Fed Moves, T Bill Purchases and AI Worries Reshape Markets

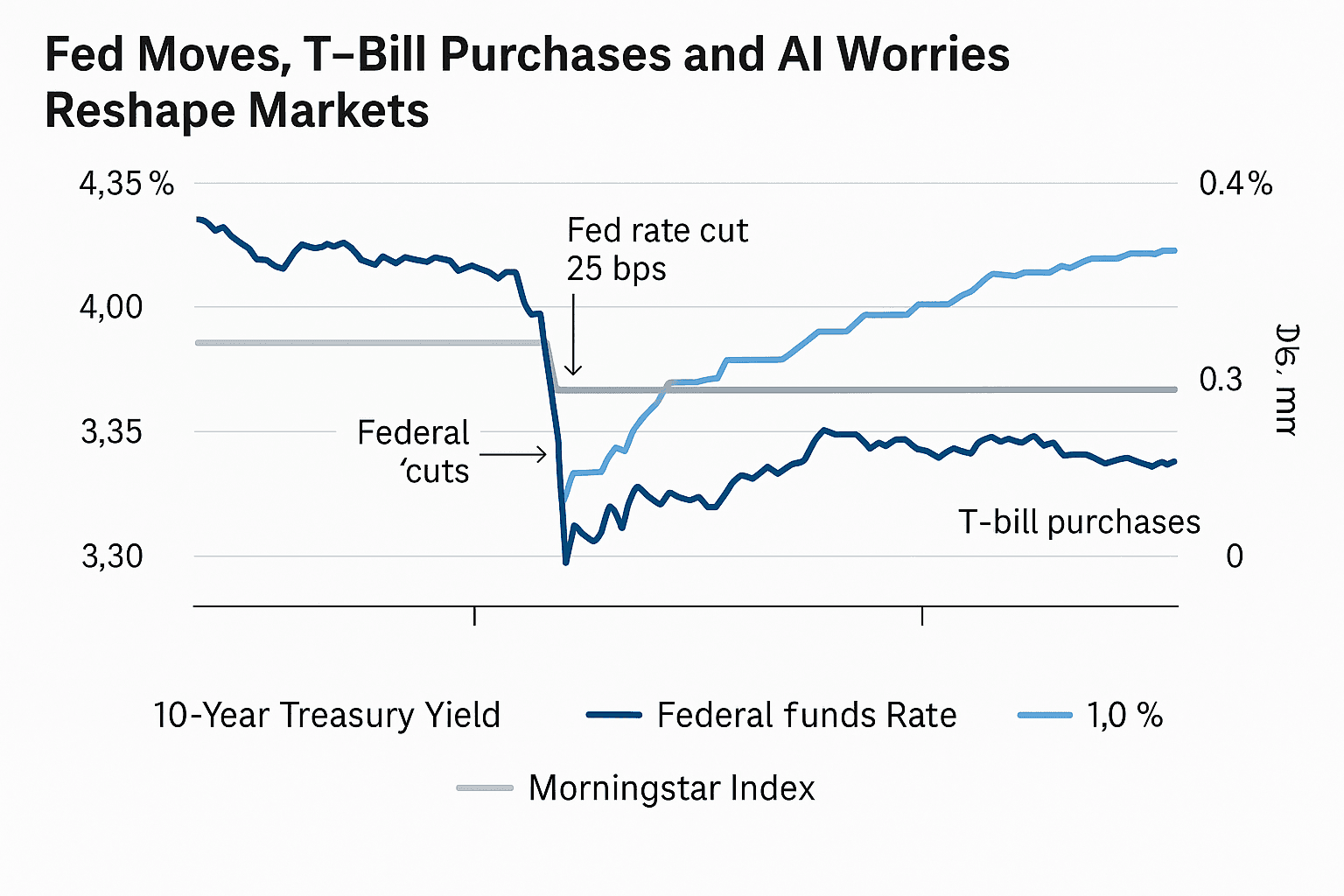

The Federal Reserve stunned investors in early December by cutting rates by 25 basis points and launching a roughly $40 billion per month Treasury bill purchase program, a move that formally ended quantitative tightening on December 1 and injected fresh liquidity into markets. The immediate effects were lower sovereign yields, a softer dollar and modest equity gains, while lingering anxieties about artificial intelligence temper longer term risk appetite and cloud the year end outlook.

The Federal Reserve’s surprise policy pivot in early December altered the market landscape as the year draws to a close. Policymakers cut the federal funds rate by 25 basis points and on December 10 announced plans to buy about $40 billion of Treasury bills each month, with operations beginning on December 12. Officials framed the action as a definitive end to quantitative tightening, which had concluded on December 1, and an operational response to reserve management needs.

Market responses were swift. Short term liquidity flows pushed Treasury yields lower, with the 10 year Treasury yield slipping to about 4.15 percent after the announcements. The U.S. dollar weakened notably around Fed Chair Powell’s press conference as market participants interpreted the T bill purchases as a direct liquidity injection. Equities climbed modestly in the immediate aftermath, with the Morningstar US Market Index rising roughly 0.4 percent as traders moved toward risk assets.

Reuters’ Morning Bid captured market sentiment on December 12, observing that the combination of a rate cut and renewed T bill operations "stunned some investors." The reaction underscored how quickly markets adjusted to a dual easing in rates and balance sheet policy after months of tightening. For money markets and reserve balances, buying short dated treasury bills expands central bank reserves without expanding duration risk on the Fed’s balance sheet in the same way that coupon bearing securities do.

There is a clear historical precedent for the tool. The Fed employed a similar T bill program in late 2019, purchasing roughly $60 billion per month to ease repo market strains and restore smooth functioning in short term funding markets. That episode is frequently cited by policymakers and market participants as the model for using T bills as an operational lever rather than a broad stimulus measure.

Policy implications are threefold. First, the move signals that the Fed retains a pragmatic toolkit to manage overnight funding and reserve scarcity, which could reduce acute volatility in money markets. Second, pairing rate easing with asset purchases complicates the central bank’s messaging on inflation and normalization, raising questions about how and when the balance sheet will be pared if inflation reaccelerates. Third, the operational pivot may influence term premia and the shape of the yield curve, removing some upward pressure on yields while supporting credit availability.

Offsetting these liquidity friendly forces are persistent non monetary uncertainties, notably what market commentary has described as lingering anxieties around artificial intelligence. Analysts flagged AI related concerns as a restraint on exuberance, even though the immediate economic data and policy moves leaned toward accommodation. As investors recalibrate for 2026, the key items to watch are the Fed’s follow through on T bill operations, incoming inflation readings, and any policy responses to the evolving AI landscape that could reshape risk and regulatory frameworks.

Know something we missed? Have a correction or additional information?

Submit a Tip