Fed Could Surprise Markets With Massive Treasury Bill Purchases

Bank of America strategists and other analysts say the Federal Reserve could announce a surprise program of large short term Treasury bill purchases to keep bank reserves "ample", alongside an expected December rate cut. The move, estimated at roughly sixty billion dollars a month in short term buying, would aim to prevent money market stress and calm markets amid heavy Treasury issuance, but it could also be seen as a de facto expansion of the Fed balance sheet.

Federal Reserve policy makers are widely expected to trim interest rates at their December meeting, and analysts say they could accompany that easing with a surprise program of large short term Treasury bill purchases aimed at keeping bank reserves "ample". Bank of America strategists and other market observers estimate the operation could amount to roughly forty five billion dollars a month in new bill purchases in addition to about fifteen billion dollars a month in reinvestments from maturing mortgage backed securities, bringing total short term purchases toward sixty billion dollars monthly.

The proposal would be framed by the Fed as liquidity management rather than conventional quantitative easing, focused on ensuring smooth functioning of money markets rather than directly stimulating the economy. Proponents say the step would reduce the risk of episodes like the September 2019 money market squeeze when repo rates spiked and the central bank moved quickly to inject liquidity. With Treasury issuance remaining large, analysts say adding bills to the Fed balance sheet would reassure dealers and money market mutual funds that reserves will not be too sparse at critical junctures.

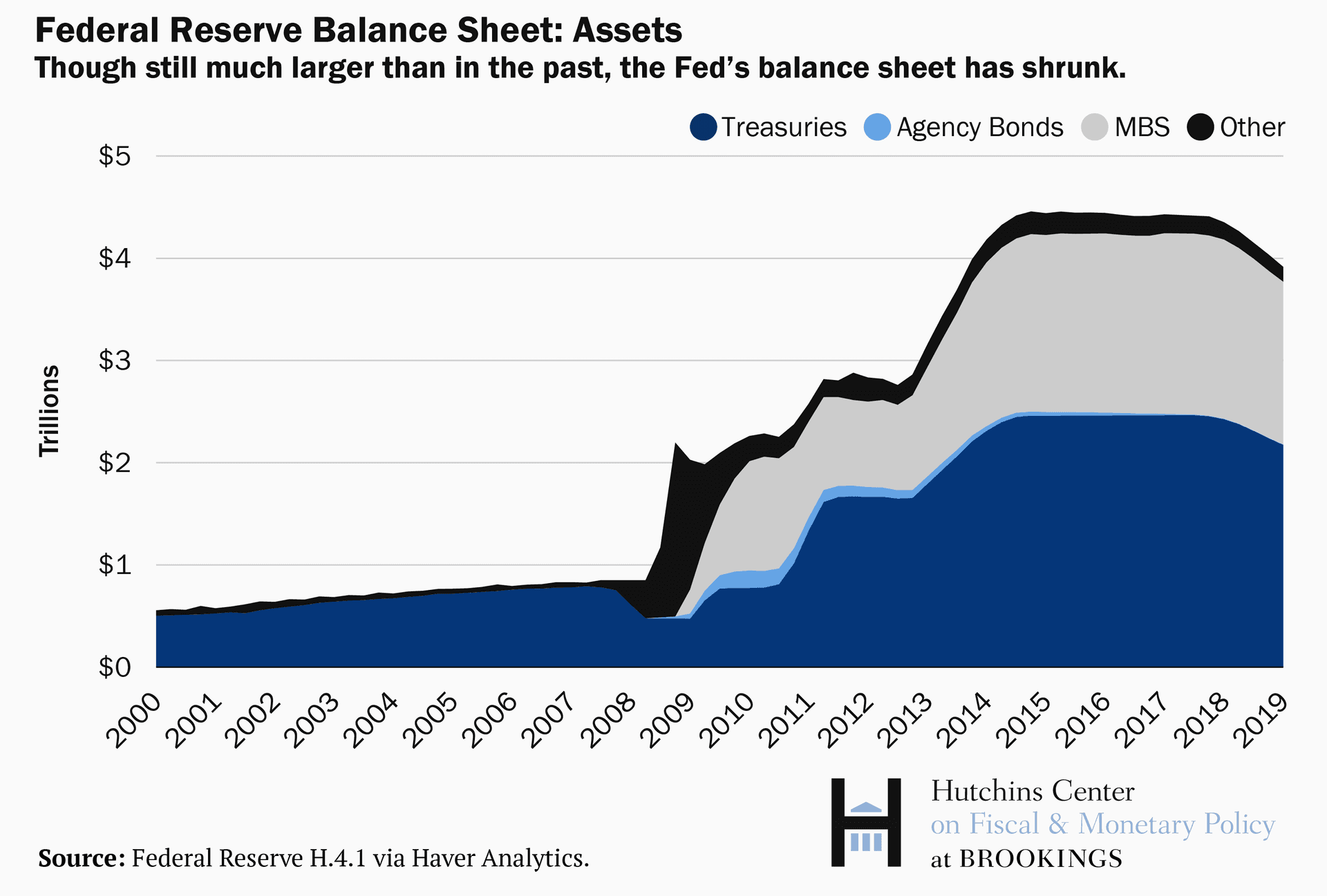

The idea comes against the backdrop of a significantly smaller Fed balance sheet than its 2021 peak. While the central bank has been shrinking its holdings through passive runoff and maturing securities reinvestment policy, market participants have grown sensitive to the interaction between reserve levels and the supply of short term Treasury securities. A program of Reserve Management Purchases as described by strategists would reverse some of that contraction in the short term segments of the Fed portfolio.

Markets would likely receive such a move as risk reducing for short term funding, lowering pressure on repo and commercial paper markets and potentially reducing term premiums on Treasury securities. The additional buying could also put downward pressure on short term Treasury yields, compressing parts of the yield curve even as the Fed lowers policy rates. That combination would be welcomed by financial institutions that rely on stable money market conditions, but it could complicate the Fed message about its stance toward inflation and balance sheet normalization.

Critics argue the operation would amount to a stealth balance sheet expansion, blurring the line between temporary liquidity operations and monetary policy easing. If investors perceive the purchases as loosening financial conditions, longer term yields and asset prices could respond in ways that complicate the central bank's inflation objectives. Policy makers will face a communication challenge in explaining why large scale bill purchases do not represent a shift back to the large scale asset purchases used earlier in the decade.

For markets and policy watchers, key things to monitor are the size and duration of any announced bill program, the rate at which the Fed reinvests maturing securities, and Treasury borrowing plans that will influence money market supply. Any formal move would mark a notable tactical change in how the Fed manages reserves, with implications for liquidity, the balance sheet, and the interplay between fiscal supply and monetary control.