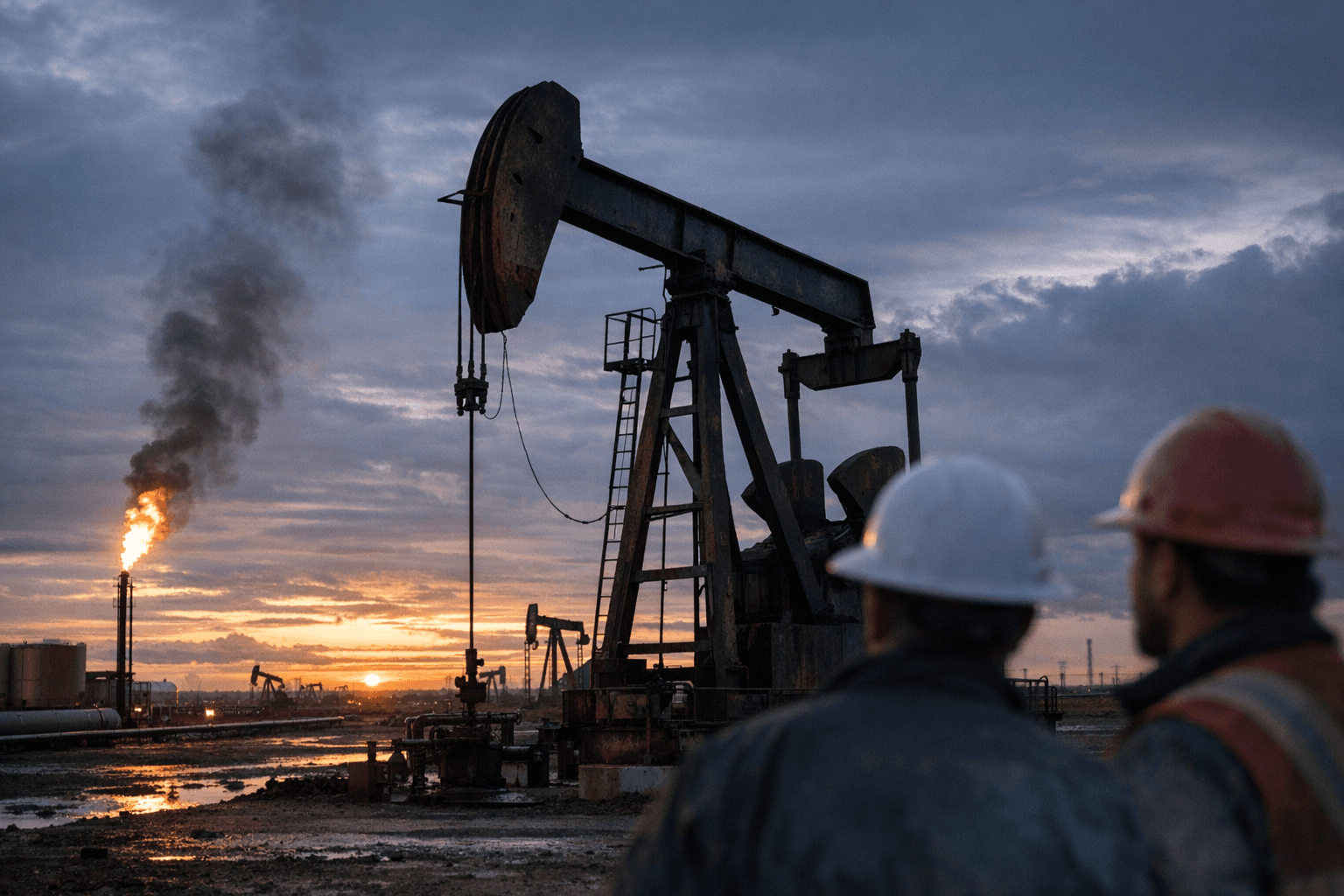

Goldman Sachs projects 2026 oil surplus, prices set to drift lower

Goldman Sachs forecasts a 2026 crude surplus that will pressure prices, with recovery expected from 2027 as underinvestment slows supply growth.

Goldman Sachs says the global crude market will move into a notable surplus in 2026, driving lower average prices for Brent and West Texas Intermediate and setting the stage for a later recovery as new supply wanes. In a note published Jan. 12, 2026, the bank reiterated baseline averages of $56 per barrel for Brent and $52 for WTI for 2026 and quantified an implied surplus of roughly 2.0 to 2.3 million barrels per day.

Market conditions at the time of the note show futures trading above those averages: Brent near $63 per barrel and WTI around $59 per barrel at 04:12 GMT. Goldman’s scenario nonetheless anticipates a near-term slide as OECD inventories build, with prices drifting toward troughs of roughly $54 for Brent and $50 for WTI by the end of the quarter and bottoming out more broadly in mid-to-late 2026 before a gradual recovery later in the year.

The bank traces the 2025–26 supply wave to several concrete factors. Long-lead projects sanctioned before the pandemic are coming online in 2025–26, adding material volumes. OPEC+ plans to unwind production cuts, and higher output is expected from the United States and Brazil. Those flows, combined with seasonal inventory accumulation in OECD countries, are the proximate drivers of the forecast surplus.

Goldman frames the rebalancing mechanism as price dependent: sustained lower prices in 2025 and 2026 would likely slow non-OPEC supply growth outside Russia, especially in higher-cost or longer-cycle projects, which in turn would open the market to a deficit from 2027. Under that base case, Goldman projects Brent could return to roughly $80 per barrel and WTI to about $76 by the end of 2028 as underinvestment and delayed sanctioning of new projects bite.

Risk factors create a wide potential range for outcomes. On the downside, resilient non-OPEC production or a global growth slowdown could push Brent into the $40s in 2026–27. On the upside, a larger-than-expected decline in Russian output would lift prices above $70 per barrel. Geopolitical volatility remains salient; analysts warn that disruptions tied to Russia, Venezuela or Iran could materially tighten markets. Some estimates cited by market participants place Iranian export flows at risk of up to about 1.9 million barrels per day in extreme scenarios, illustrating the scale of disruption that would be required to overturn the surplus.

Domestic policy and political dynamics also matter. A policy emphasis on robust domestic energy supply and lower pump prices in major consuming countries, notably the United States ahead of midterm elections, could blunt upward pressure on crude by supporting production and capping price gains.

Broader energy trends add texture to the outlook. Goldman highlights a concurrent surge in liquefied natural gas capacity through 2032 that will weigh on gas prices and on the competitive fuel mix, with implications for gas-linked oil demand in some regions.

For markets and policymakers, the immediate implication is lower forward oil revenue and reduced reinvestment incentives for producers in 2026, followed by an elevated risk of tighter markets and higher prices from 2027 if supply growth slows. Investors and governments will be watching production decisions and inventory flows closely this year to see how quickly the theoretical surplus translates into price action.

Sources:

Know something we missed? Have a correction or additional information?

Submit a Tip