcement actions. Binance previously pleaded guilty in 2023 to anti money laundering offenses and agreed to pay large penalties totaling approximately 4.3 billion dollars to U.S. authorities. The exchange has disputed allegations of systemic wrongdoing and says it complies with laws and has strengthened controls since 2023.

The lawsuit raises clear legal and market implications for Binance and the wider crypto sector. If a civil judgment were to hold the exchange financially responsible for transfers claimed in the complaint, potential damages could exceed prior penalties by virtue of the treble damages provision. For a platform that has traditionally accounted for roughly half of global crypto trading volumes, elevated legal risk could sway customers and counterparties, compress liquidity and increase funding costs.

Beyond immediate balance sheet consequences, the case underscores a shift in enforcement tactics. Regulators and plaintiffs are increasingly targeting intermediaries for third party flows, treating centralized exchanges as gatekeepers whose compliance failures have real world consequences. This trend could encourage more aggressive civil litigation under the Anti Terrorism Act and similar statutes, expanding the universe of legal exposures for financial intermediaries that facilitate or clear transactions.

For policymakers the suit will intensify debates over how to regulate digital asset markets. Lawmakers and regulators may respond with tougher licensing, higher standards for know your customer procedures, expanded transaction monitoring obligations and greater penalties for failures. Those measures would raise ongoing compliance costs for exchanges and could accelerate onshoring of operations into jurisdictions with clearer rules. At the same time, tighter enforcement may also reduce the ability of illicit actors to exploit gaps in the financial system, a stated public policy goal.

Longer term, the litigation highlights an enduring tension as crypto markets become more integrated with mainstream finance. Greater integration brings benefits of scale and liquidity but also creates concentrated points of failure when compliance systems are inadequate. Investors and institutional clients will be watching this case closely for signals about legal risk and the reliability of crypto infrastructure. The outcome could influence valuations, market structure and the pace at which traditional financial institutions engage with digital asset markets.