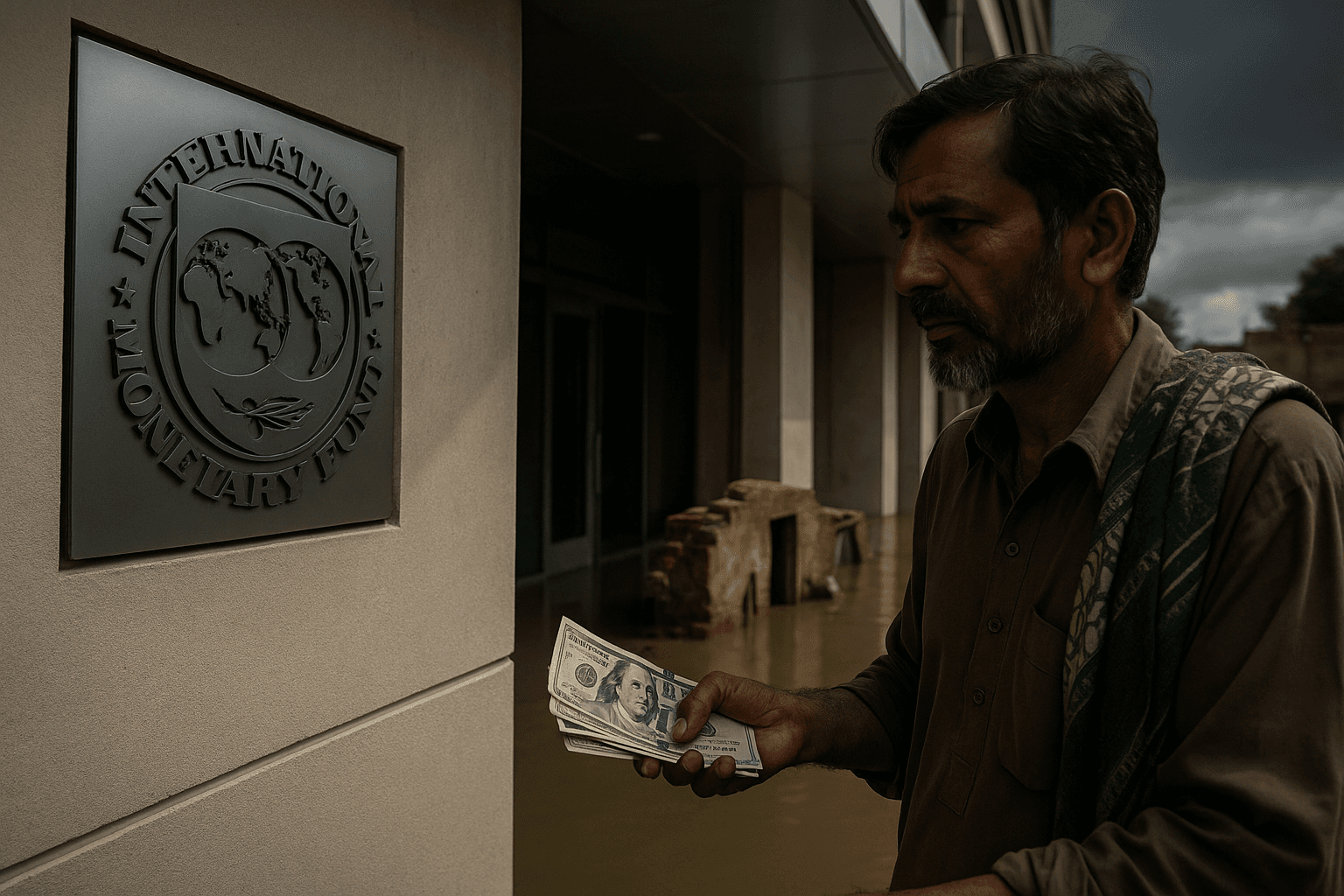

IMF approves $1.2 billion for Pakistan, cites reform and climate strides

The International Monetary Fund approved a $1.2 billion disbursement to Pakistan on December 9, 2025, split between the main Extended Fund Facility and a climate focused Resilience and Sustainability Facility. The move gives Islamabad breathing room for reserves and reconstruction after floods, but the IMF made clear further fiscal discipline and energy sector reforms remain conditions for continued support.

The IMF’s executive board approved a $1.2 billion disbursement to Pakistan on December 9, 2025, allocating roughly $1 billion under the country’s principal Extended Fund Facility and $200 million through a climate focused Resilience and Sustainability Facility. In its statement the Fund praised Pakistan’s “significant progress” in stabilizing the economy during a year marked by severe floods, and it cited stronger foreign exchange reserves and fiscal improvements as the basis for the release.

The disbursement arrived as Pakistan reported foreign exchange reserves of about $14.5 billion, a metric IMF staff flagged as improving but still vulnerable to external shocks. Islamabad intends to use the funds to rebuild reserves and to shore up near term external financing needs while continuing reconstruction from the flood damage. The climate tranche is expressly targeted at resilience and sustainability measures tied to recovery and adaptation.

The bailout package aims to tackle long standing structural weaknesses. Officials said the funds will support measures to strengthen tax collection and to reform loss making state owned enterprises, particularly in the energy sector, where subsidies and circular debt have long strained public finances and utilities. The IMF emphasized the need for disciplined fiscal policy, a flexible exchange rate, and continued energy sector reform as preconditions for the multi year program to stay on track.

Prime Minister Shehbaz Sharif welcomed the decision, commended the finance team and military leadership for their roles in supporting reforms, and described the approval as a step toward sustained growth while warning that further effort will be required to meet program targets. The disbursement is conditional; future releases will depend on Islamabad meeting agreed benchmarks under the multi year arrangement.

For markets and external creditors the decision signals a modest but meaningful reengagement by the IMF. The immediate effect is likely to be a boost to investor confidence by strengthening Pakistan’s short term external buffer and by reaffirming the program’s conditionality. Over the medium term, adherence to fiscal consolidation and exchange rate flexibility could reduce pressures on the currency, ease sovereign funding stress, and make private capital inflows more likely. Failure to implement energy firm reforms, however, would sustain contingent liabilities and could undermine market confidence.

The inclusion of a dedicated climate component reflects a broader shift in international lending, where climate related financing is increasingly embedded within macroeconomic programs. For Pakistan, which endured devastating floods earlier this year, the integration of resilience funding with conventional stabilization support underscores the intersecting shocks of extreme weather and macro fragility.

Long term prospects hinge on political will to push through difficult reforms. Strengthening revenue collection and restructuring state firms are technically feasible but politically sensitive, and the IMF’s insistence on strict benchmarks means Islamabad must show sustained implementation to secure further support. For now the $1.2 billion disbursement offers crucial breathing room, but the trajectory of Pakistan’s recovery will depend on whether policy commitments are translated into measurable, durable change.