India and France agree revised tax treaty, halves dividend levy

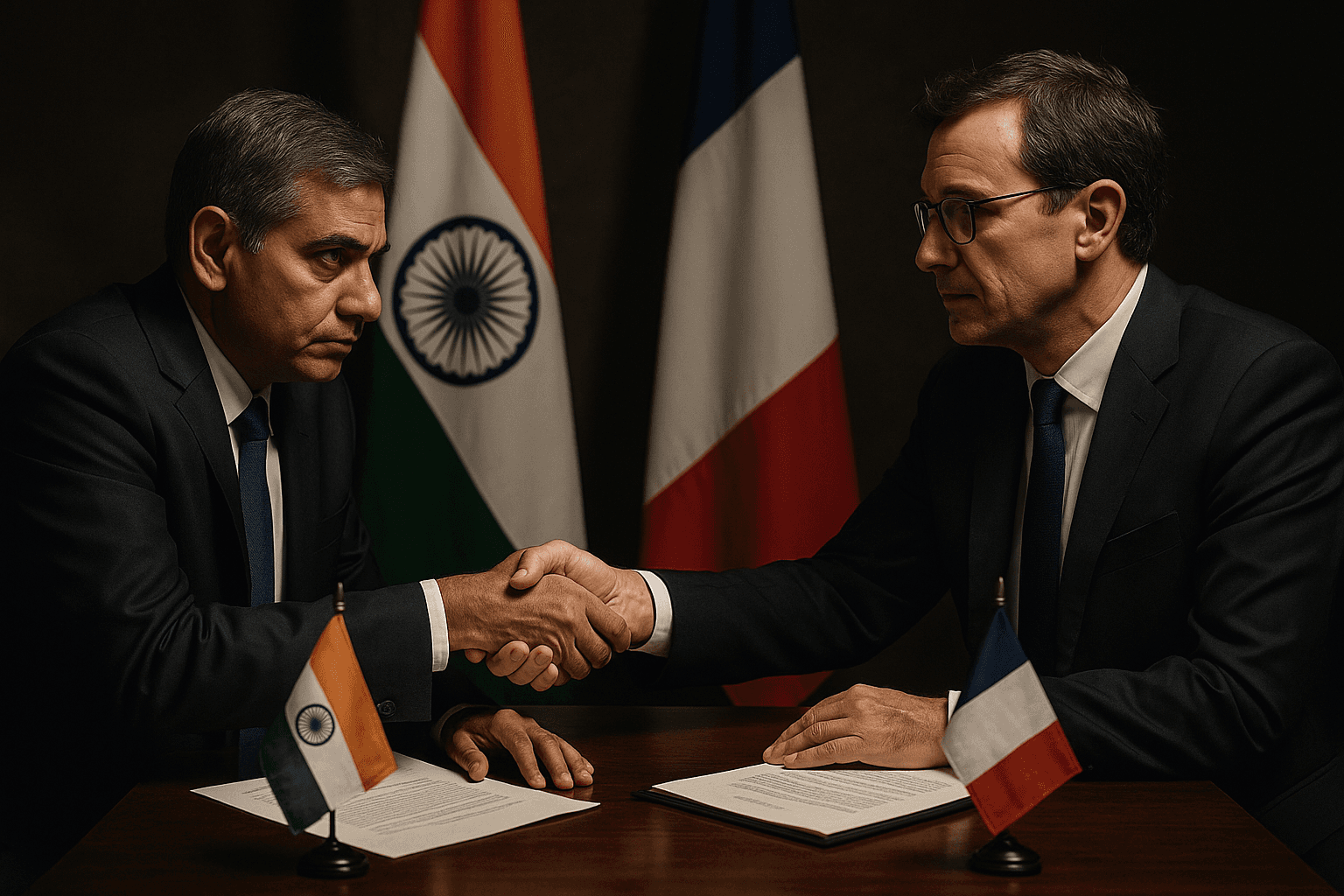

India and France have moved to revise their 1992 bilateral tax treaty, with media reports saying the deal would cut dividend withholding tax for major French parents and expand India’s right to tax capital gains on share sales by French entities. The change could alter returns for French investors in India and reshape cross border investment incentives at a time when countries are rebalancing source and residence taxing rights.

India and France have signaled a shift in their bilateral tax relationship, with Reuters and Bloomberg Tax reporting that the two governments have struck a deal to revise the 1992 tax treaty. Multiple outlets describe two central elements in the reported package, a reduction in dividend withholding tax for French parent companies holding substantial stakes in Indian subsidiaries, and a broadening of India’s rights to tax capital gains related to Indian shareholdings.

Under the reported terms, dividend withholding tax on payments from Indian resident companies to French parent companies with more than ten percent ownership would be cut from ten percent to five percent. That reduction was flagged by Reuters and carried in Bloomberg Tax and other professional summaries. Separately, the Economic Times reports that for minority shareholdings under the ten percent threshold the proposed treaty would apply a fifteen percent dividend withholding tax. That figure appears only in the Economic Times account among the reports reviewed, creating a notable discrepancy about minority shareholder treatment and whether the arrangement is fully agreed.

The package also moves toward a source based approach for capital gains, expanding India’s taxing rights over gains arising from disposals of shareholdings by French residents. The Economic Times frames the change as allowing India to tax share sales by any French entity in transactions tied to Indian assets, and Reuters likewise highlights an expansion of India’s capital gains authority. Sources do not yet provide treaty text or describe effective dates, transitional rules, or any carve outs for legacy investments.

The reported revisions have clear economic and market implications. Cutting the dividend levy to five percent for meaningful holdings would improve after tax cash flow for French parent companies, potentially supporting dividend repatriation and sustaining investment returns for strategic long term investors. Expanding India’s claim on capital gains would raise the tax exposure for foreign sellers of Indian assets, potentially increasing exit costs for portfolio investors and influencing deal timing and valuations in mergers and acquisitions.

Policy trade offs are visible. A lower dividend levy for large parents favors stable, long term investors, while a source based capital gains rule strengthens India’s revenue take from transactions tied to domestic assets. The reported fifteen percent rate for minority holdings, if confirmed, would further complicate incentives by creating a steeper tax wedge for smaller holdings, possibly prompting investors to reconsider ownership structures. Absent an official text, corporate treasurers and tax advisers will face uncertainty on compliance, repatriation planning, and treaty relief mechanisms.

Officials in New Delhi and Paris have not published a joint protocol or signed text as of this reporting, and outlets vary on whether the pact is final or still being finalized. The next steps are clear from the reporting environment, governments must release the treaty protocol and explanatory notes so investors, advisers and markets can quantify potential revenue changes and adjust structures. Until those documents are disclosed, the market impact will be priced with a premium for legal and policy uncertainty even as investors begin to reassess cross border strategies.

Know something we missed? Have a correction or additional information?

Submit a Tip