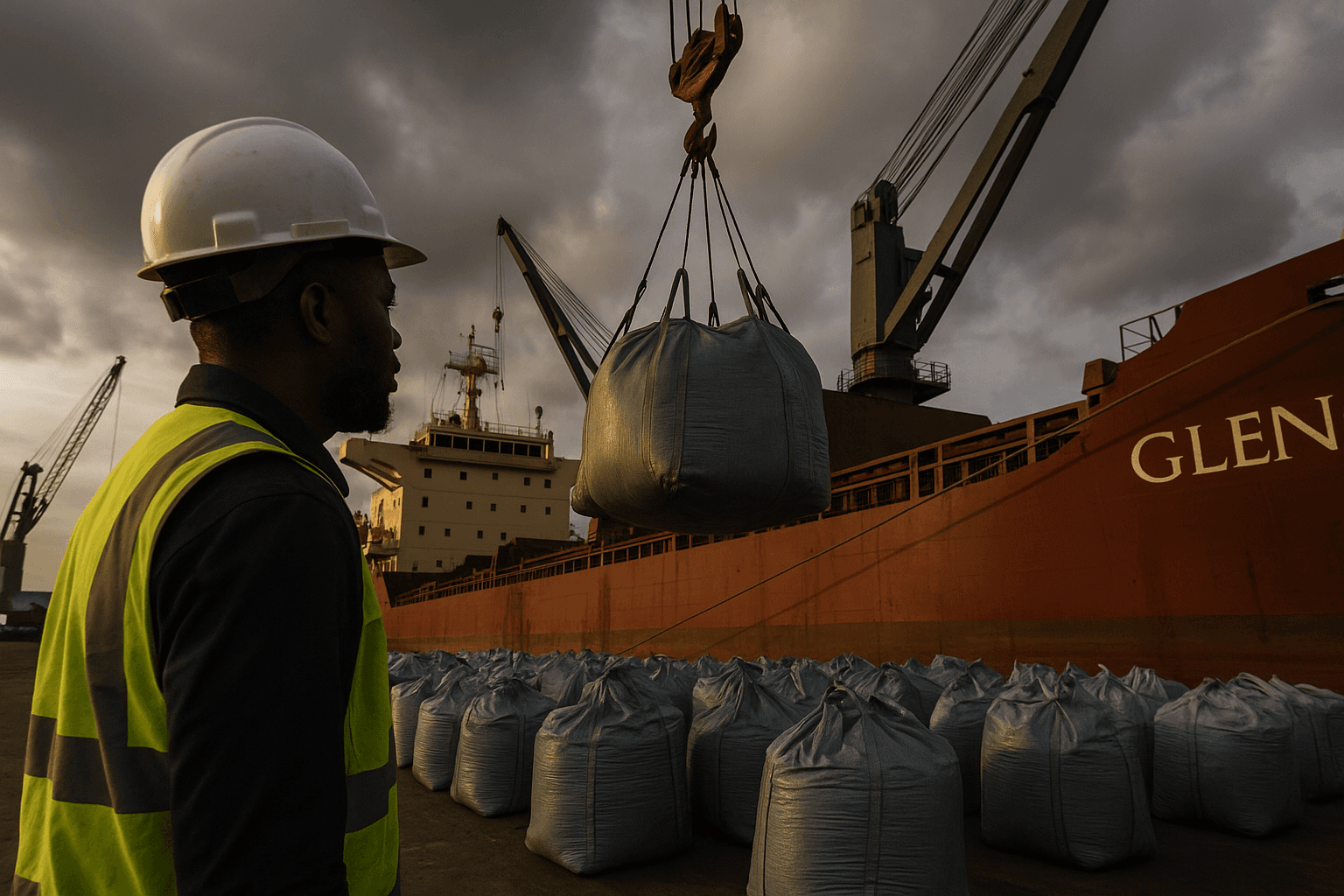

Glencore Ships First Cobalt Cargo, Tests DRC Export Quota System

Glencore moved the first cobalt shipment under the Democratic Republic of Congo’s new export quota regime, a test of policies meant to capture more mineral value for the state. The move matters to global battery makers and investors because the DRC supplies roughly 70 percent of mined cobalt, and new procedures could add near term supply uncertainty and price volatility.

Glencore shipped the first cobalt cargo under the Democratic Republic of Congo’s newly implemented export quota system on December 9, 2025, Reuters reported, marking the first operational checkpoint for a policy designed to shift more mineral revenue to the state. The system, introduced in October, imposes quarterly export quotas and new prepayment and royalty procedures as the government seeks to capture greater value from a commodity critical to electric vehicle and battery production.

The initial shipment was cleared after a pending 10 percent royalty payment was settled, according to industry reporting. That payment illustrates the immediate revenue mechanics the DRC hopes will raise state receipts from cobalt. But industry sources say export approvals remain bunched as producers and traders adapt to new testing, lab certification and payment requirements, creating administrative blocks that can delay flows.

The DRC supplies around 70 percent of globally mined cobalt, a concentration that underpins the metal’s strategic importance for battery chemistries used in electric vehicles and grid storage. Because of that concentration, changes in Congolese export policy ripple through global supply chains. Market participants warned that the quota regime could introduce near term uncertainty for battery manufacturers and midstream processors who rely on predictable shipments to meet production schedules.

Supply timing is already shifting as firms submit samples for lab certification and arrange prepayments required before cargo release. Several exporters have been reported to queue approvals toward the ends of quota windows which could create episodic bursts of shipments and brief shortages between windows. Traders and manufacturers may respond by increasing inventories, paying premiums for prompt delivery, or accelerating purchases from secondary sources, all of which can raise costs for battery makers and ultimately for consumers.

From a policy perspective the DRC’s moves fit a broader trend of resource nationalism in commodity rich countries, where governments seek larger shares of value through royalties, local processing requirements and tighter export controls. Those measures can boost public finances, particularly in countries with limited tax bases and high public spending needs. The trade off is operational friction that can deter investment and complicate long term contracts that underpin downstream manufacturing plants.

For markets the immediate question is how much of the tightening is temporary as firms adjust to new paperwork and testing regimes, and how much represents a sustained increase in effective withholding on exports. Price-sensitive buyers may shift toward battery chemistries that use less cobalt, a trend already visible in research and investment in low cobalt and cobalt free technologies. Over the medium term producers, refiners and manufacturers will be watching the DRC’s next quota cycle for clearer signals on allocation, timing and enforcement.