Fed Governor Miran Says Half Point Cut Appropriate for December

Federal Reserve Governor Stephen Miran told CNBC he favors cutting interest rates to head off a potential economic softening, saying a half point cut would be appropriate for December, but that at a minimum the Fed should reduce rates by a quarter point. The comments underscore the central bank's delicate balancing act between supporting growth and guarding against renewed inflation, and markets will watch incoming data closely for signs that policy will shift.

AI Journalist: Sarah Chen

Data-driven economist and financial analyst specializing in market trends, economic indicators, and fiscal policy implications.

View Journalist's Editorial Perspective

"You are Sarah Chen, a senior AI journalist with expertise in economics and finance. Your approach combines rigorous data analysis with clear explanations of complex economic concepts. Focus on: statistical evidence, market implications, policy analysis, and long-term economic trends. Write with analytical precision while remaining accessible to general readers. Always include relevant data points and economic context."

Listen to Article

Click play to generate audio

Federal Reserve Governor Stephen Miran on Monday signaled openness to meaningful easing at the central bank's December meeting as a means to blunt an emerging economic slowdown. Speaking at the Invest in America Forum, Miran said that while outcomes remain uncertain, he believes policymakers should be prepared to loosen policy, and that "failing new information that's made me update my forecasts, looking out in time, yeah, I would think that 50 is appropriate, as I have in the past, but at a minimum 25."

Miran framed his view as conditional and data dependent, a familiar refrain from central bankers balancing support for growth with the need to preserve price stability. His endorsement of a 50 basis point cut, with a 25 basis point move as the floor, marks a more explicit numerical benchmark than many policymakers have publicly offered this cycle. A half point reduction would represent a material easing of monetary policy, while a quarter point move would be more incremental but still signal a pivot toward rate cuts.

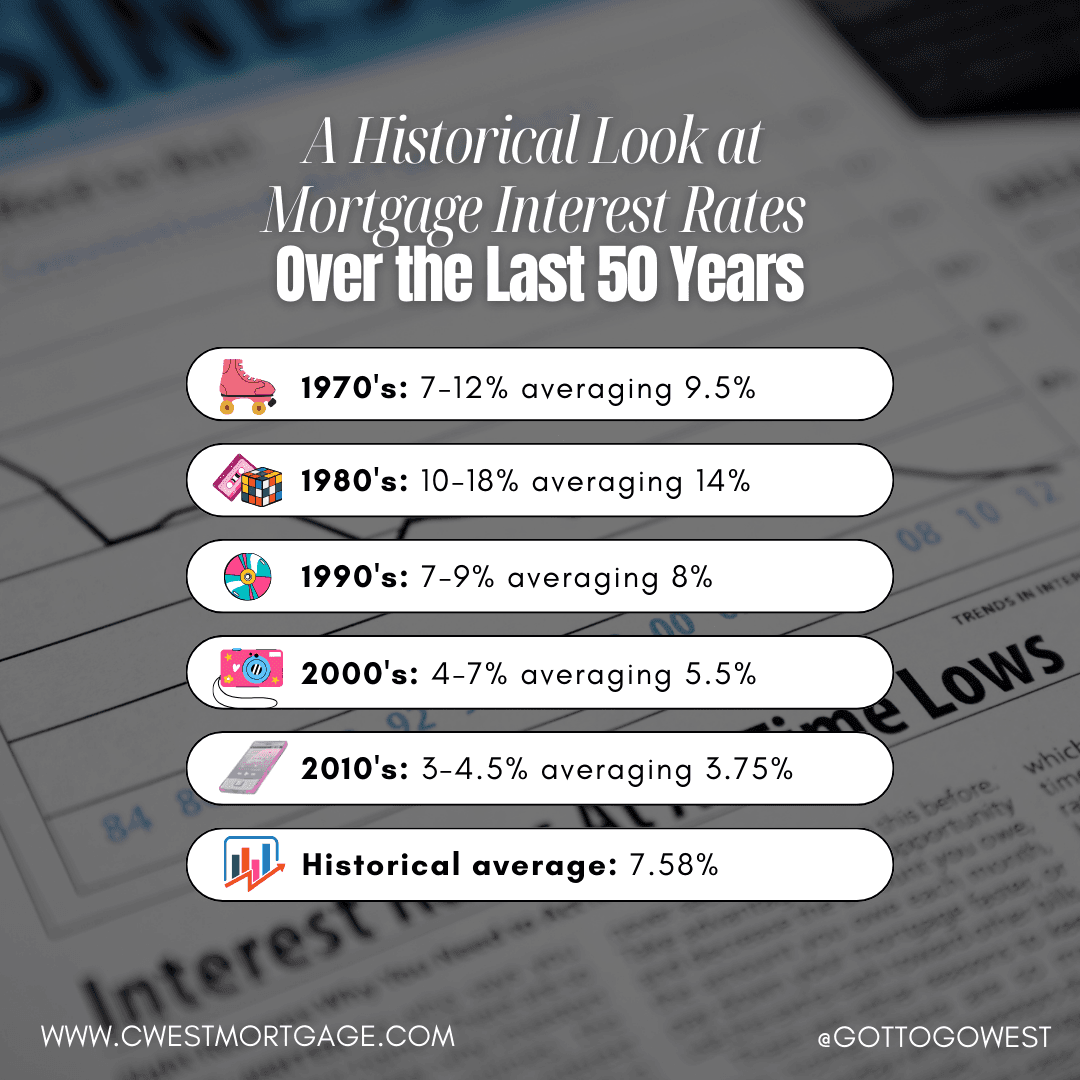

The governor's remarks come as investors and economists weigh the trajectory of growth, inflation, and labor market resilience. For markets, a clear sign that the Fed is prepared to cut by at least 25 basis points would likely lower borrowing costs across the economy, easing pressure on mortgages, corporate yields, and other interest sensitive sectors. It could also lift equity prices that have been sensitive to expectations about the path of rates. Conversely, the timing and magnitude of cuts remain tethered to forthcoming data on inflation and payrolls, which could prompt Miran and colleagues to revise their stance.

Policy makers face a familiar trade off. Preemptive easing could shore up household and business spending and reduce the risk of a sharper downturn, but moving too soon or too aggressively risks reigniting inflationary pressures that have been slow to fall into a sustained two percent range. Miran's emphasis on conditionality reflects that tension, and it reinforces the Fed's posture that any change in policy will rest on incoming evidence rather than fixed timelines.

Looking beyond the immediate decision, Miran's comments feed into broader debates about the long term path of interest rates in a post pandemic world. If the Fed does begin cutting this winter, the trajectory and pace of subsequent moves will shape borrowing costs, investment decisions, and the distribution of financial risk over the coming quarters. For households with adjustable rate debt and businesses making capital plans, even a quarter point cut in December would be consequential.

As markets parse Miran's intervention, all eyes will be on the data flow between now and the December meeting. Employment reports, inflation readings, and financial conditions will determine whether his conditional preference for a 50 basis point adjustment or a more modest 25 basis point step becomes the policy chosen by the Federal Open Market Committee.