House approves three-year renewal of ACA premium tax credits

House passed a clean three-year extension of enhanced ACA premium tax credits; bill now moves to the Senate with its future uncertain.

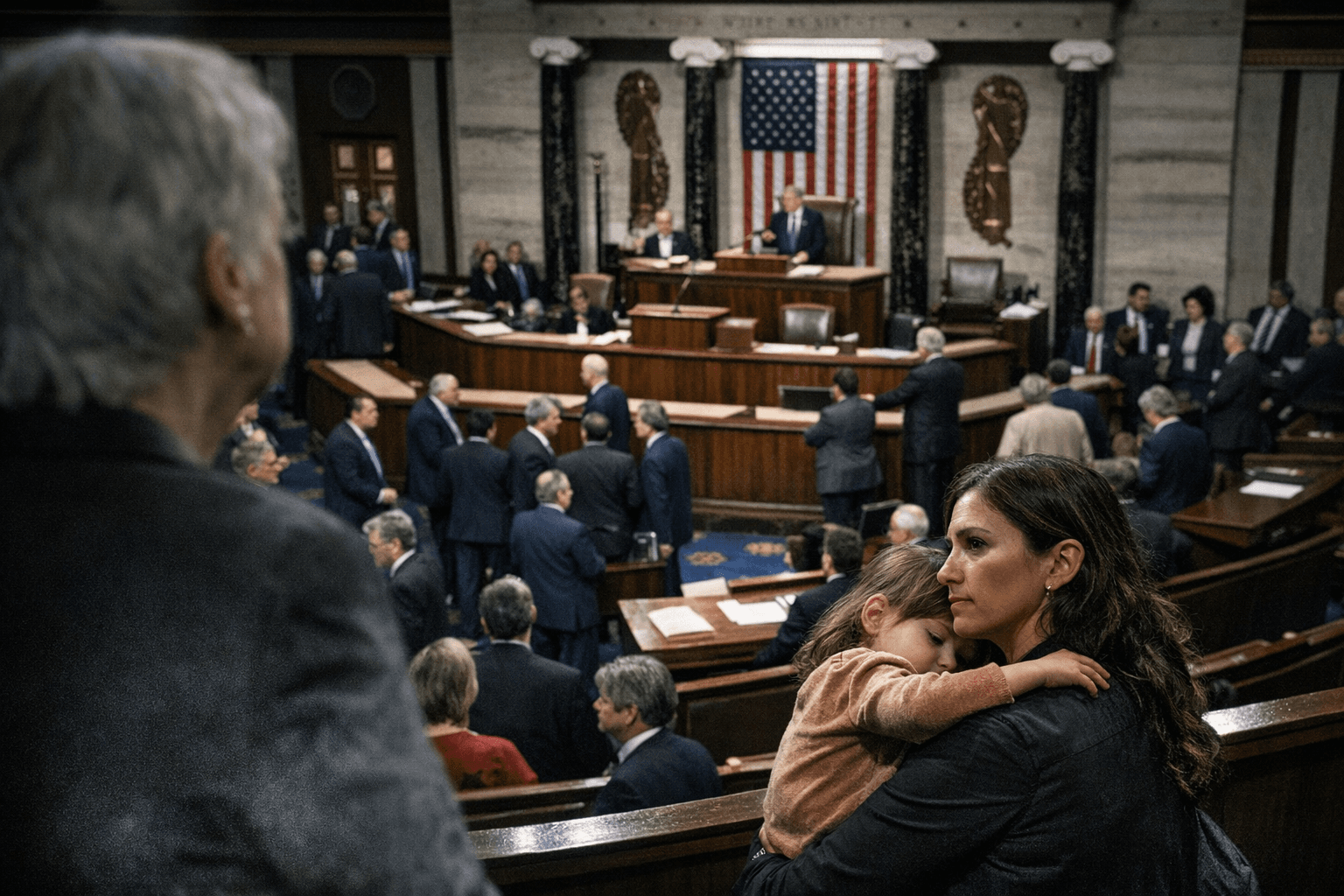

The House of Representatives approved a clean, three-year extension of the Affordable Care Act’s enhanced premium tax credits, passing H.R. 1834 by a 230-196 roll call that drew unanimous Democratic support and 17 Republican defectors. The measure, intended to restore subsidies that expired Dec. 31, 2025, now moves to the Senate where negotiations are expected to reshape or replace it.

H.R. 1834 would renew the enhanced tax credits through 2028 and temporarily shield millions of marketplace enrollees from steep premium increases. Multiple House offices placed the floor action between Jan. 8 and Jan. 10, 2026, with press releases dated Jan. 8 from Representatives Jared Golden and Jimmy Gomez and Jan. 9 from Representative Emily Randall. Democrats used a discharge petition to force the vote after House Republican leaders declined to bring extension bills to the floor last year.

