OmniVision’s Hong Kong second listing raises HK$4.8bn as shares tick up

OmniVision’s Hong Kong float raised about HK$4.8bn, the stock opened above the offer price and climbed modestly amid renewed investor appetite for mainland tech listings.

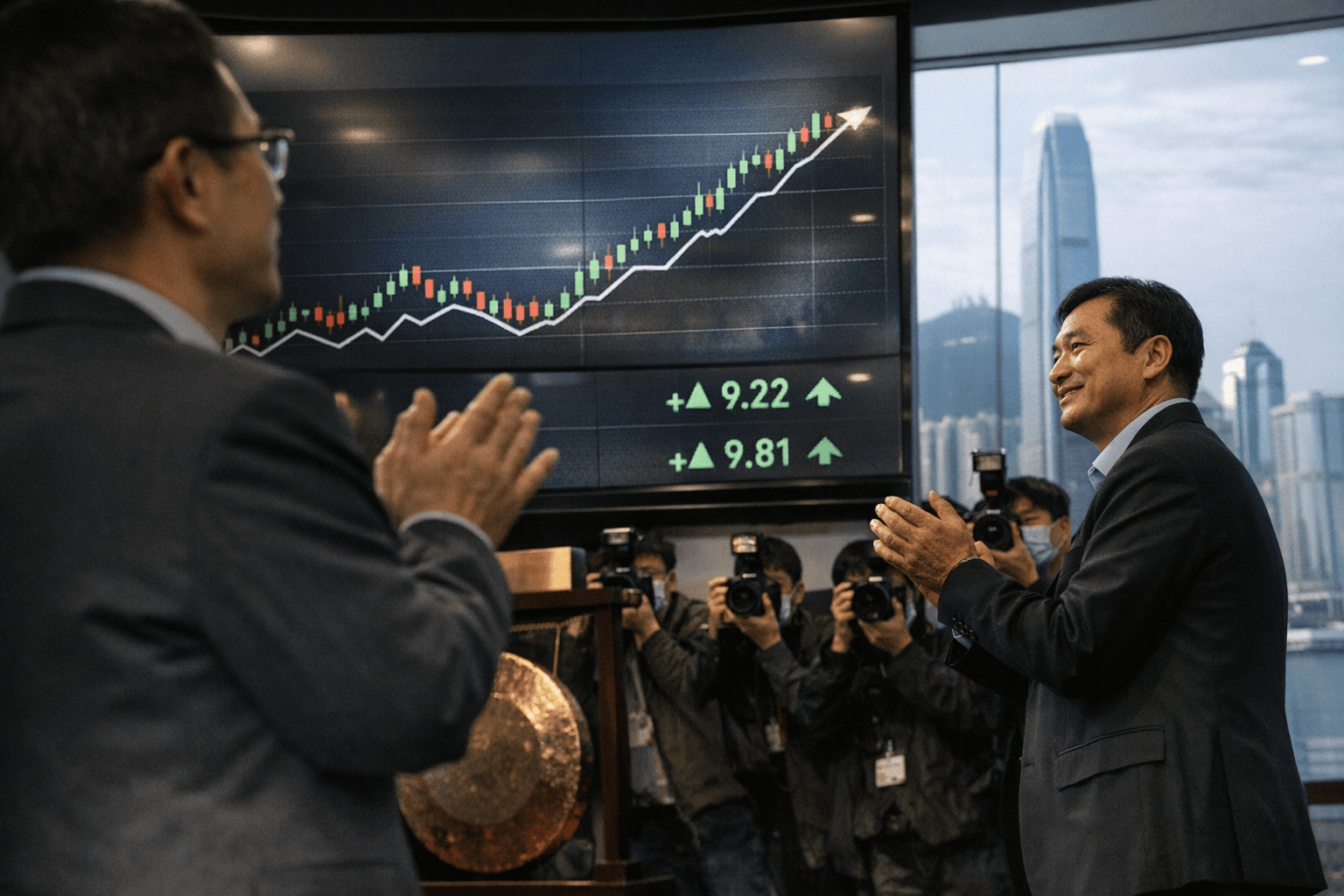

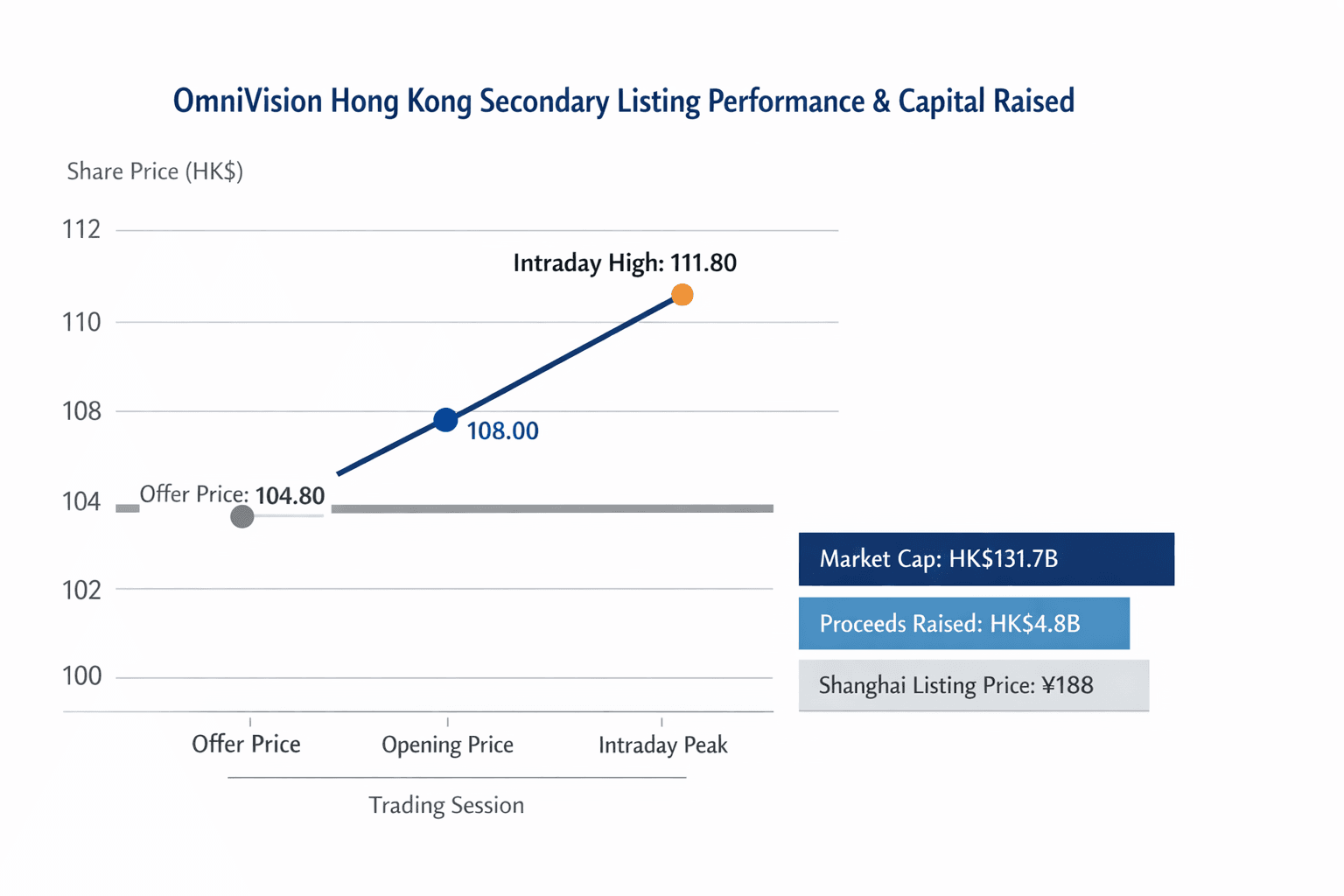

OmniVision Integrated Circuits Group’s long‑anticipated second listing in Hong Kong raised roughly HK$4.8 billion, and its shares opened above the offer price before rising further in early trade. The company set an offer price of HK$104.80 per share; shares opened at HK$108, about 3.1 percent higher, and reached an intraday peak near HK$111.80, roughly a 6.7 percent gain from the offer level on on‑market trading.

The placement yields a market capitalisation at the offer price of about HK$131.7 billion, or nearly $16.9 billion. Proceeds from the Hong Kong offering, converted to U.S. dollars, total roughly $616 million. OmniVision’s Shanghai‑listed A‑shares also moved higher, trading around 132.26 yuan and rising about 0.6–0.7 percent, implying a Shanghai market value near 159 billion yuan, or about $22.8 billion.

OmniVision, a major designer of complementary metal-oxide-semiconductor (CMOS) image sensors, told investors in its Hong Kong prospectus that it will allocate about 70 percent of the new proceeds to research and development. The remainder is earmarked for global market expansion, investments and acquisitions. The filing and related coverage identify R&D priorities as sensing and display technologies and analog solutions, areas central to the company’s efforts to serve smartphones, automotive systems, smart glasses and emerging edge AI applications.

