Fed Vote Reveals Deep Split, Three Officials Dissent

The Federal Open Market Committee approved a 25 basis point cut to the federal funds target range on December 12, but the 9 to 3 vote exposed an unusual and widening split within the central bank. The dissents and a dispersed dot plot signal that the policy path ahead is contested, with implications for markets, inflation and the committee's composition next year.

The Federal Reserve on December 12 approved a 25 basis point reduction in its federal funds target range, marking the third cut of 2025 and the latest step in an easing cycle that has reduced borrowing costs by 75 basis points since September. The vote was 9 to 3, the largest number of dissents since September 2019, and the pattern of opposition underscores growing disagreement over the direction of U.S. monetary policy.

The three dissenting votes split in an uncommon alignment. Governor Stephen Miran favored a larger 50 basis point reduction, continuing a dovish streak and recording his third consecutive dissent in favor of steeper easing. Kansas City Federal Reserve President Jeffrey Schmid and Chicago Fed President Austan Goolsbee opposed the 25 basis point cut, voting instead to hold rates unchanged and citing concerns that inflation remains too elevated to justify loosening policy.

The December outcome extended a run of non unanimous meetings in 2025. The committee produced one dissent in September, two in October and three in December, representing the fourth straight meeting with at least one vote against the majority. In addition to the formal dissents, four non voting meeting participants registered what officials described as soft dissents, and the Fed's dot plot showed six officials projecting a year end federal funds rate 25 basis points higher than the level implied by the new target range. Those higher dots included several members who are not current voters but could rotate into voting roles next year, a dynamic likely to influence the committee's stance in 2026.

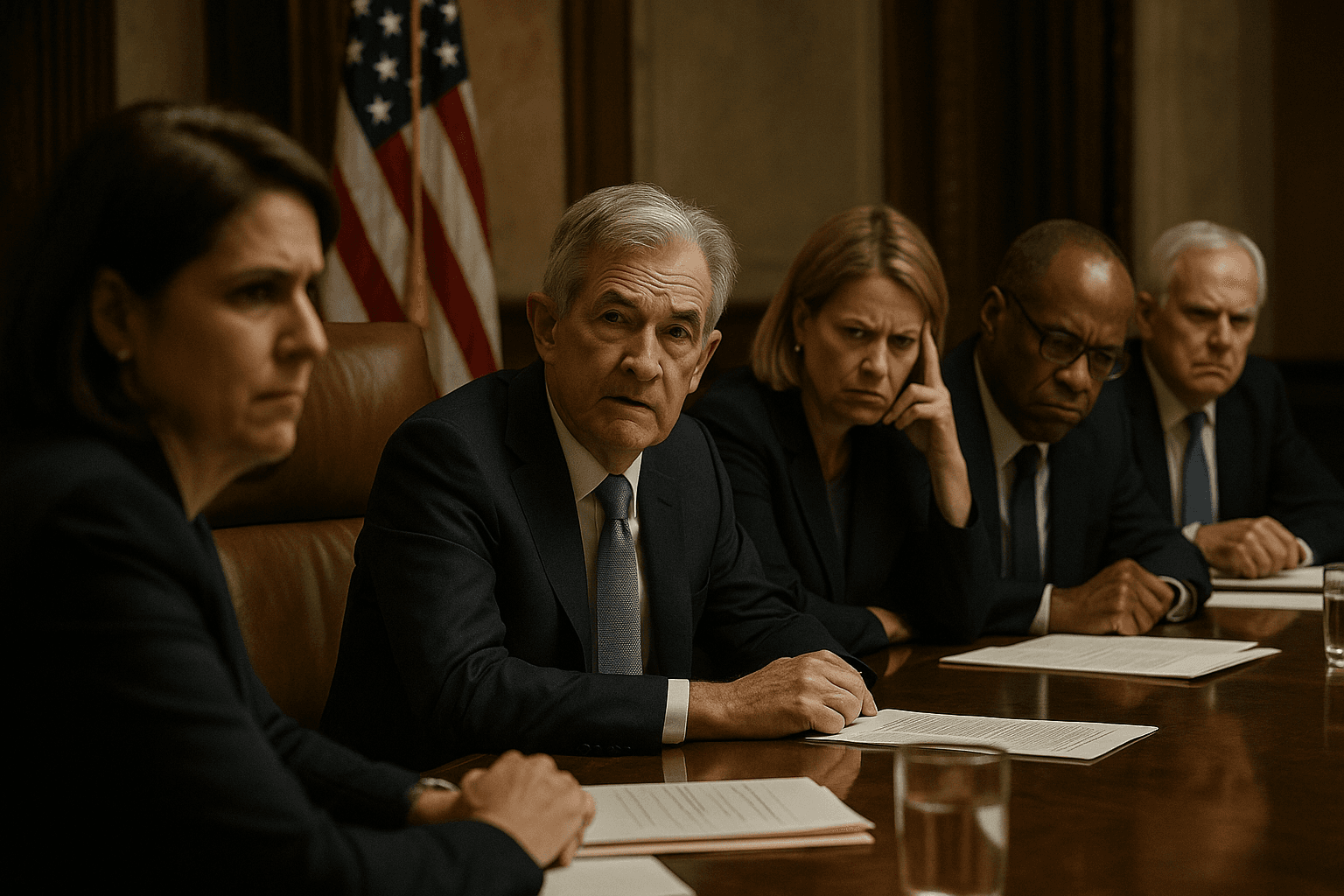

Chair Jerome Powell framed the decision as cautious and data dependent, saying the current target range is "in a broad range of estimates of neutral value" and that the committee "is well positioned to wait and see how the economy evolves from here." His remarks acknowledged disagreement on the committee but emphasized a calibrated approach in light of the broader outlook.

The split has immediate market implications even though the cut itself was widely expected and largely priced in. The public dissents and the scatter in officials' rate projections complicate guidance for investors, as they suggest a meaningful probability that policy will not follow a uniform path toward additional easing. Equally important is the committee's changing membership. Miran is set to leave the Fed in January, and rotating voting slots next year will include regional presidents who have publicly signaled reservations about further rate cuts, notably Dallas Fed President Lorie Logan and Cleveland Fed President Beth Hammack. Those potential changes could tilt the balance toward a more cautious stance.

The December decision sits against a backdrop of significant easing since 2024. Powell noted that the committee has cut rates by 175 basis points since September 2024, a large recalibration even as inflation remains a central concern. With signs of persistent price pressures and an FOMC increasingly divided along both dovish and hawkish lines, policymakers will face a delicate task in 2026, balancing support for growth against the risk of reigniting inflation. Markets and businesses will be watching voting rotations and incoming economic data closely, since small shifts in committee composition or in inflation readings could meaningfully alter the path of policy.

Know something we missed? Have a correction or additional information?

Submit a Tip