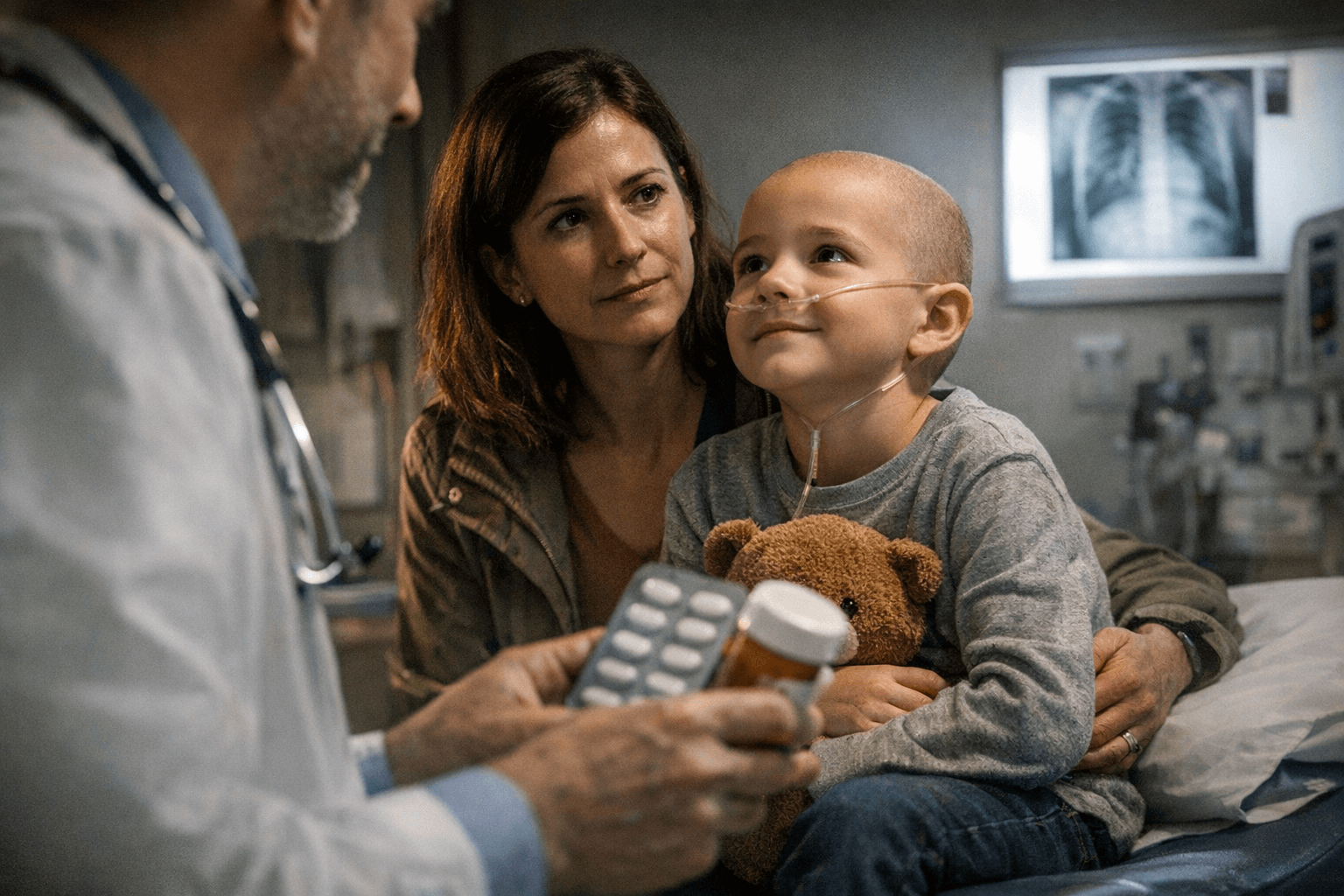

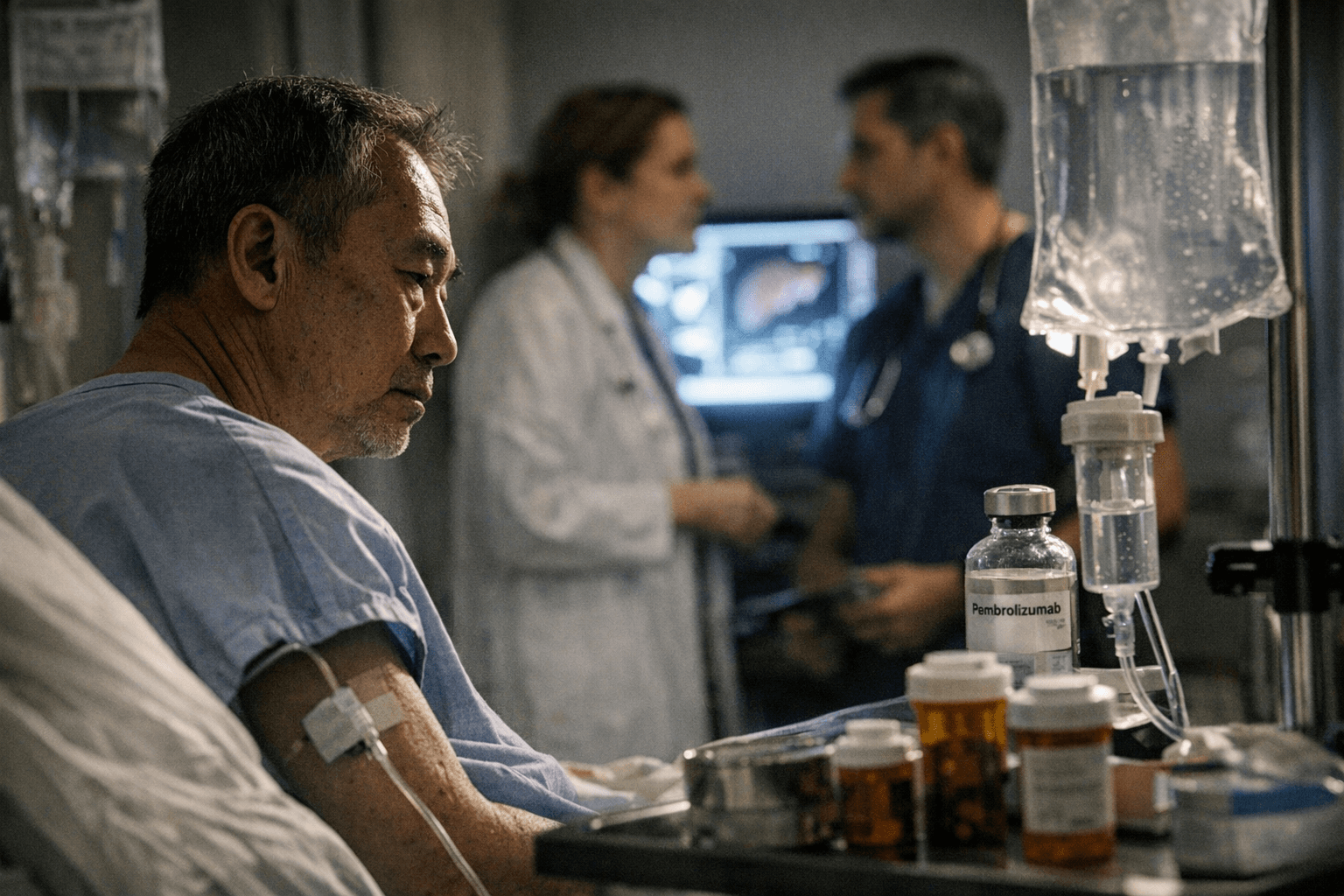

Congressional offices and reporting place the number of affected Americans in the low tens of millions. Estimates range from about 22 million to 24 million people who buy coverage on ACA marketplaces; one House release cited up to 27,000 enrollees in Rep. Gomez’s district, CA-34. Rep. Golden’s materials warned that premiums had jumped by an average of 114 percent for 22 million exchange purchasers, with increases described as more than $1,100 per month for some enrollees if the subsidies remained expired.

The vote exposed fissures in the Republican conference, with 17 members from swing districts breaking with leadership after warnings that the credits’ lapse would produce politically painful premium spikes ahead of the 2026 midterm elections. House Democrats framed the measure as urgent protection for working families and a bargaining position for senators.

Rep. Jimmy Gomez said he voted to extend the credits "to lower costs and keep working families covered," and described the discharge petition as necessary after Republican leaders blocked floor action. Representative Emily Randall sharply criticized GOP leadership, saying, "Republican leadership let tax credits expire in order to pay for tax breaks for billionaires. They didn't make an abstract budget decision. They decided that their wealthy and well-connected donors deserve the very best this country has to offer, while condemning everyday Americans to lose health insurance…"

The bill faces a fraught path in the evenly divided Senate. Senators negotiating alternatives have signaled they prefer a scaled or shorter extension. Sen. Bernie Moreno (R-Ohio) is pushing a two-year package that reportedly would limit eligibility to 700 percent of the federal poverty level, impose a minimum premium of $5 per month for the lowest earners, allow an option to redirect enhanced credits into health savings accounts beginning in year two, and attach other policy conditions that Democrats say would undercut the current subsidies.

Advocacy groups and local officials urged swift Senate action. The United States Conference of Mayors and local mayors including Allentown Mayor Matt Tuerk warned that delays would worsen affordability and force coverage losses for families.

House passage of a clean three-year extension sets a clear negotiating marker: Democrats sought to preserve the subsidies in full and press the Senate to accept a simple renewal, while Republicans in the upper chamber appear poised to demand trade-offs. The coming days in the Senate will determine whether the protections for millions of marketplace enrollees are restored as written, trimmed, or replaced with a compromise.

Know something we missed? Have a correction or additional information?

Submit a Tip