Property Tax Changes Shift Burden Between Homeowners and Businesses

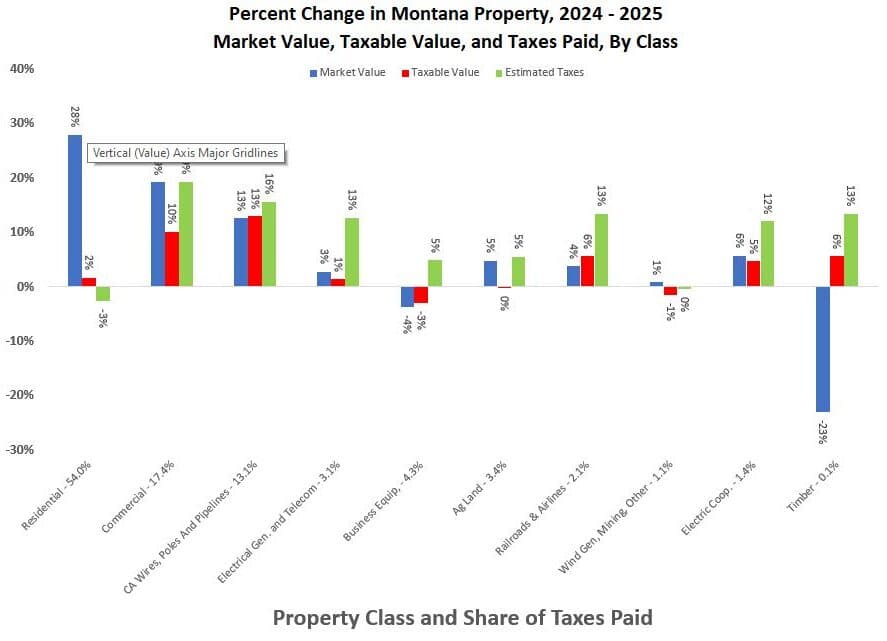

Business leaders at the Montana Chamber of Commerce’s Business Days at the Capitol in Helena on Jan. 6 debated the local effects of property tax changes enacted in 2025. Panelists said House Bill 231 and Senate Bill 542 have lowered taxes for many primary residences while increasing tax loads for some businesses and larger non-homestead properties, a shift that could affect investment, hiring and local budgets across Lewis and Clark County.

On Jan. 6, Helena hosted a central conversation about Montana’s changing property tax landscape as business leaders gathered for the Montana Chamber of Commerce’s Business Days at the Capitol. The panel discussion focused on legislation passed in 2025 — cited at the event as House Bill 231 and Senate Bill 542 — and explored how the new rules redistribute tax liability across residential and non-homestead property classes.

Panelists, including the state Chamber president and representatives from the Montana Taxpayers Association and several industry groups, outlined a common assessment: the reforms effectively reduce property taxes for many primary residences while shifting more of the burden onto certain businesses and larger non-homestead properties. That reallocation has immediate implications for Lewis and Clark County, where Helena functions as both the state capital and a regional economic center.

For homeowners the change can mean lower annual property tax bills and increased disposable income, which could support consumer spending in local shops and services. For business owners and investors, however, the consequences are more complicated. Panelists warned that higher property taxes on commercial and non-homestead holdings could depress returns on local investment and make Montana less competitive for new business capital. That could influence decisions about expansion, property purchases, and employment in sectors that are property-intensive.

Panel discussion also revisited a long-standing policy option: a statewide sales tax to broaden the revenue base and potentially reduce reliance on property taxation. Panelists acknowledged that while a sales tax could spread the burden more evenly across consumption and capital, political obstacles remain significant. The idea has surfaced repeatedly in state policy conversations, but gaining traction would require overcoming entrenched opposition and designing exemptions and rates that consider regressivity and rural impacts.

From a market perspective, the short-term outlook is likely to include recalibration by firms that own or lease property in Lewis and Clark County. Property owners may pass higher tax costs to tenants through rent increases, and some businesses may delay capital projects pending clearer signals on future tax policy. On the local government side, shifts in assessed revenues could alter fiscal planning for services funded in part by property taxes.

The Helena session underscored that the capital remains the policy forum where such trade-offs are hashed out. As lawmakers and stakeholders continue to evaluate revenue options, the practical question facing local residents and business owners is how these tax shifts will affect household budgets, investment plans and the long-term economic competitiveness of the county.

Sources:

Know something we missed? Have a correction or additional information?

Submit a Tip