Helena forum: new property-tax rules could deter business investment

Business leaders and policy experts debated HB 231 and SB 542 tax shifts at a Jan. 6 Helena forum, warning higher bills for larger properties could affect local investment and services.

At the Montana Chamber of Commerce’s "Business Days at the Capitol" event in Helena on Jan. 6, state business leaders, policy experts and industry representatives gathered to unpack the economic effects of two recently enacted property-tax laws, House Bill 231 and Senate Bill 542. The bills rewrote the short-term tax framework and, participants said, change who pays for local government services.

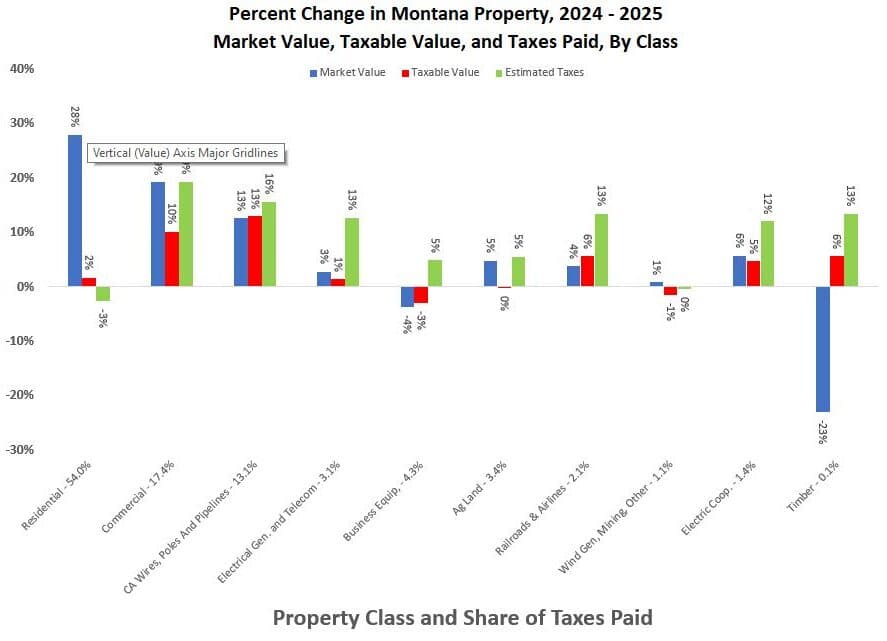

"HB 231 and SB 542 established interim tax rates for 2025, with higher rates for properties worth more." Panelists at the forum said the changes generally lower rates for many primary residences and some smaller properties while increasing rates for larger or non-homestead commercial parcels. That reallocation, they argued, could raise effective tax bills for firms holding substantial real estate and for larger utility and commercial operations.

Organizers described a split message: homeowners in Lewis and Clark County may see relief compared with previous valuations, while larger property owners could face material increases that feed into operating costs. Representatives of Montana industry groups cautioned that higher property levies on big commercial holdings could complicate capital allocation decisions, delay expansion plans and make the state less competitive for certain types of investment. Taxpayer advocates at the event emphasized the intended equity goal of protecting homestead owners but also flagged the risk of concentrated tax exposure on remote or capital-intensive businesses.

Panel discussion turned to the state's revenue mix as speakers debated whether Montana should broaden its base with a statewide sales tax to smooth revenue volatility created by the property changes. Participants agreed a sales tax would broaden the revenue stream, but they also noted substantial political obstacles that make such a change unlikely in the near term. Absent a broader base, municipalities and school districts could face more pronounced swings in funding sources tied to property market dynamics.

Local utilities and larger commercial landlords were singled out as particularly exposed. Increased property levies can alter utility rate cases, influence decisions about maintenance versus new investment, and encourage businesses to reconsider siting or expansion within Lewis and Clark County. Smaller local firms that lease space rather than own property may face secondary effects if landlords pass on higher tax costs through rents.

For residents, the immediate takeaway is mixed: many homeowners could see slower growth in tax bills, but the longer-term implications include potential impacts on jobs, business services and the pace of new commercial development. County officials and affected businesses will now have to model their 2025 budgets under the interim rates and plan for potential adjustments in capital spending.

The takeaway? If you own property, run a business with significant real estate, or rely on local services, check how the interim 2025 rates affect your bottom line and budgeting. Our two cents? Start the math early—talk to your accountant or the county assessor and plan for both higher operating costs and opportunities that shifting tax burdens may create.

Sources:

Know something we missed? Have a correction or additional information?

Submit a Tip