Fed face off between easing and credibility, Atlanta Fed warns

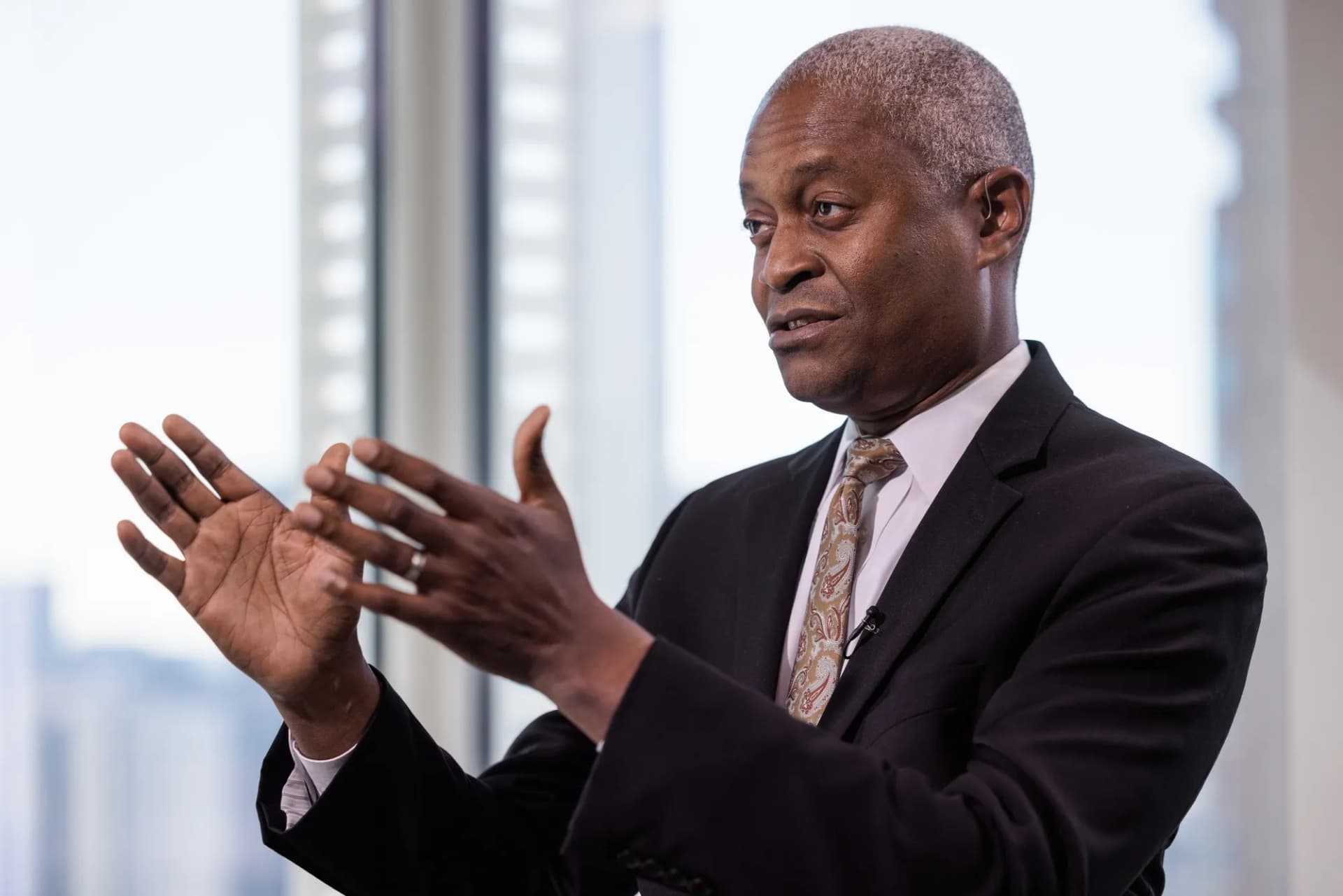

Atlanta Federal Reserve President Raphael Bostic warns that additional interest rate cuts could rekindle inflation and unsettle expectations, forcing a painful policy backtrack. The warning frames a broader debate among economists over the trade off between supporting jobs and preserving the Fed's hard won credibility, a choice with big implications for markets and the economy.

Atlanta Federal Reserve President Raphael Bostic is warning that further reductions in interest rates risk putting U.S. monetary policy on an accommodative footing that would boost growth but also "puts the country at risk of a new jump in inflation and inflation expectations." His caution arrives as Federal Reserve officials weigh whether to ease policy further after a September 17 rate cut that already signaled a shift in stance.

Bostic's message sits at the center of a wider argument among policymakers, academics and columnists over the likely costs and benefits of additional easing. Paul Krugman, writing on his Substack, reiterated a standard economics view that a large cut in the federal funds rate in the absence of a severe slump would be inflationary and could damage the Fed's credibility, the market belief that the central bank will act to fight future inflation. Krugman cites research by Nakamura and colleagues and references a Federal Reserve Bank of Atlanta chart to argue that credibility built over decades helped the Fed lower inflation without inducing recession in past cycles.

A separate column by Gonzaga frames the choice as a narrow, high stakes balancing act. Gonzaga warns that cutting rates too quickly could cause inflation to spike, while moving too slowly could allow deterioration in the labor market. Tariffs are identified as a factor making inflation stickier, and the political dimension is front and center with former President Donald Trump publicly urging rate cuts. Gonzaga notes that the September 17 rate cut appeared driven more by incoming data than by politics, and highlights that the Fed a year ago projected rates would be much lower today than they actually are, a sign the central bank has been responsive to evolving conditions.

The policy stakes are concrete for markets. Renewed accommodation could lift demand and reaccelerate price gains, prompting consumers and firms to revise inflation expectations upward. That change would likely push nominal yields higher and real yields lower, tightening financial conditions in ways that could force the Fed into larger and faster rate increases later. The opposite risk is that insufficient easing prolongs labor market stress, weakening household income and spending and adding to political pressure on the central bank.

Long term, analysts say credibility is the linchpin. If markets believe the Fed will tolerate higher inflation or be swayed by political pressure, the central bank's ability to anchor expectations erodes, raising the cost of restoring price stability. Conversely, a reputation for consistent, data driven policy can allow the Fed to bring inflation down with smaller output costs, as the research cited by Krugman suggests.

Bostic's intervention underscores that the Fed's path is not purely mechanical. Officials must weigh incoming labor market and inflation readings, the added complications of tariffs on prices, and the message their actions send to markets and the public. The central bank faces a narrow path to a soft landing and significant risks on either side of its policy choice.

Know something we missed? Have a correction or additional information?

Submit a Tip