Cornerstone investors named in the prospectus included Boyu Capital’s Wildlife Willow, UBS Asset Management Singapore and China Post’s PSBC Wealth Management, with additional reported backing from sovereign funds such as Qatar Investment Authority and Singapore’s GIC. The mix of strategic and institutional backers underscores broad investor interest in semiconductor names seeking deeper access to international capital via Hong Kong.

The listing arrived amid a resurgence of IPO activity in Hong Kong, which has regained traction as a global capital-raising venue. Market data show roughly $37.2 billion was raised from 115 new listings in the prior year, the most since 2021, a trend that has encouraged a string of mainland technology firms to pursue second listings in the city. Several mainland chip names have taken advantage of the renewed liquidity and investor demand, deploying secondary listings to broaden investor bases and narrow valuation gaps between domestic and offshore markets.

Short‑term market implications are straightforward: the stock’s modest debut indicates healthy, if measured, demand for a company with a clear technology focus and significant R&D plans. For OmniVision, the capital will underpin product development in competitive sensor segments where scale and innovation matter. For investors, the dual listing delivers arbitrage and diversification opportunities but also highlights valuation differences between onshore and offshore markets.

Longer term, the offer reflects broader structural dynamics in China’s technology financing: companies are seeking international pools of capital while pitching domestic strategic autonomy through intensified R&D spending. How effectively OmniVision converts the Hong Kong proceeds into technological advantages will shape its competitive position in a market dominated by rapid product cycles and growing demand from automotive and AI end markets.

Sources:

Know something we missed? Have a correction or additional information?

Submit a Tip