Fed to Resume Treasury Bill Purchases, Eases Year End Money Market Strains

The Federal Reserve announced it would restart purchases of short term Treasury bills beginning December 12, aiming to buy about $40 billion to calm strains in repo and overnight funding markets. The move, framed as precautionary liquidity management, sought to restore reserves drained by heavy T bill issuance and an elevated Treasury General Account, and to maintain effective control of policy rates.

The Federal Reserve on December 10 said it would resume purchases of short term Treasury bills starting December 12, a targeted intervention designed to relieve acute strains in U.S. money markets as the year end approaches. The initial program will seek roughly $40 billion of T bill purchases, the central bank said, with officials describing the action as a liquidity management step rather than a change in the stance of monetary policy.

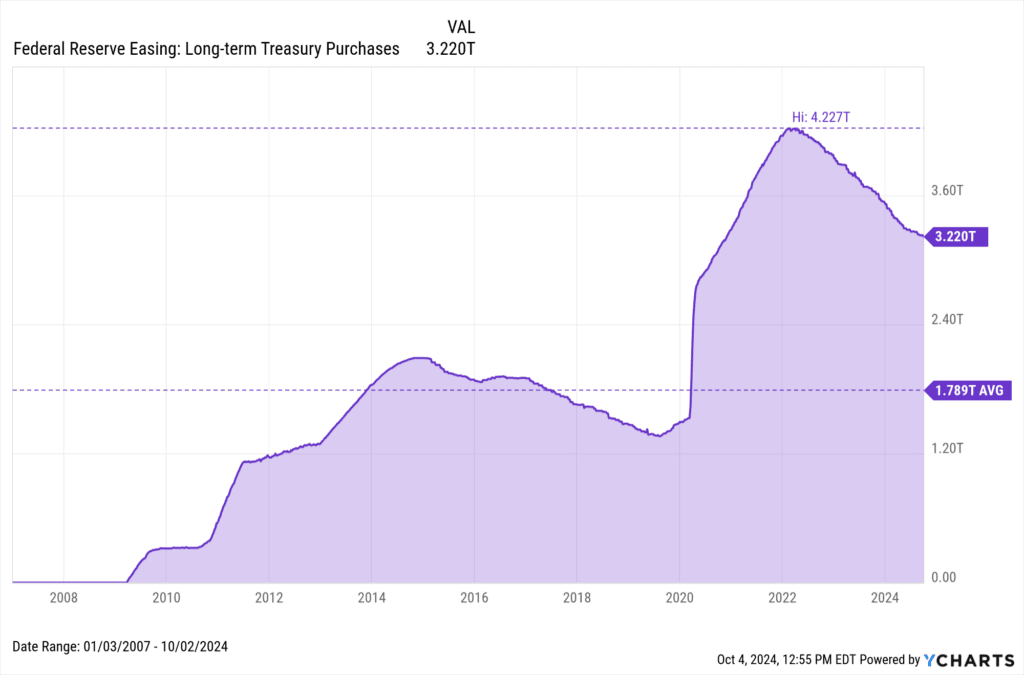

The decision followed recent episodes in which short term borrowing costs in the repo market and other overnight funding venues spiked, complicating the transmission of the Federal Open Market Committee's policy rate to broader financial conditions. Reuters reporting noted the restart came after the Fed had already halted quantitative tightening earlier in the year, and was prompted by a surge in Treasury bill issuance together with an elevated Treasury General Account balance that drained bank reserves.

Market makers and strategists told Reuters the purchases were aimed at stabilizing year end funding conditions and preserving the Fed's ability to keep overnight rates close to the policy target. By adding reserves through T bill purchases, the Fed can alleviate upward pressure on secured and unsecured short term rates without altering the federal funds rate itself, a distinction policymakers emphasized in explaining the move.

Analysts said the $40 billion program is modest relative to the scale of the U.S. Treasury market, but it can be timely and effective at smoothing transient dislocations. With large Treasury issuance to fund fiscal needs and Treasury General Account balances that fluctuate with tax receipts and payments, reserve scarcity can emerge quickly late in the year when banks reduce balance sheet capacity. Restoring intraday and overnight liquidity helps avoid forced selling, volatile repo rates, and potential knock on effects for broader financial markets.

The intervention underscores a longer term shift in how the Fed uses its balance sheet as a day to day tool of monetary operations. Since the pandemic era, central bank policymakers have shown greater willingness to adjust the composition and size of holdings to ensure smooth functioning of short term funding markets, even while signaling that such interventions do not signal a shift in policy rates. The Fed framed the action explicitly as precautionary, intended to maintain effective control of policy rates rather than to provide ongoing stimulus.

For markets, the immediate implication is lower probability of disruptive spikes in overnight financing costs as institutions manage year end demands. For investors and borrowers, that should keep short term funding spreads more stable and limit pressure on money market funds and repo counterparties. Over the medium term, frequent reliance on balance sheet tools could prompt debate about the Fed's operational framework and the interaction between Treasury cash management and central bank reserve supply.

The move was reported by Reuters on December 10. The Fed will monitor market conditions and adjust purchases as needed to meet its operational goals and preserve the transmission of monetary policy.

Sources:

Know something we missed? Have a correction or additional information?

Submit a Tip